Crypto Trader Digest

BitMEX - Bitcoin Mercantile Exchange | Sep 03, 2017 04:38AM ET

In order to expand BitMEX's though leadership in the wider digital currency community, we launched a dedicated research desk. The BitMEX Research Desk will produce thoughtful, interesting, and provocative research pieces dealing with issues facing the community.

The majority of the pieces will be written by a long time Bitcoiner. The desk aims to produce 1-2 pieces of content per week.

The following newsletter is dedicated to the first pieces of content. In the future, all content will be published to a dedicated research portal. In order to create an excellent product, we need reader feedback. Please don't hesitate to suggest ways in which we can improve.

Bitcoin Cash: Potential Price Implications of Investment Flow Data

The launch of Bitcoin Cash

On 1st August 2017, a new coin was launched, Bitcoin Cash (BCH). This was a chain split from the Bitcoin (BTC) chain. Therefore, every Bitcoin holder at the time of the split, received both Bitcoin Cash and got to keep their original Bitcoin holdings. For example those holding 1 coin prior to the split, then received 1 BTC and 1 BCH after the split.

Bitcoin Cash has the following key features:

- Blocksize limit increase

Bitcoin Cash increased the blocksize limit, to 8MB from 1MB. This increases the potential transaction throughput of the network, by approximately 4x compared to Bitcoin with SegWit or 8x compared to Bitcoin before SegWit. This higher capacity is a key advantage and should result in lower transaction fees.

- New transaction digest algorithm

Bitcoin Cash uses the new transaction digest algorithm for signature verification in BIP143 (part of the SegWit upgrade to Bitcoin, while other parts of the SegWit upgrade were removed). This upgrade fixes the quadratic scaling of sighash operations bug and improves scalability. Using the old hashing digest, each time the transaction size doubles, the number of hashing operations required to verify the transaction increases by a factor of 4 (2 squared), however after this fix, hashing scales linearly with respect to transaction size. The new digest algorithm is compulsory on Bitcoin Cash and is only optional on Bitcoin after SegWit.

The new transaction digest algorithm also ensures that Bitcoin Cash transactions are invalid on Bitcoin and Bitcoin transactions are invalid on Bitcoin Cash, such that issues with users accidentally losing funds are mostly avoided. For example, if you send Bitcoin, your Bitcoin Cash remains where it is, and vica versa.

- New mining difficulty adjustment

Bitcoin Cash has a new downward difficulty adjustment, this made the Bitcoin Cash block header invalid according to Bitcoin’s rules. Many mobile wallets therefore need to upgrade to follow the Bitcoin Cash chain, a key safety mechanism ensuring wallets follow the same chain as the one their transactions occur on. In addition to this, the new difficulty adjustment ensures the block time will not be too long, should only a small number of miners decide to switch to Bitcoin Cash.

Get The News You Want

Read market moving news with a personalized feed of stocks you care about.Get The AppThe new difficulty adjustment can cause the difficulty to fall too quickly if the gap between blocks is too long. Unfortunately this can incentivize miners to leave the network so that they can return when the difficulty adjusts and profitability improves. The impact of this appears to be that the capacity of the network oscillates in a volatile way and this appears to be a major weakness of the coin. In our view this requires a fix.

The coin launch was in many respects born out of a political dispute over the best way forward for Bitcoin, with opposing factions strongly disagreeing with each other on the best strategy. Therefore, to some extent, there is an ideological competition between the two coins, with each side hoping their chosen coin will be the most successful. The dispute is difficult to accurately characterize, however the cause of it appears to be that each side looks at the scaling issue with a different key focus.

One side appears to prioritise onchain capacity increases, while the other side appears keen to ensure that upgrades occur in a smooth, safe and voluntarist manner. Therefore, although there is not necessarily any direct disagreement between the sides, both groups are determined advocates of their favoured solutions, such that their respective coins have the potential to remain viable in the long run, in our view. It is this determination that can keep coins alive, more than anything else.

