Danske Daily - Inflation Friday

Danske Markets | Aug 30, 2019 04:35AM ET

Market movers today

- In the euro area, we get the preliminary August HICP figures today. This will be the last inflation input before the ECB meeting on Sept. 12, hence setting the scene for the monetary stimulus package. In July, headline inflation fell to a three-year low of 1.0% y/y, while core inflation stood at 0.9% - just below the 1.0% level it has hovered around for the past five years. Energy prices have fallen substantially since August and hence we expect both headline and core inflation to print at 0.9% in August.

- After a cacophony of Fed speakers last week, U.S. inflation data will be in focus today with the PCE figures for July due out. We expect PCE core rose +0.2% m/m in July, implying an unchanged PCE core inflation rate at 1.6%.

- In the Scandi countries, we are looking forward to Danish Q2 GDP figures and Norwegian unemployment data for August.

Selected market news

Markets took courage from indications that China would not immediately retaliate against the latest U.S. tariff increase announced by President Trump last week. Next focus reverts to whether negations planned for September will still take place. Asian equities extended Wall Street's rally this morning, also supported by better than expected Japanese industrial production figures that reversed June's sharp decline in factory output.

Incoming ECB President Christine Lagarde signalled policy continuity. Mirroring the official ECB communication, Lagarde said the institution has the tools to tackle a downturn and has not yet hit the lower bound on interest rates. Quite a different message came from ECB Governing Council member Klaas Knot who argued against a package of easing measures including a restart of QE. The comments are not that surprising given he is the most hawkish ECB member. With two weeks to go before the ECB meets, the market remains priced for significant easing from the ECB.

The Brexit situation remains fluid. Boris Johnson's suspension of the UK parliament will get an early test on Friday when two courts could rule on challenges from Brexit opponents. In light of the recent events, we have changed our call and our base case now is that a small majority in the House of Commons will eventually bring the Johnson government down, form a temporary government, ask the EU 27 for an extension and call for election when the extension is granted (40%). However, we stress that uncertainty is high and the risk of a no-deal Brexit has increased in the past days in our view (30%).

Italy's President Matarella tasked Prime Minister Conte to form a new governing coalition between the Five Star Movement and the centre-left Democratic party. The deal reduces the risk of another budget clash with Brussels over the 2020 budget and rating downgrades. Italian yields cheered the avoidance of snap elections with the 10Y yield breaking below 1% for the first time ever. A final hurdle still needs to be cleared by getting support for the tie-up amid Five Star members in an online vote.

Scandi markets

Today brings details of the Danish national accounts. The GDP indicator showed strong growth of 0.8%, which we expect was driven mostly by foreign trade, while domestic demand has been more modest.

The past couple of months have seen a worrying change in the downward trend in Norwegian unemployment of the past three years. On the other hand, vacancies have continued to climb, so we see the NAV jobless rate holding at 2.3% in August.

Fixed income markets

BTPs continued to rally yesterday as Conte agreed to form a new coalition and as risk appetite remained a positive backdrop. The 10Y IT-DE spread is back at 167bp and almost the whole ‘Salvini premium’ from 2018 has now been erased. We still see room for further BTP performance and call for a test of 150bp in the 10Y IT-DE spread during the autumn.

However, much will also depend on the ECB delivering a supportive QE programme in two weeks’ time. Over the next week, we should expect more ECB comments before the seven-day silence period kicks in. Yesterday, we had Knot on the wires and he lived up to his hawkish reputation, saying that the euro area economy is not weak enough to warrant a resumption of the QE programme. It pushed Bund yields a few basis points higher and spreads widened but nothing dramatic. It underlines that as long as the euro area economy sees a rapid weakening trend and inflation stays muted, Draghi has the upper hand. The dovish ECB line also got support from incoming ECB President Lagarde who said that ECB rates have not reached the lower bound.

FX markets

EUR/USD trended lower yesterday and shrugged off hawkish comments from ECB’s Knot. We see a risk that the ECB fails to live up to current market pricing and ends up pushing EUR/USD higher.

In the Scandies, both NOK and SEK have been under pressure in a move that at least partially seems related to month-end flows. In addition, domestic data releases have been to the weak side of expectations with notably the NIER survey in Sweden painting a gloomy picture. In Reading the Markets Sweden, released this morning, we lay out our thoughts on the Riksbank decision next week and thereafter and why, given the current pricing, we continue to have a bearish view for the SEK.

Yesterday’s mainland GDP release in Norway at first sight also disappointed. However, with positive revisions to Q1, growth in 2019 has actually been marginally stronger than Norges Bank has projected and with solid employment growth the national accounts is NOT an argument against a September rate hike. On the labour market, today’s NAV report will be very important to us economists but we doubt it will trigger any noteworthy NOK move.

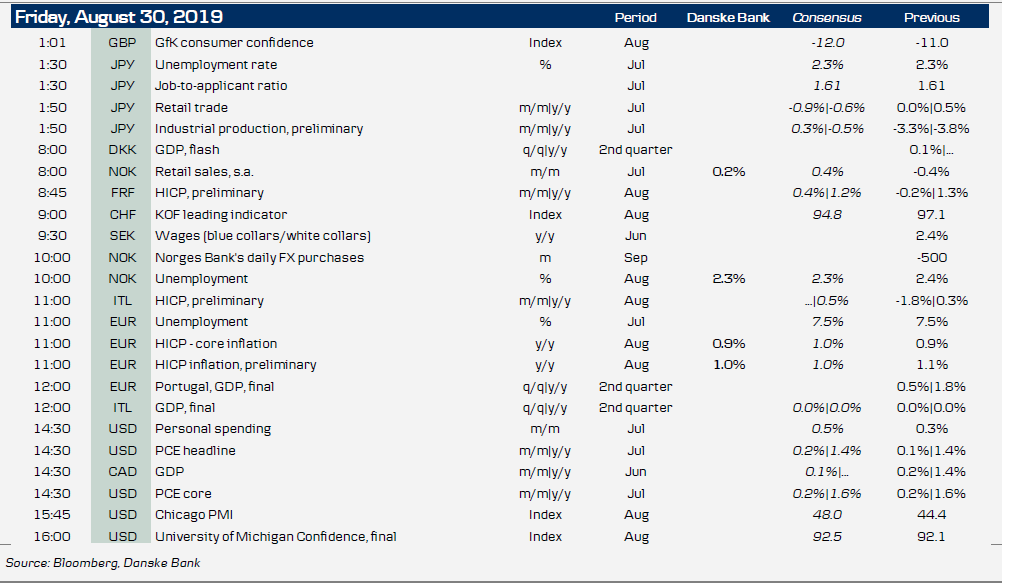

Key figures and events

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.