Darth Vader Profits Again From Genetic Technologies Ltd.

Chris Vermeulen | Sep 02, 2012 04:44AM ET

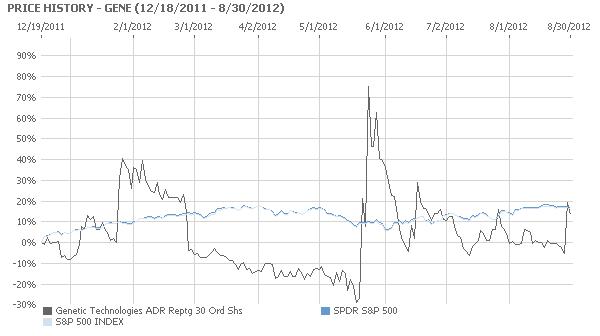

Genetic Technologies Ltd has demonstrated that it will rise on good news, and then fall again. The chart below certainly reveals that trend.

That results in Darth Vader profits for traders. This has been detailed in previous articles: both how to capture Darth Vader profits and how to gain from trading Genetic Technologies Ltd. A Dart Vader profit is when traders gain from going both long and short on the same stock. “The circle is complete” as profits are booked taking a round trip. That was the line Darth Vader used to goad Obi Wan Kenobi into laser sword combat.

Today, Genetic Technologies Ltd fell more than 5%. It was a leading gainer yesterday, soaring. For the week, as a result, it is up more than 14%. The good news that sent the share price surging for the micro cap ($57 million) was the filing of a patent law suit. For a micro cap, Genetic Technologies Ltd has sizable volume: more than 250,000 are traded shares daily.

Genetic Technologies Ltd has a negative profit margin of 86.15% and a negative return-on-equity of 55.87%. Now trading around $3.73 a share, the mean analyst target price for Genetic Technologies Ltd over the next year of market action is $7.50. The 52-week range for Genetic Technologies Ltd is $2.29 to $7.45.

The short float is tiny at just 1.84%. There is no debt and plenty of cash on the balance sheet. On a quarterly basis, both sales growth and earnings-per-share growth are plunging. For the year, however, earnings-per-share growth is higher by 108.56%. Next year, earnings-per-share growth is projected to rise by another 36.80%

As Genetic Technologies Ltd, once again, demonstrates: go short on good news and go long on good earnings to profit.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.