There has been some analysis comparing various metrics of the two coins, in particular focusing on mining profitability. Mining profitability is an area of particular interest given the volatile difficulty adjustment on Bitcoin Cash, causing hashrate swings between the two coins. This research note will instead focus on the apparent investor flows between the two coins.

Obtaining meaningful data here is more challenging than looking at mining profitability, however the implications of this analysis could prove to be more significant in the long run. The fact that two potentially opposing groups were each given both tokens and can now trade them against each other, to reflect their ideological objectives, makes the trading and financial market dynamics of this situation somewhat unique and interesting, in our view.

Analysis of investment flows

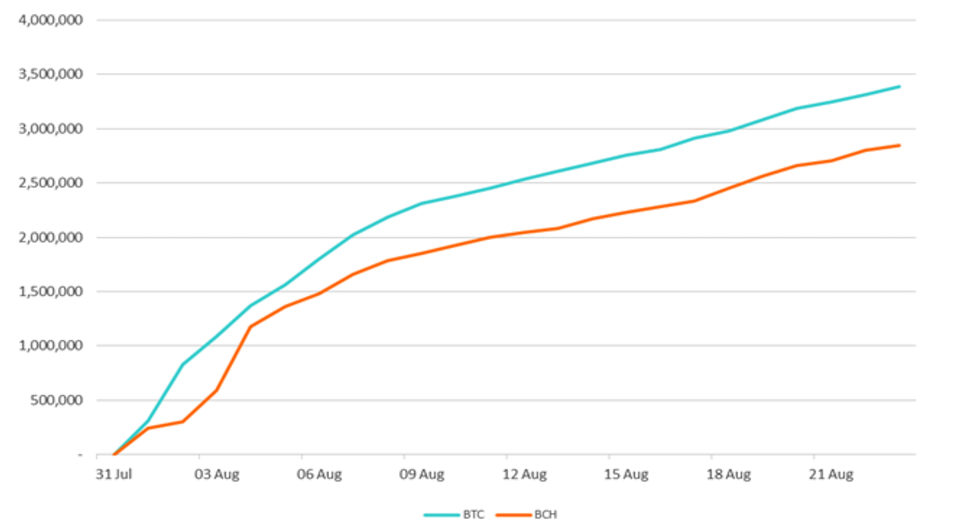

As the following chart shows, since the chain split, as at 23rd August, 2.8 million coins on Bitcoin Cash have been spent at least once. This compares to 3.4 million coins being spent at least once on the Bitcoin chain. We calculated these figures by looking at both blockchains and subtracting the amount of coins which were unspent since the split, from the total coin supply.

Bitcoin Cash has c82% of the spend, using this metric, compared to Bitcoin (2.8m/3.4m = c82%). In contrast, according to data from fork.lol , Bitcoin Cash only has c4.9% the transaction volume of Bitcoin. Therefore, since Bitcoin Cash usage is low relative to Bitcoin, it may be somewhat reasonable to assume that most of spend on Bitcoin Cash is “investment flow related”. One may think this low usage (4.9%) is a negative for Bitcoin Cash, however although transaction volume is an important metric, in our view, this has limited implications on financial markets compared to investment flows, which consider value.

Bitcoin (BTC) vs Bitcoin Cash (BCH) – Value of coins spent at least once since the chain split

Source: BitMEX research, Bitcoin blockchain, Bitcoin Cash blockchain

At the time of the split, there were approximately 16.5 million Bitcoins in existence. Therefore, as the chart below shows, 17.2% of these have been spent at least once on Bitcoin Cash, while the remaining 82.8% of coins remain unspent.

Bitcoin Cash (BCH): Proportion of spent vs unspent coins since the chain split

Source: BitMEX research, Bitcoin Cash blockchain

The above data can in theory be used to estimate the behavior of investors. One could use this information to indirectly estimate the proportion of coin holders that have sold their Bitcoin Cash, which may have implications on the future price. For example:

- If the value of Bitcoin Cash coins spent since the split is large (perhaps 40%), many users may have already sold their Bitcoin Cash and therefore the future price outlook could be positive, as the future supply of Bitcoin Cash coins could be limited.

