Deja Vu: Markets Fall To Open 2016 As Risk Aversion Dominates

MarketPulse | Jan 04, 2016 07:43AM ET

Global financial markets in 2015 were pulled between two opposing forces: The first was the Federal Reserve’s determination to raise interest rates as the U.S. job market strengthened. The second was pressure for lower interest rates in much of the rest of the world as China’s economic growth slowed and commodity prices sank.

These two themes again dominate the first day of trading in the New Year as investors are being greeted with risk aversion as bond futures rally while equity markets plummet. Expect the “big” dollars direction to be dictated mostly by two main reports later this week – Friday’s December U.S. NFP report and Wednesday’s last FOMC meeting minutes.

China halts stock trading after rout triggers circuit breaker. Disappointing PMI figures in China (Dec CAIXIN PMI Man: 48.2 vs. 48.9e – 10th straight contraction) and India (Dec PMI Man: 49.1 vs. 50.3 prior – first contraction in 26-readings and lowest since Aug 2013) overnight has equity markets seeing red. Both domestic and external demand from two of the world’s largest nations is already have a material impact on commodity sensitive currencies (AUD, CAD, NOK and NZD). China’s Shanghai composite halted trading after triggering a new A-share circuit at -7%. India’s economic data confirms that the country has moved to contraction for the first time in over two-years, in part as a result of devastating floods last month. The Reserve Bank of India’s (RBI) continued depreciation of the INR outright will only push inflation higher, with more currency weakness to result in further corporate strain through higher import costs.

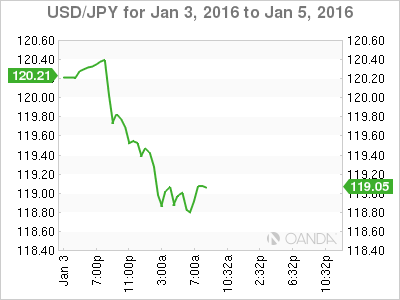

In FX, risk aversion demand has USD/JPY falling -150 pips (¥118.84), the AUD down -100 pips (A$0.7210), CAD down over -90 pips (to $1.3934), while the EUR/NOK traded at a seven-year high (€9.6843). The “single unit” has managed to reverse its early losses to trade above €1.0910 as evidence of EM turmoil could affect the pace of the Fed’s expected “four” rate hikes in 2016.

China weakens the yuan to new four-year lows. The yuan will be the most watched currency for 2016. The People’s Bank of China (PBoC) has pushed the value of the Yuan down for the fifth consecutive day in its daily fix (¥6.5190 +0.30%). The offshore yuan rate continues to fall at a faster rate than onshore – a sign that that the market expects the PBoC to weaken the yuan even further.

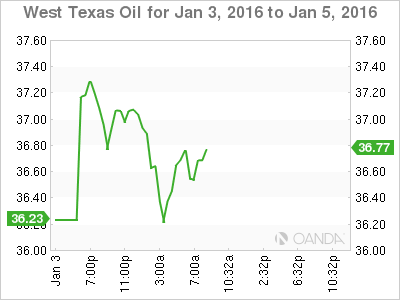

Geopolitical tension is supporting oil prices. Crude prices rallied nearly +3% in early trade above $38.10 (WTI Feb contract) as sectarian Saudi- Iran tensions has the market concerned about possibility of supply disruptions. Oil prices have since given back some of those earlier gains ($37.78).

Japanese data is improving. Japan PMI has again held up well (Final Dec PMI Manufacturing: 52.6 vs. 52.5 prelim.). This would suggest that the official GDP figure for Q4 2015 could signal some growth. Coupled with positive rhetoric from PM Abe, who noted that their economy is firmly on a recovery path with Japan no longer in deflation has given the yen some support.

European December Manufacturing PMI’s are mixed this morning. The Eurozone, Germany, Italy, Turkey and the Czech Republic managed to all beat expectations, while the U.K, France, Spain and Poland all missed.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.