Daily Shot: Why China Won't Devalue The Yuan

Sober Look | Apr 13, 2015 07:35AM ET

Let's begin with several developments in China:

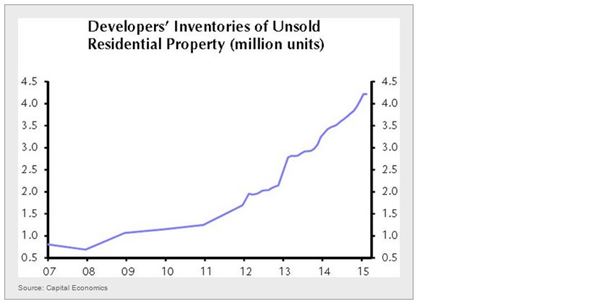

1. Unsold new residential property inventory remains elevated.

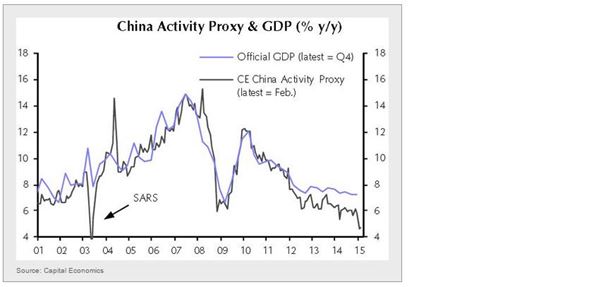

2. Capital Economics China activity index is diverging sharply from the official GDP trend, pointing to growth below 5%.

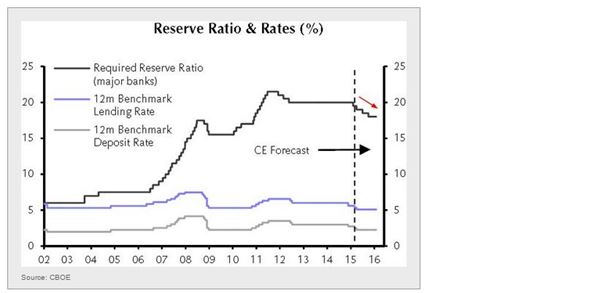

3. As a result Capital Economics expects the People's Bank of China to begin a series of cuts in the banking system reserve requirements (RRR) – and to a lesser extent interest rates.

4. In fact China's money market rates have already declined sharply.

Seven-day repo rate:

SHIBOR (overnight and one-week):

5. Analysts are becoming increasingly convinced that China will not devalue the yuan. There are a number of reasons for this, including the fact that a sizable component of China's private debt is dollar-denominated.

Moreover, Beijing wants to keep the yuan stable in order for it to become a major reserve currency. For example the International Monetary Fund is talking about including the yuan in its Special Drawing Rights (SDRs) – an international reserve asset. In fact, according to Scotiabank it could become a significant component of the SDR, eclipsing sterling and the yen.

6. A major transformation is taking place in China's municipal finance. Beijing wants municipalities to borrow via the bond markets rather than through the corporate sector.

That could crowd out corporate bonds and push longer term bond rates higher. China, it seems, is fully embracing the western habit of tapping the debt markets.

*********

Switching to the energy markets, we are starting to see more evidence of lower oil prices making their way through the US economy.

1. I already discussed falling US oil rig count – here are the updated data from last week.

2. Energy investment is experiencing the biggest decline since 2008. And the data below is a bit dated – the decline through today is likely to be worse.

3. Some energy-dependent communities such as the Houston area are seeing a slowdown in housing demand. Here are housing construction permits in the Houston area (year-over-year).

4. On the other hand, cheaper fuel prices are creating more demand for gasoline and putting more Americans on the road.

5. And cheaper diesel (lowest in five years) is reducing shipping costs.

Now some food for thought...

According to the Quartz publication, here are the countries where the US has military presence (outside of US).

Disclosure: Originally published at Saxo Bank TradingFloor.com

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.