- If the value of Bitcoin Cash coins spent since the split is low (perhaps 4%), many users may still be yet to sell their Bitcoin Cash and therefore the future price outlook could be negative, as the future supply of Bitcoin Cash could be high.

The below chart may illustrate this to some extent. On the 2nd day after the split, there was significant spend on the Bitcoin Cash chain (around 520,000 coins spent for the first time since the split), which may have increased the supply of coins on exchanges and then had a negative impact on the price in the following days. Since around 10th August, the daily spend (for the first time since the split) of Bitcoin Cash has been lower at around the 60,000 level, indicating supply entering the market may be lower. This could be supporting the Bitcoin Cash price to some extent.

Bitcoin Cash price (% vs Bitcoin) compared to daily Bitcoin Cash spend

Source: BitMEX research, Bitcoin Cash blockchain, Bittrex (for market prices)

In our view, the 17.2% figure could be considered reasonably high, given that perhaps millions of coins may be lost and that the many investors are likely to be lazy and do nothing. The supply of new Bitcoin Cash coins entering the market may therefore continue this gradual decline. Therefore, in our view, this analysis indicates the price outlook for Bitcoin Cash is neutral to positive.

Of course the above analysis is an oversimplification and there are many other factors at play. The 17.2% figure does not imply this value of coins has actually been sold, many investors may have either spent their coins in preparation to sell at a later point or even be splitting coins before doing the opposite trade (Selling Bitcoin and buying Bitcoin Cash). In addition to this, the analysis says little about the demand for Bitcoin Cash and focuses primarily on supply. In order for the price of Bitcoin Cash to increase, strong demand is also required.

There are also many other challenges facing Bitcoin Cash, such as fixing the volatile and unusual difficulty adjustment system and improving the P2P network. Therefore we are not recommending readers to invest in Bitcoin Cash, however if you are considering it, we believe this type of analysis may be useful.

An Overview of the Covert ASICBOOST Allegation

Explanatory Image - Illustrative diagram of the Merkle Trees inside a Bitcoin block

Overview

ASICBOOST is a methodology of reducing the amount of work a mining ASIC is required to do, in order to compute a hashing attempt for Bitcoin’s Proof of Work (PoW). SHA256, which is the hashing algorithm used for Bitcoin's PoW, splits the data into 64 byte chunks before the computations occur. The Bitcoin block header is 80 bytes and therefore there are two chunks. The ASICBOOST methodology involves keeping the value of one of the chunks the same, for multiple hashing attempts. This reduces the work required by only partially doing the work for this chunk, for multiple hashing attempts.

This research note should be considered as an illustrative overview of covert ASICBOOST, not an accurate or detailed analysis. Some of the complexities have been overlooked.

It is not known whether miners are actually using this methodology to mine Bitcoin or not. We do not have sufficient evidence to conclude one way or the other. The purpose of this piece is to outline the theory of covert ASICBOOST, without reaching any conclusions. The ASICBOOST methodology was first formally described in a paper published in March 2016.

"Normal” Hashing

When a Bitcoin miner hashes, for each attempt, some data in the block header is changed, such that the hash is different. The string which changes is called the nonce.

The miner varies the 4 byte nonce, which is located in the block header (on the top right of the image), for each hashing attempt. Once all the nonces have been exhausted, the extra nonce, which is located in the coinbase transaction (on the bottom left of the image) is altered, to provide extra entropy. Changing the coinbase transaction alters the Merkle root hash, which impacts both chunk 1 and chunk 2, such that work is required on each chunk of the block header to calculate the PoW. Contrary to a popular myth, the extra nonce was in Satoshi’s original Bitcoin design and was not added later to provide extra entropy to miners.

Overt ASICBOOST

Using this methodology, instead of changing the extra nonce the miner alters the 4 byte version bits field in the block header instead (top left of the image). This implies chunk 2 remains unchanged for multiple hashing attempts and work is therefore saved. If this methodology is used, changes in the version bits are visible to everyone and this ASICBOOST methodology is therefore easily detectable.

Covert ASICBOOST

The aim here is to keep the last 4 bytes of the Merkle root hash the same, while generating entropy by changing the first 28 bytes of the Merkle root hash. Therefore chunk 2 remains unchanged for multiple hashing attempts and work is saved.

