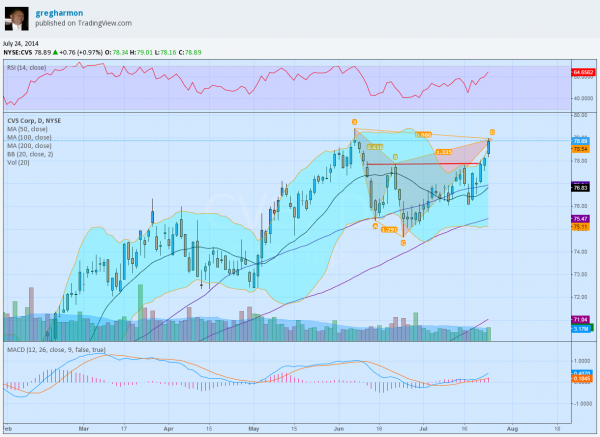

Diagnosing CVS As It Tests All-Time Highs

Dragonfly Capital | Jul 25, 2014 02:19AM ET

CVS Corporation (NYSE:CVS) broke above short term resistance earlier this week and is testing the all-time high price level. Stocks making new all-time highs are often described by pundits as one that you should ‘take off some risk’ in. Does that really make any sense? If you sell every stock that makes an all-time high then as the market keeps making all-time highs you will be on the sidelines watching, uninvested. I guess the bright side is that you will have more time to play golf or what ever else you enjoy.

I am not trying to discourage proper risk management, but come on! You got to be in it to win it! So what do you do? With a stock like CVS there are plenty of options. Literally.

The chart does have some things in it that raise caution. The bearish Shark Harmonic has a Potential Reversal Zone (PRZ) at 79 nearby. Of course that could always morph into a longer Shark with PRZ at 80.05. Or the prior top could halt its progress. But the momentum indicators, RSI and MACD, suggest there is more upside.

If you are long this stock already then you can add protection by buying a collar. This is selling a covered call and buying a put or put spread. With earnings coming up on August 5th, maybe a August 9 Expiry 78/75 Put Spread (offered at 62 cents as I write). That is less than 1% cost to protect the downside to the 200 day moving average, below the last consolidation. And if you sold the August 29 Expiry 81 Calls, making them Covered Calls, the options combination comes at no cost, and still allows for 2.5% upside over the next month.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.