Crude Oil Falls Below The Bottom End Of Its Trading Range

ETF Daily News | Nov 03, 2020 01:30AM ET

- Crude oil probes under its support level

- Inventories have risen significantly since the beginning of 2020

- The global pandemic weighs on the price of the energy commodity- The election creates uncertainty

The first four months of 2020 was a volatile period for the crude oil market. While it seems like years ago, in January, a standoff between the US and Iran in Iraq pushed the price of nearby NYMEX crude oil futures to the high for the year at $65.65 per barrel. The spread of the coronavirus worldwide sent the price over $100 per barrel lower to below negative $40 per barrel in late April when storage reached capacity, and there was nowhere to store landlocked petroleum in the United States.

By June, the price crawled back to the $40 per barrel level over the last five months. The $40 level has had a magnetic impact on the price of the energy commodity. While the price reached an all-time peak of $147.27 in 2008, before 2004, NYMEX futures never traded north of $41.15 per barrel. Therefore, the crude oil futures market has a historical tie to the $40 level.

Crude oil has been consolidating for months. Unprecedented production cuts from OPEC, Russia, and other producing nations addressed the decline in demand caused by the global pandemic. The price weakness caused US output to decline. The second wave of the virus comes at a time of the year when crude oil demand tends to reach a low during the winter months.

Crude oil probed below the bottom end if its recent trading range at the end of last week. Over the past months, each push below $40 had been a buying opportunity, and each move above the level had been a chance to sell. The United States Oil Fund (NYSE:USO) moves higher and lower with the price of NYMEX futures.

Crude oil probes under its support level

Crude oil was just below the $40 level at the beginning of last week. As the stock market began to decline, the energy commodity went along for the bearish ride.

