Thursday's Technical Report: EUR/USD, GBP/USD, USD/CHF, USD/JPY

ICN.com | Jun 18, 2015 08:31AM ET

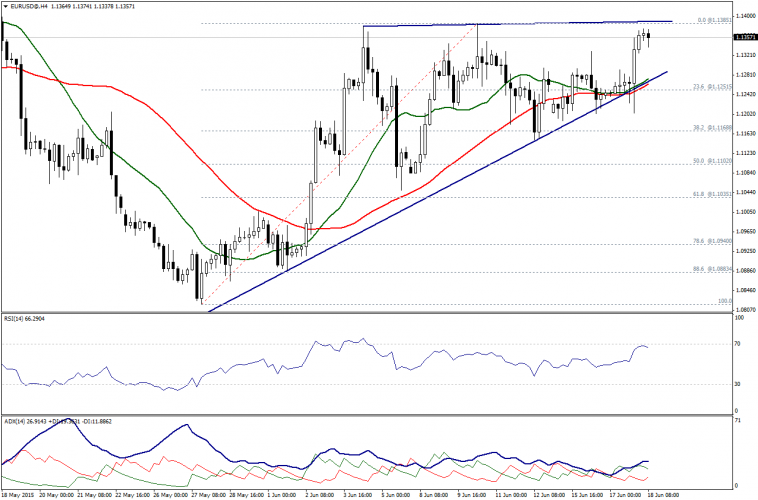

EURUSD

EUR/USD is trading near important resistance where a previous resistance exists at 1.1385, which should be breached to affirm the bullish direction.

The pair may extend the upside direction as far as 1.1250 holds in addition to stability above moving averages.

ADX and RSI shows the probability of achieving some kind of fluctuation but the bullishness may continue.

Support: 1.1300-1.1250-1.1170

Resistance: 1.1385-1.1420-1.1485

Recommendation: Buying is preferable with targets at 1.1385 followed by 1.1485 and stop loss at 1.1240.

GBP/USD

The GBP/USD pair succeeded in taking out the previous recorded high at 1.5814, suggesting extension in the bullish wave.

Targets resides in the 113% and 127.2% Fibonacci projection at 1.5*900 and 1.5990 respectively.

RSI 14 moves within overbought territories, while ADX remains positive; however, clearing 1.5900 is a condition to witness more upside moves.

Support: 1.5800-1.5740-1.5675

Resistance: 1.5900-1.5990-1.6060

Recommendation: Buying is preferable with targets at 1.5900 followed by 1.5990 and stop loss below 1.5740.

USD/CHF

The USD/CHF pair has collapsed yesterday, while the negative effects of moving averages coverage becomes stronger.

RSI14 and ADX are turning into bearish due to yesterday’s long black candlestick.

The interim support resides in the 0.9060 levels and breaching it will be a very negative sign for the USDCHF pair.

Anyway, we will be bearish today as far as 0.9330 resistance holds.

Support: 0.9150-0.9135-0.9060.

Resistance: 0.9220-0.9265-0.9330

Recommendation: Sell around 0.9220 with potential target at 0.9060 and stop loss at 0.9330.

USD/JPY

With a long upper shadow, the USD/JPY pair has ended yesterday’s trading bearishly after FOMC decision and Yellen conference. The pair is on its way to re-test the short-term low recorded in the 122.40 regions.

Meanwhile, ADX and RSI are turning into negativity and that affirms the strength of the negative pressures.

Ultimately, a break below 122.40 may trigger panic sell-off actions.

Support: 122.40-122.00-121.50

Resistance: 123.15-123.60-124.00

Recommendation: Selling is favored with potential target at 121.50 and stop loss at 123.90.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.