Danske Daily - May's Deal Or A Long Extension

Danske Markets | Mar 19, 2019 06:12AM ET

Market movers today

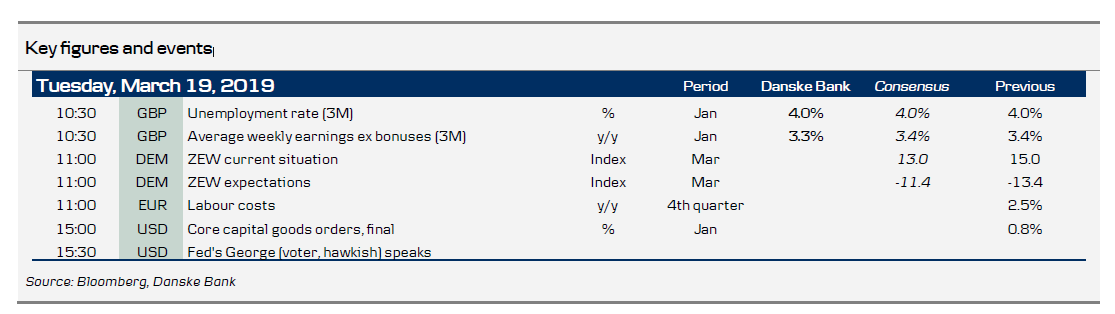

The data release calendar is rather thin again today. Markets will follow political discussions in the UK and the EU countries on an Article 50 extension (see more below).

In Germany, the ZEW index is released, where we look for further signs of stabilisation in business expectations, in spite of the falling trend currently.

Riksbank Governor Skingsley will speak on Monetary Policy at a seminar in Stockholm, 14.00 CET. Market focus is likely to be on SEK comments (more page 2).

Selected market news

Yesterday, the market focus was yet again on Brexit. After a relatively quiet day in terms of other market-moving events, Speaker John Bercow 'stole the show' as he made it clear that he will (at least in principle) not allow for a third vote unless there are "substantial changes" to the current deal.

Therefore, it seems unlikely that there will be a third vote in the House of Commons on May's Brexit deal before the EU summit starts on Thursday (21 March). The big question now is whether the EU27 leaders will grant an extension when they meet on Thursday (the decision has to be unanimous but the EU council tends to work by consensus). While we previously thought a short extension was likely, we have changed our minds and now expect a long extension (60% likely versus 30% probability of a short extension). We would be more concerned if the EU leaders were not able to reach a consensus around an extension (10% probability). This clearly increases the chance of a no deal Brexit but from a legal perspective, the extension can be granted right up until the deadline.

A long extension may increase the pressure on the Brexiteers to such a degree that they end up backing the deal. Some are speculating, despite Bercow's reservations, that May may try bring the deal forward for a vote next week, if her strategy works. A long extension would mean that the high uncertainty is prolonged for a longer period, which would continue to have damaging effects on the economy.

Overall, it seems like we will get a long extension or May's deal will pass soon. We still think May's deal passing is the most likely final outcome and that a second EU referendum (after a long extension) is the second most likely final outcome. See , 19 March.

In the US, former NY Fed president Dudley called for caution as the Fed is waiting for further data, although he still expects a hike later this year. Inflation holds the key here. We published our Fed preview yesterday, where we outlined our expectations for the Fed to stay on hold while lowering the 'dot' signal for 2019 to one hike (from two). We would not be surprised if the Fed signals "one and done". Our base case with two hikes this year will be under pressure if the Fed confirms it has changed its reaction function by looking more at inflation expectations. We expect the Fed to announce it will end a shrinking of the balance sheet in Q4 19. The impact on fixed income markets should be limited even if the Fed completely removes all hikes from the dots.

Scandi markets

Riksbank Governor Skingsley previously said she was surprised by the SEK weakness, something that is likely to be repeated today. This should not be seen as “FX intervention” and is not an expression of “concern”. However, recall that two inflation prints in a row have been significantly below the Riksbank’s forecast and a third for March is what we currently expect ahead of the April policy meeting.

Fixed income markets

The periphery continues to perform relative to core-EU and semi-core EU, as shown by the spread tightening yesterday. The periphery was supported by the rating news on Friday, where Portugal was upgraded and Italy remained on hold. Portugal has seen a very strong performance this year, but with decent macro fundamentals and an increased investor base where ETF bond funds are also scaling into PGBs, we expect the rally in PGBs still has some more to go even though spreads to e.g. Spain are very tight relative to levels seen since the sovereign debt crisis began in 2010-11.

There are no auctions today from the European debt issuers, but tomorrow the Danish Debt Office will tap in the 5Y and 10Y segments DGBs have performed versus their EU peers and are supported by the demand for duration among domestic investors as well as the modest supply and strong public finances, where the refinancing of social housing loans is being done through the government’s account with the Danish Central Bank rather than the issuance of DGBs (see more here https://bit.ly/2JmZn3p).

The slope of the EUR swap curve keeps flattening out to 10Y, but 10Y-30Y is steepening. This has steepened the forward curve as well and the slope 10Y-30Y (5Y forward) is now positive and close to the highs seen since 2017. It shows that the 10Y segment rather than the 5Y segment is the pivotal point on the curve in terms of ECB expectations at the moment. We have been recommending the 10Y-30Y (5Y forward) steepening trade, and are looking to close it with a decent profit.

FX markets

Riksbank Governor Cecilia Skingsley, who recently got her mandate on the Board extended to 2025, will share her and the Riksbank’s view on the current economic situation and monetary policy in a speech today at 14:00 CET (see above). We have heard Board members saying they are surprised by the year-to-date depreciation of the SEK, but while markets may be SEK-positively susceptible to these kinds of comments, we do not consider them as verbal interventions against SEK weakness: surprised yes, concerned no. So we wait to hear what she has to say about the currency and the implications of inflation misses. Positive momentum is slowly returning to the oil market, where investors have started to add to long positions again. The recent string of news that OPEC+ compliance to output cuts remains high has helped this development. OPEC+ announced yesterday that it will skip its April meeting and wait on deciding on an extension to output cuts until June. The GBP spiked on the news from Speaker Bercow (front page), but came quickly back and is now trading around the 0.855 level against the EUR, which is slightly lower than pre-Bercow news.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.