However, finding multiple Merkle root hashes where the last 4 bytes collide is not easy. The only way to do this is to calculate many hashes, using the brute force method.

In order to find one such collision the square root of 2^32 hashing attempts are expected to be required. This is because we are looking for one 4 byte collision, which is 32 bits. This requires 2^32 attempts and then we square root this due to the birthday paradox. This is a total of 65,536 attempts.

Each attempt may require changing the extra nonce to generate a new Merkle root hash. However, due to the structure of the Merkle tree, this would require even more additional hashing. If we change the extra nonce, a new is hash is required for each row of the Merkle tree. For a large Bitcoin block, with perhaps 10 or more rows, this is a lot of extra work and therefore this is an inefficient process.

The following methodologies may make this process more efficient:

- Option 1 – Produce empty or smaller blocks. This simply reduces the size of the Merkle tree and therefore fewer hashing operations are required to generate a different Merkle root hash. The extra nonce can therefore be varied in the normal way to produce more Merkle root hashes.

- Option 2 – Shuffling the branches of the right hand side of the Merkle tree. An illustration of this is provided in the red circles in the explanatory image. By shuffling the top of the right hand side of the Merkle tree, a new Merkle root hash is generated, by only doing 2 extra hashes, regardless of the size of the Merkle tree. This may be possible, but there could be restrictions preventing such shuffling, such as transaction ordering. If one transaction spends the output of another transaction in the same block, it must be to the right hand side of it.

- Option 3 – Shuffling the position of transactions on the right hand side of the tree, or swapping transactions.

The above methodologies could be combined.

The impact of the Segregated Witness upgrade proposal

As shown in blue in the explanatory image, the Segregated Witness proposal gives the miner the option (if they want to use SegWit) of adding a 2nd Merkle tree to the block, with the Merkle root hash of this tree inside the coinbase transaction.

This 2nd Merkle tree is required to have the same structure as the main Merkle tree, the difference is that transaction inputs redeemed by segregating the witness, have their signature in the 2nd Merkle tree (as well as the other transaction data). In contrast to this, only the version, inputs, outputs and locktime of the transactions remain in the main Merkle tree, with the signature excluded. Since the transaction structure must be the same, any alterations to the main Merkle tree, such as shuffling branches, must also be reflected in the 2nd Merkle tree. Therefore any efficiency gains from option 2 or option 3 above, are lost, and covert ASICBOOST becomes inefficient.

However, after the SegWIt upgrade, a miner could still do covert ASICBOOST, but only by either using option 1 or by excluding the optional witness commitment. The theory is that doing either of these things, too often, may be suspicious and that the miner would like to keep the usage of ASICBOOST as unprovable, to maintain a secret competitive advantage.

Alleged evidence of the usage of covert ASICBOOST

There have been accusations that a large mining pool may be using covert ASICBOOST and that this pool is therefore more profitable than other miners. Evidence for this claim is said to include the following:

- The particular pool in question produces a much higher proportion of empty or smaller blocks than its mining peers (we will publish research on this in the coming weeks).

- The ability to do ASICBOOST is built inside the pools hardware products. This has been available for over a year and may be costly to include. One could argue that this investment would be wasted if ASICBOOST is not being used. However, this hardware based evidence does not point to covert ASICBOOST in particular and could also be used for overt ASICBOOST.

- The pool in question is said to own some patents related to ASICBOOST, which could be considered as circumstantial evidence.

- Further circumstantial evidence is that this may be an explanation for the company’s desire to prevent SegWit being activated on Bitcoin. Although in our view, even if this is true, this may only be part of the reason for attempting to prevent the activation of SegWit.

In our view, although it is possible the allegations are true, the evidence is not conclusive.

Risk Disclaimer

BitMEX is not a licensed financial advisor. The information presented in this newsletter is an opinion, and is not purported to be fact. Bitcoin is a volatile instrument and can move quickly in any direction. BitMEX is not responsible for any trading loss incurred by following this advice.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.