Delta, Theta, And The Impact On Our Covered Call And Put Selling

Dr. Alan Ellman | Mar 13, 2016 03:00AM ET

The Greeks play a major role in both covered call writing and selling cash-secured puts. Understanding these factors and tailoring our strategy based on this insight will allow us to elevate our returns to the highest possible levels. In today’s article, we will focus in on Delta and Theta and discuss when they are an asset or a liability in our investment positions. We will also examine how to best take advantage of mastering this information.

Definitions

Delta: The amount an option value will change for every $1.00 change in the price of a stock. Deltas range from 0 to 1 for calls and 0 to (-)1 for puts.

Theta: The amount the theoretical value of an option will change with the passage of one calendar day, all other factors remaining the same. Theta is a negative number for both calls and puts.

Theta: Asset or liability?

Once we’ve established our position, Theta is our friend. Once we execute the option-selling trade, Theta goes to work eroding the time value of the option, much like buying a car and pulling it out of the show room parking lot and boom…it goes down in value. This is a positive for us, because we may want to take advantage of an exit strategy opportunity and buy back the option. Because of Theta, we may be able to sell high and buy low.

Theta also teaches us to sell our options early in the contract to capture as much premium as possible. Most of us sell monthlys (options with 1-month expirations), so our obligation is only four or five trading weeks depending on the contract month. So while Theta is assisting us, Delta is weighing in as well, and Delta may also be our friend but it could also turn against us.

Delta: Asset or liability?

For both covered call writing and selling cash-secured puts, we are okay if share price rises. Puts will not be exercised and calls, if exercised, will result in sale of our shares at a price we felt was favorable to us when we entered the trade. Plus we can always roll the option if we want to retain our shares. Our main position concern is share value deterioration. When selling calls, we start to lose money when share value declines more than the option premium received from the short call. For put-selling, the option may be exercised and the shares “put” to us at a higher price than current market value, leaving us in an unrealized losing position. Both of these scenarios assume no exit strategy intervention. But, as we all know, exit strategies are crucial to our success, so we may benefit from buying back the short options. To visualize the impact Delta has on option value, let’s first look at a price chart for Cal-Maine Foods, Inc. (NASDAQ:CALM) from 8/25/2015 to 11/25/2015:

CALM Price Chart from 8/25/2015 through 11/25/2015

- Brown fields show share price decline which should decrease call premium value and increase put premium value

- Yellow fields show increases in share price which should increase call premium value and decrease put premium value

With CALM trading at $60.00 near the start of the November contracts (October 16, 2015), I focused in on the December $57.50 in-the money calls and December $57.50 out-of-the-money puts. My conservative positions were the result of an upcoming Fed meeting in December where interest rates may be hiked.

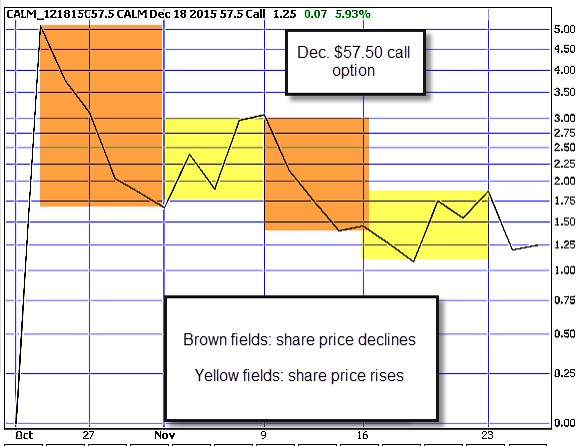

Price chart of the December $57.50 call option

CALM: December $57.50 Call Option

As price value declines (brown fields), our biggest concern, option value also declines, making it more cost effective to buy back an option if position management techniques are called for. If stock price rises (yellow fields) we have the choice of buying back the option or allowing assignment and selling our shares at a price we deemed favorable at the start of the trade.

Price chart of the December $57.50 put option

CALM: December, 2015 $57.50 put option

If share price rises (yellow fields), option value declines and we may be presented with an opportunity to close our position at virtually no cost and use the “freed up” cash to secure another put, a second income stream in the same month, if you will. If share price declines (brown fields) put option value will increase, making it more expensive to close out a potential losing situation. Now there are times we must do this to prevent substantial losses but there is one silver lining in these situations…while Delta is rearing it’s nasty face, Theta is helping us out by decreasing the time value of the put option each calendar day.

Discussion

Understanding the Greeks is critical to our success. Once we enter our option-selling positions, Theta is generally our friend while Delta is Dr. Jekyll and Mr. Hyde. When Delta represents an asset, we should know how and when to take advantage of it, and when it is our enemy when need to manage our trades and mitigate losses.

Live interview

On March 15th at 9 PM ET, I will be interviewed live on blog talk radio (Solutionsology Radio). I will provide the link to this event once it is available. The focus of the conversation will be about my third book, The Complete Encyclopedia for Covered Call Writing .

Link to live event

Market tone:

Global equities rose again this week, strengthening the position that a bottom has been established. The Chicago Board Options Exchange Volatility Index (VIX) remained steady at about 17. This week’s reports and global news:

- European Central Bank President Mario Draghi announced an aggressive package of additional measures to ease monetary policy in the eurozone, but suggested that he will not move further. The euro ended the week higher than it was before the ECB meeting

- Although China’s foreign exchange reserves declined $28.6 billion in February, that drop was not nearly as steep as the $99.5 billion decline in January. Exports fell sharply in February, declining 25% year over year

- Production cuts in the United States and a slower ramp-up in Iran’s production are helping to stabilize oil prices, according to the International Energy Agency. US production will decline 530,000 barrels per day in 2016, the agency said. It does not expect balance to return to the global oil market until well into 2017

- Two members of the US Federal Reserve Board spoke publicly this week and came to different conclusions on the inflation outlook. Vice Chair Stanley Fischer said that inflation may be stirring, whereas Governor Lael Brainard said she wants the Fed to put “a high premium on clear evidence that inflation is moving higher” before tightening monetary policy further

- Markets do not expect the Fed to hike rates when the Federal Open Market Committee meets in Washington next week

- Former Brazilian president Luíz Inácio Lula da Silva was charged with money laundering and concealing ownership of assets as the Operation Carwash scandal spread

- The Reserve Bank of New Zealand also cut its policy rate to a record low 2.25% from 2.5%. Further policy easing may be required, said RBNZ governor Graeme Wheeler

- Nasdaq agreed to buy the International Securities Exchange, an options exchange operator, for $1.1 billion from Deutsche Boerse (DE:DB1Gn)

Coming up next week

- The Bank of Japan holds a rate-setting meeting on Tuesday March 15th

- The United States releases retail sales data on Tuesday March 15th

- The US Federal Open Market Committee meets on Wednesday March 16th

- The Bank of England’s Monetary Policy Committee meets on Thursday March 17th

For the week, the S&P 500 increased by 1.11% for a year-to-date return of (-)1.06%.

Summary

IBD: Market in confirmed uptrend

GMI: 4/6- Buy signal since market close of March 2, 2016

BCI: After four winning weeks, I am moving to a more aggressive position of an equal number of in-the-money and out-of-the-money strikes.

Wishing you the best in investing

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.