DAX And FTSE 100 Technicals: March 02, 2018

FxPro Financial Services Ltd | Mar 02, 2018 09:52AM ET

On Thursday, President Trump said that the U.S will impose tariffs of 25% for steel and 10% for aluminium and that these tariffs will be implemented without targeting specific countries. The main trading partners of the U.S. have reacted by declaring they will take retaliatory steps. U.S. equity markets fell on worries that this action could potentially result in a trade war. This risk-off sentiment was felt in Europe, weighing particularly on the export-oriented German DAX Index. Trump tweeted this morning that “When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good and easy to win”. It should be noted that the tariffs have not come into force yet and traders should remain alert to further tweets on the subject from the President.

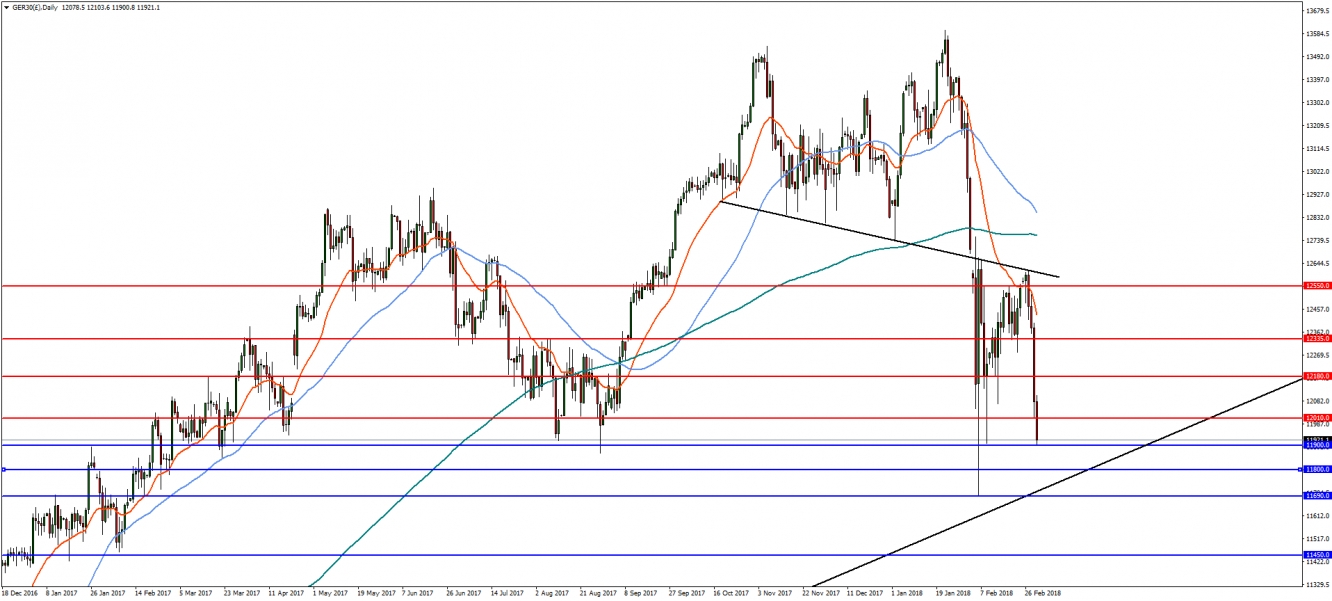

DAX

In the daily time frame, DAX is now approaching a major level of support at 11900, which has held for over a year. A break below would see a decline to trend line support near 11800, followed by a return to the February lows of 11690. Below that, major support can be found at 11450 and then the 50% retracement at 11140. However, if the 11900 support holds, a bullish reversal and break of 12010 will change the outlook, with initial resistance at 12180.

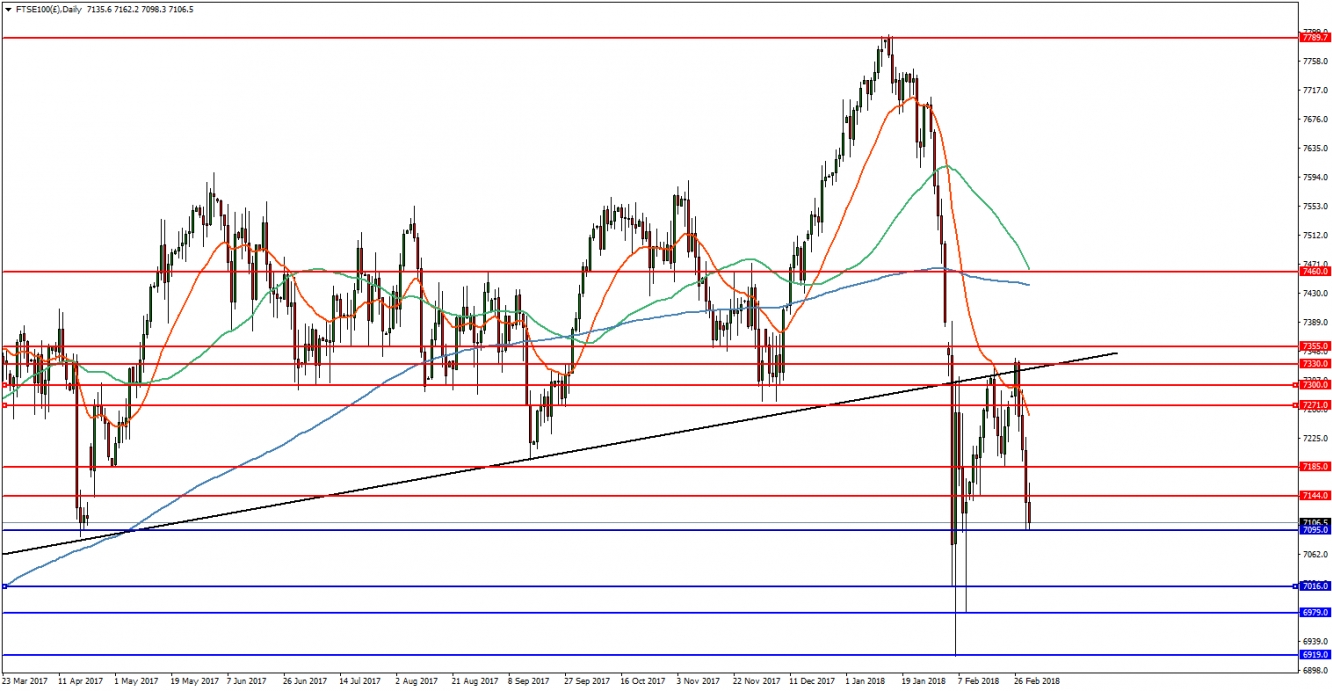

FTSE 100

In the daily timeframe, FTSE 100 failed to break the important 7300 zone and has declined sharply to test support at 7095, which is the 61.8% Fibonacci retracement of the move from 6650 in October 2016. A break would lead to further downside movement, with immediate support at 7016 and 6979. Major support can be found at the 78.6% retracement and spike lows at 6919. However, a reversal and break above 7144 is needed for an upside move to resistance at 7185.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.