Delta Airlines Vs. American Airlines: Which Is A Better Buy?

Sayat Kartabayev | Oct 16, 2018 01:41AM ET

Airlines experienced a resurgence in recent years as investors flocked to these once hated stocks. After the September 11th, 2001 attacks the ARCA Airline dropped from $180 to $120. It barely peaked above $60 before tanking to $15 with the rest of the market in 2009. Since then the index increased 8x through 2017.

Delta Airlines (NYSE: NYSE:DAL) exited bankruptcy in 2007. Shares dropped from an open at $19.10 per share down below $4 a share in 2009. Yet, the stock took off to over $60 a share through 2017. Their current share prices reflect modest growth but a low P/E and good value.

American Airlines Group (NASDAQ:AAL) saw a high of $62 a share in 2007 to crash down below $2 a share in 2009. Yet, in 2018 the stock hit a high of $58 a share, 29x it's low. With a rock-bottom P/E of 6.06x and a great PEG ratio, why wouldn't you want to own AAL?

Looking at Delta Airlines vs. American Airlines across a handful of metrics, it becomes apparent that American Airlines is a value trap.

Valuation: American Airlines

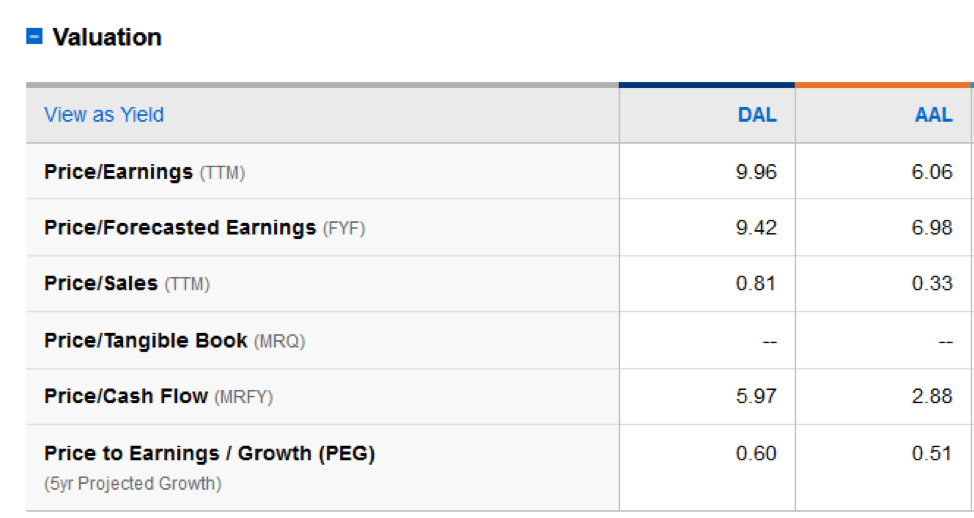

American Airlines and Delta Airlines both present a good value. Neither trades above the single digits in terms of price to earnings. Both trade in-line on a forward P/E basis compared to their current P/E. Across all the valuation metrics DAL trades at a higher multiple than AAL.

Delta's higher growth rate gives it higher multiples in every category. However, comparing the price to earnings growth, American Airlines still appears to be the cheaper alternative. With AAL prices depressed on valuation, any turn in growth provides the stock price a quick boost.

Growth: Delta Airlines

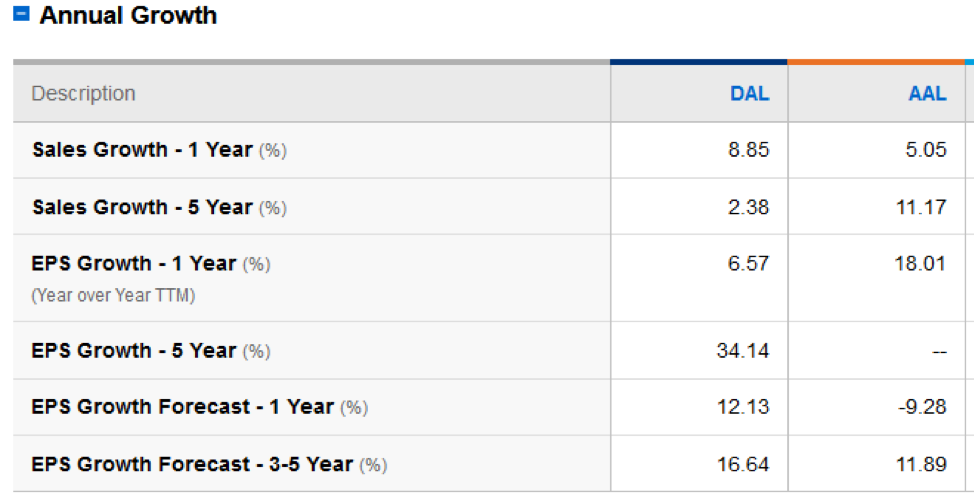

Delta Airlines presented much better earnings and growth in recent years. Compared to American Airlines, Delta put up 8.85% growth vs. American's 5.05% growth. The 5-year growth would appear to paint a different picture. However, AAL merged with US Airways to effectively double sales. Their growth remained subpar when considering this acquisition. DAL not only keeps acquiring more business travelers but manages to do so with a better margin. Their growth in earnings remains substantial and is expected to continue. American Airlines is expected to continue to suffer from higher fuel prices.

Profitability: Delta Airlines

At first glance, American Airlines shows a higher gross margin. Yet, they quickly fall short once you get down to the operating margin. Both companies continue to suffer from higher fuel costs as they deal with the rise in oil over $70 per barrel. Neither hedges their fuel costs which means that they take the full brunt of the effect when oil trades higher and the benefits when it trades lower.

However, the difference lies in how they manage their business. DAL continues to maintain its overheads and operations more effectively than AAL. Comparatively, they drive nearly 50% more sales per employee than AAL. That says something, given the positive survey results DAL still achieves.

In fact, American Airlines' operating margin declined from a higher of 17.6% in 2015 to a low of 8.8% TTM. Compare that to Delta Airlines' who went from 17.5% to 12.4%. The evidence grows that better fuel management strategies favor DAL.

Source: Charles Schwab

Efficiency: Delta Airlines

Delta Airlines continues to bring in business clients. They've led in most consumer surveys and done a good job keeping costs down. Compared to AAL, DAL performs better on returns on assets and investments. Return on equity has remained skewed due to AAL's negative shareholder equity.

Financial Strength: Delta Airlines

A quick look at the financial health of these airlines shows both on about equal footing. Yet, one major issue exists for American Airlines. Right now it shows negative shareholder equity. While it's not something they are unaccustomed to, Delta Airlines doesn't have that problem. Negative shareholder equity signals problems to any investors.

Shareholder equity equals total assets minus liabilities. While operating cash flow comes in at $3.69 billion, free cash flow comes in at -$819 million. Capital-intensive industries can have these problems at times. Given DAL offers a nice equity line, why bother with AAL? With their current trends, they look more like a company headed for bankruptcy than a stock pick.

Source: Morningstar

Overall Winner: Delta Airlines

Airlines operated in a boom and bust environment. What separates the winners from the losers is operating efficiency and value. Delta Airlines continues to promote the business traveler experience and maintain an efficient operation around its fleets. Oil prices hurt both airlines equally as neither hedge these costs. Yet, American Airlines barely keeps itself afloat.

AAL's declining and now negative shareholder equity should scare investors. The economic environment remains strong, and though fuel prices have climbed, the company operated in a soft environment for several years. The failure in these conditions would suggest the company needs a management and strategy change.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.