Danske Daily - EU Game Of Thrones Can Now Begin

Danske Markets | May 27, 2019 03:35AM ET

Market movers today

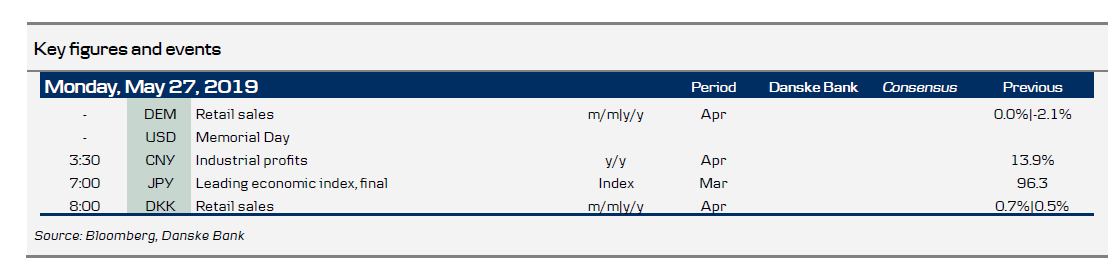

The week starts out quietly on the data front, so focus will be on politics, notably the outcome and implications of the EU parliamentary elections.

A key area of interest will be the EU election result implications for the appointment of the next head of the EU Commission, which could also have implications for the ECB presidential appointment, see also ' .

In the UK, the results for the Conservative Party will be scrutinised in light of the impending leadership contest.

Selected market news

Although the EU elections saw shrinking support for established parties in many countries, the influence of Eurosceptic groups will remain limited with a vote share of c.23% (from 20.6% previously). Losses for the Social Democrats and Conservatives - which lost their absolute majority for the first time since 1979 - were amply offset by gains for the Greens and Liberals, meaning that overall sentiment in Parliament will remain pro-EU. Still, in France, President Macron's party En Marche lost the race against the far-right Rassemblement National, calling into doubt his grand plans for domestic reforms and further EU integration.

Similarly, in Germany, critical voices in the grand coalition are getting louder after another heavy defeat for the SPD party. While national governments will digest the repercussions of the election results in the coming days, focus in Brussels reverts to coalition building and the election of a new Commission president, see 2019 EU Parliament elections: Setting the scene for the 'European Game of Thrones '. Note that in the UK, the Conservatives only got 9% of the votes, while Nigel Farage's new Brexit Party got 32%. It may further support the hard Brexit camp as the Conservatives prepare to elect the successor to PM May.

All in all, we expect financial markets to react positively to the EU election results (higher equities and yields). But it is not a big market mover, as we see it. The next major events are the ECB and Fed June meetings.

On Friday night, Fitch changed the outlook on Portuguese government bonds from "stable" to "positive". Fitch pointed to falling public debt/GDP and a low headline fiscal deficit and sees little risk of a sharp deviation from current fiscal policy after the October elections. It shows that the positive rating cycle is still intact in Portugal despite the weaker Eurozone outlook. That said, Moody's did not change the rating or the outlook for Spain. However, the Spanish economy is, like Portugal's, in quite good shape and it is just a matter of time, in our view, before Spain receives a positive outlook.

Fixed income markets

BTPs performed on Friday after the more conciliatory comments from Italian Deputy Prime Minister Salvini on the budget deficit. Salvini’s League won 30% of votes in the EU election. However, as other populist parties across Europe, except France, did poorly in general, we doubt that Salvini can use his victory in any future stand-off with the EU Commission, and further support to BTPs could be seen this week. German yields could edge marginally higher after the EU election results, though upside is limited after the weak Eurozone PMIs last week.

On Friday night we published our Government Bonds Weekly, 24 May. We have closed our long position in 5Y Spain versus France as our profit target was reached. However, we still like Spain versus France on fundamentals and carry, and we recommend to buy the 8-10Y segment of the Spanish curve versus France. We also argue that the new Dutch 20Y green bonds look cheap on the curve. Index extension and ETF demand should also be supportive for the green bond. Also see our Index Extension update.

There is limited supply this week as only Italy and Germany are coming to the market. There is a new 2Y schatz and a tap in the 5Y benchmark. Italy is tapping in 5Y and 10Y linkers as well as a zero-coupon bond on Tuesday. On Thursday, the Italian Tesoro will tap in nominals. They are due to announce which bonds they will tap today.

FX markets

Following last week’s dire PMI readings and trade war escalation, the call on central banks is clearly rising. USD/JPY and EUR/CHF remain on the back foot but EUR/USD made a strong finish last week as Fed cuts are being more and more intensively priced. And indeed everyone is looking towards Powell and co for cues on whether the Fed will come to the rescue; vice chair Clarida is speaking on Thursday. In the interim, on Wednesday, Bank of Canada could be used as a bellwether of central bank willingness to mend faltering risk sentiment. In FX Edge: Sell USD when you see the Fed put, 27 May, we stress how last week’s weak PMI data could mark a turning point and trigger a break with recent policy inaction. Indeed, we are now vigilant to a dovish turn from the Fed, which could trigger a higher EUR/USD and EUR/JPY, in addition to NOK and SEK strength.

In the Scandies, EUR/NOK has returned to the low end of the 9.70s. We still think the fundamental case for a stronger trade-weighted NOK remains in place, but the timing for a sustained move lower in EUR/NOK has become tricky given the global environment. As an alternative way of playing a stronger NOK, we recommend looking for a lower AUD/NOK as a relative bet on commodity prices, global data policy interplay and relative monetary policy between Norway and Australia, see also Reading the Markets Norway, 27 May. Last week we saw EUR/SEK trade down below 10.70, which we had argued could be possible given signals that the cross was somewhat overbought. As for this week, the main event will be the GDP print for Q1 on Wednesday, which we believe could surprise on the downside. If so, the SEK should again come under pressure as the cyclical outlook deteriorates.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.