DAX Edges Higher Ahead Of ECB Rate Decision

MarketPulse | Jun 07, 2017 07:16AM ET

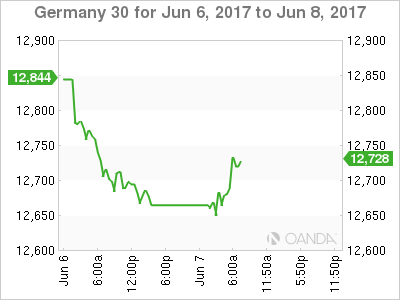

The DAX index has posted slight gains in the Wednesday session. The index is up 0.28%, and is currently at 12,725.50 points. On the release front, German Factory Orders disappointed, with a sharp decline of 2.1 percent. This figure was much weaker than the estimate of -0.2 percent. On Thursday, the ECB is expected to maintain interest rates at a flat 0.00%. German Industrial Production is expected to rebound in April, with the estimate standing at 0.6%.

Will the ECB make any changes to its monetary stance at Thursday’s rate meeting? German markets and the euro have been drifting all week, so we’re unlikely to see any significant moves from the central bank. The benchmark rate has not budged since March 2016, and policymakers do not appear in any rush to alter course. At the same time, the eurozone economy has improved in recent months, and the markets want to see the ECB acknowledge the improvement in economic conditions, such as a hawkish rate statement.

The ECB has been reluctant to taper its asset-purchase program or raise interest rates, despite grumbling from economic powerhouse Germany, which wants a tighter monetary policy out of Brussels. The markets will be poring over the rate statement and Draghi’s follow-up comments, looking for any nuances which are hawkish in tone. If this occurs, the German stock market could show some movement and head to higher ground.

The Federal Reserve is widely expected to press the rate trigger next week, which would mark the second quarter-point increase in 2017. Even a shockingly soft Nonfarm Payrolls report on Friday hasn’t put much of a dent in these expectations, with a rate hike currently priced in at 91 percent. Another rate hike by the Fed would mark a vote of confidence in the US economy, but Fed policymakers continue to have some concerns.

Inflation remains stubbornly low, despite a labor market that remains close to capacity. Fed policy makers are also scratching their heads over soft consumer spending, which has not kept pace with high levels of consumer confidence. As for additional rate hikes in the second half of 2017, the markets remain skeptical, with the odds of a September rate hike at just 22%. However, stronger economic numbers in the third quarter could easily increase the likelihood a September hike.

Economic Calendar

Wednesday (June 7)

- 2:00 German Factory Orders. Estimate -0.2%. Actual -2.1%

- 4:00 Italian Retail Sales. Estimate +0.2%. Actual -0.1%

Thursday (June 8)

- 2:00 German Industrial Production. Estimate 0.6%

- 5:00 Eurozone Revised GDP. Estimate 0.5%

- 7:45 ECB Minimum Bid Rate. Estimate 0.00%

- 8:30 US ECB Press Conference

*All release times are EDT

*Key events are in bold

DAX, Wednesday, June 7 at 7:10 EDT

Open: 12,667.50 High: 12,747.75 Low: 12,638.75 Close: 12,725.50

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.