Daily Insight

Matt Simpson | Apr 16, 2014 08:16AM ET

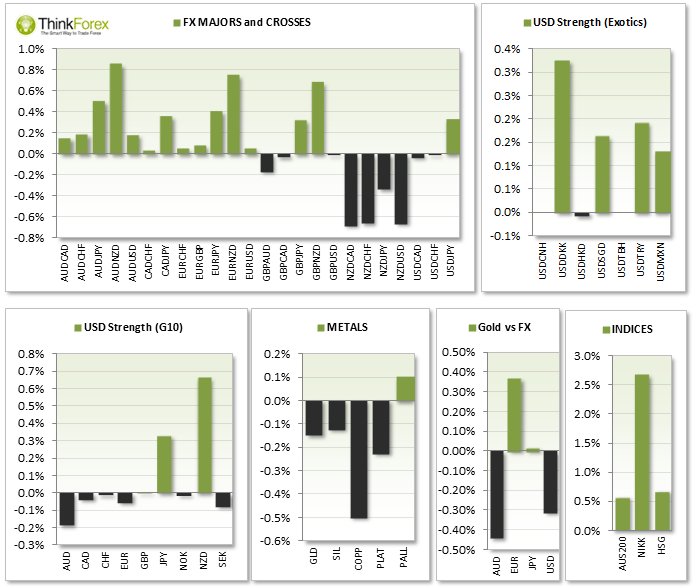

MARKET SNAPSHOT:

ASIA ROUNDUP:

- Chinese GDP up 7.4% m/m but has slowed down compared to this time last year of 7.7%; Industrial production fell short at 8.8% vs 9.1% expected; Fixed Asset Investments also fell flat at 17.6% vs 18.1% expected; China Stats Bureau warn we can no longer expect double digit returns for growth and slower growth is down to restructuring.

- Japan Economy on steady track Toward 2.0% Inflation

- NZD depreciation stole the limelight following poor CPI data and a 5th consecutive day pf dairy prices NZD/USD broke the Feb '13 bullish trendline; NZD/CAD also broke a bullish trendline from Dec '13; AUDNZD back up near 8-week highs and reached out 1.09 target which is a likely resistance level

- AUS200 continued bullish sentiment early on, albeit dampened following the lead from Wall Street;

- BoJ Gov Karudo stated it was "too soon to debate monetary easing exit strategy"

- Gold is rumoured to move higher due to shrinking supplies

UP NEXT:

- CAD interest rate is unlikely to change from 1%, so we are likely to see more volatility from GBP claimant amount and Eurozone CPI data later today.

- GBP claimant has declined for 2 consecutive months and at a 3-month low; Forecast at -30k a lower reading is positive for GBP but Cable will also take into consideration Lady Yellen's speech later along with the Beige Book.

- US Crude Oil inventories are more related to CAD and GBP than the US

- US Building Permits are within a steady uptrend and considered to be a leading indicator for the economy. Therefor a particularly disappointing number could be more bearish for USD than a positive one would be bullish.

Pairs to watch:

USD/CHF, USD/CAD, EUR/USD, GBP/USD, USD/JPY, NZD/USD, AUD/USD, WTI, XAU/USD

TECHNICAL ANALYSIS:

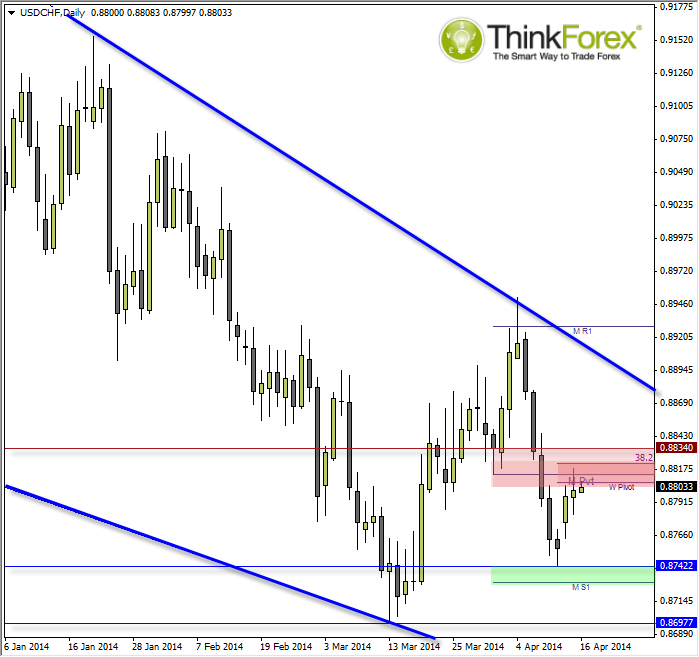

USD/CHF: Hesitates at resistance confluence zone

Yesterday's volatility during the 'Nylon' session produced Doji's / Spinning Tops across a few USD pairs. The Swissy is a good example as it is also beneath a resistance zone comprising of Weekly/Monthly pivots and 38.2% retracement.

Zones are never perfect and merely highlight areas in which to monitor (but allow room for market noise). The fact we have an indecision candle adds a little more confidence in the level holding but there are a couple of approaches for a short position.

- Wait for a more decisive bearish candle pattern to form (Shooting Star, Evening Star Reversal, Dark Clod Clover) and enter on the low of the pattern

- Or enter on the low of the Doji

Personally I prefer a little more than just a Doji but there is room for lots of volatility tonight with data coming out from Europe and US, so there is room for further reversal candles to form below resistance before feeling the need to jump in.

GBP/JPY: Intraday Flag forming around daily pivot

As we await London trading to commence price is coiling up around the daily pivot. Price is respecting the 10 period sMA and we await the next catalyst.

With UK data out there is definitely room for some intraday volatility and the bullish bias is simply based on the bullish momentum seen prior to the sideways trading.

A word of caution - London opens are known for their whipsaw before the trends develops, so be aware of this before jumping in and choosing you direction with a tight stop.

A more conservative approach may be to wait for the swing high to be broken before seeking bullish setups on lower timeframes.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.