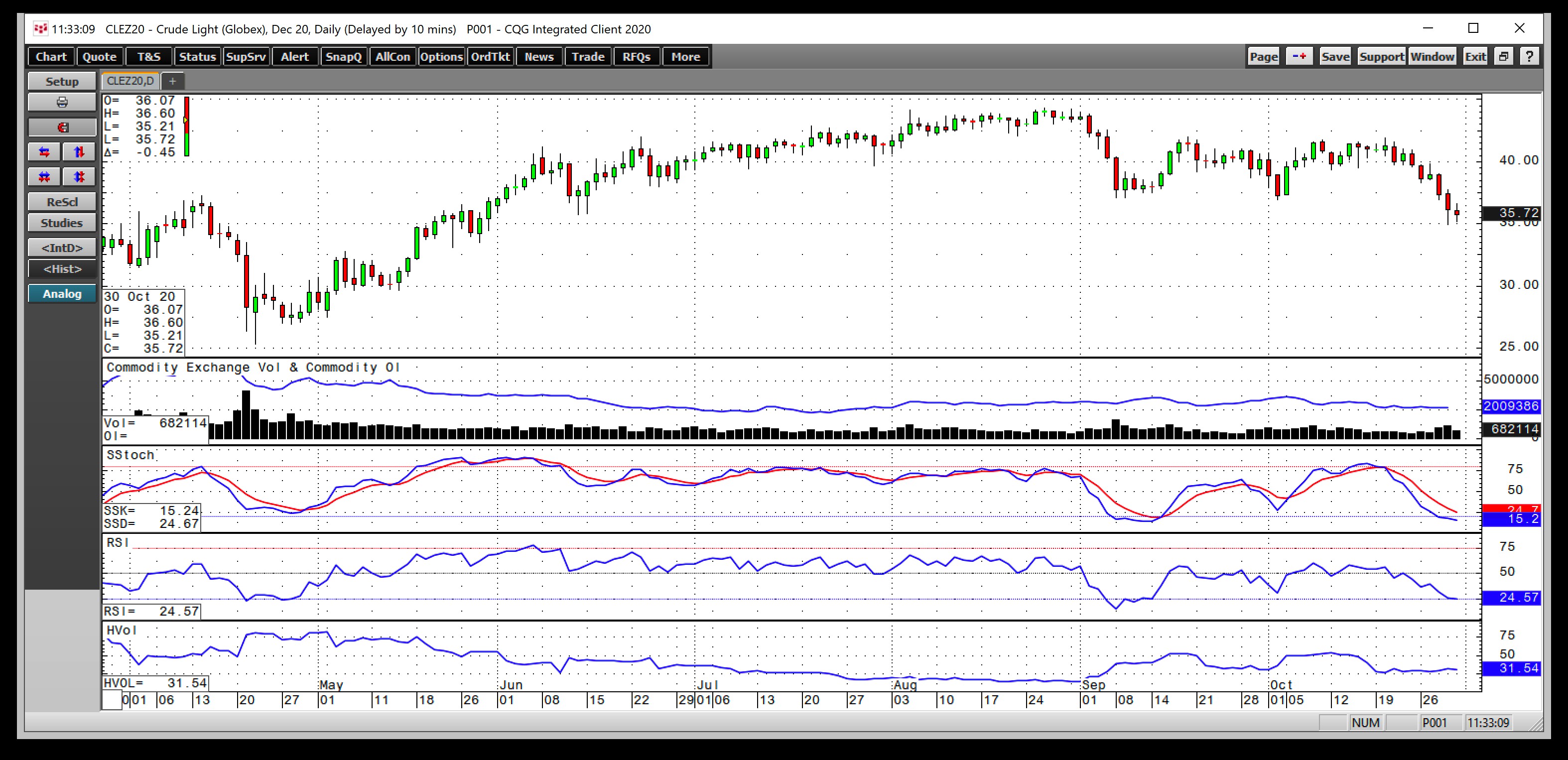

As the daily chart of NYMEX December crude oil futures highlights, the price traded to a high of $39.83 per barrel on Tuesday, October 27. Weakness in the stock market comes when crude oil is seasonally weak during the winter months and took the price to a low of $34.92 on October 29.

Critical technical support for the December contract stood at the October 2 low of $36.93. The low last week established a new level on the downside. Meanwhile, the continuous contract’s support was at $36.13, the early September low, which gave way during the final days of October.

Open interest is steady at just over the two million contract level. Price momentum and relative strength indicators were heading for oversold territory at the end of last week. Daily historical volatility at 31.54% reflects a market that has yet to make a significant move.

Crude oil was threatening to once again open a flood gate of selling.

Inventories have risen significantly since the beginning of 2020

The global pandemic caused the demand for crude oil to evaporate earlier this year, pushing the price of nearby NYMEX futures below zero for the first time since trading began in the 1980s. Even as businesses began reopening, social distancing guidelines, working from home, online education, and a substantial decline in travel caused energy demand to remain at the lowest level in years.

According to the Energy Information Administration, US crude oil inventories rose by 62.6 million barrels from the start of this year through October 23. While gasoline stockpiles fell by 16.281 million barrels, distillates rose by 28.972 million. Product stocks rose by a net 12.691 million barrels so far in 2020.

The American Petroleum Institute reported that oil stocks rose by 58.946 million barrels over the period. The API’s data points to a 13.738 million barrel decrease in gasoline stocks and a 27.881 million increase in distillates for a net increase of 14.143 million barrels of products.

According to Baker Hughes, the number of oil rigs operating in the US declined from 691 to 221 as of the end of October. Even though OPEC production cuts amount to 7.7 million barrels per day, US output declined by 1.8 mbpd since the start of 2020 and the number of operating rigs dropped, the lack of demand has caused inventories to build, which is bearish for the energy commodity.

The global pandemic weighs on the price of the energy commodity- the election creates uncertainty

The second wave of COVID-19 is now sweeping through Europe. Last week, Germany and France announced new rules for lockdowns to prevent the spread of the virus. The US stock market declined last week. All signs point to lower lows in the oil futures market and increases the chances of another elevator ride to the downside.

Meanwhile, this week, the US election will determine the future of energy policy in the world’s top producing nation. President Trump advocates for energy independence and a drill-baby-drill and frack-baby-frack agenda for the US. While challenger Joe Biden has said he will not ban fracking, he advocates for a phase-out of fossil fuels over the coming years.

The progressive Democrats favor an immediate ban on fossil fuels. A blue sweep this Tuesday would likely lead to a substantial decline in oil and gas production in the US and hand the power and influence back to OPEC, Russia, and other world producing nations.

Crude oil is still the energy commodity that powers the world. There are over 270 million registered vehicles in the US, and the majority run on oil products. While the coronavirus caused a significant decline in air travel, jets require fuel, an oil product.

Many other individuals and businesses need oil and oil products to power their lives and processes. Tuesday’s election will decide if the US remains the world’s leading oil producer or moves onto a different path for the coming years.

Crude oil looks like it is about to take a nosedive, and it may spike lower no matter who wins the election. However, the price action over the coming months and years will depend on the election’s outcome. The US continues to lead the world in output, with 11.1 million barrels per day of production as of the week ending on October 23.

However, liquidity from central banks and government stimulus programs that are expanding deficits and the money supply could have inflationary ramifications over the coming years. Nearby crude oil rallied by over $80 from the April low to the most recent high. We should expect lots of volatility in the energy commodity over the coming weeks and months. A spike lower over the winter months could lead to a robust rally in 2021.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.