Derma Sciences: DSC127 For Free

Edison | May 23, 2014 02:05AM ET

DSC127 for free on current valuation

Derma Sciences (NASDAQ:DSCI) offers a compelling risk/reward profile with the DSC127 trial and advanced wound management franchise progressing well in a vastly underserved market. The recent $80m fund-raising affords the company higher R&D and sales force investments, which we expect to propel strong sales growth, but also to deepen operating losses in 2014 and 2015. We believe the current share price attributes no probability to DSC127 successfully reaching the market, which we rate 65% likely.

Key products growing well

Q1 results highlighted progress with the DSC127 trial alongside double-digit growth of key products (MEDIHONEY, TCC-EZ, XTRASORB) and a promising new in-licensed product (AMNION skin substitute) in advanced wound management (AWM). This was despite non-recurring factors, such as adverse weather conditions, reducing patient clinic visits by up to 15% and the realignment of the salesforce, restraining top-line growth.

Fund-raising enables a higher rate of investment

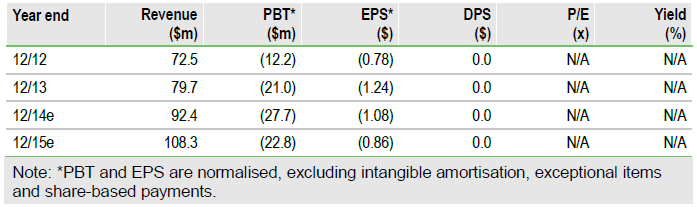

The $80m fund-raising at $11.50 per share in Q1 has allowed the company to expand its sales force aggressively, thus supporting our estimate of 20-30% sales growth in AWM in 2014-18. In the near term, we raise our forecasts for net losses in 2014 and 2015 by $3.9m and $5.9m, respectively.

DSC127 progresses steadily

We were reassured by commitments on the cost ($55-60m) and timing of the DSC127 diabetic foot ulcer trial (top-line data readout in early 2016), as new patient centres were opened in the US and South Africa. We see adverse patient selection as the key risk to replicating promising earlier clinical results in the larger Phase III trial, particularly if patient enrolment proves challenging. Nonetheless, we estimate the probability of securing regulatory clearance and reaching the market at 65%.

Current valuation implies no value to DSC127

Taking into account higher investments in the near term balanced by higher long-term forecasts for sales in AWM, we raise our valuation per share from $14.7 to $15.6. In our valuation, DSC127 represents only $2.3 per share, implying it is a free option in the current share price. The stock trades at 2.1x sales in 2014e versus its larger peer Smith & Nephew on 3.4x and its own historical range since 2011 of 1.0-3.2x.

To Read the Entire Report Please Click on the pdf File Below

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.