Crocs (CROX) Stock Dives on Agreement to Acquire HEYDUDE

Zacks Investment Research | Dec 24, 2021 07:28AM ET

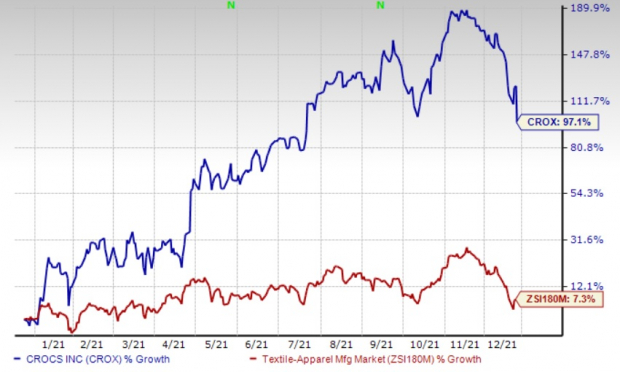

The Crocs (NASDAQ:CROX) Inc. industry ’s growth of 7.3% in the same period.

Sturdy consumer demand and brand strength have been contributing to Crocs’ robust growth story. The company’s focus on product innovation and marketing, digital capabilities, and tapping of growth opportunities in Asia also bode well.

Crocs’ timely actions helped mitigate the impacts of factory closures in Vietnam, its major manufacturing hub, and the global supply-chain bottlenecks in the third quarter. The company took immediate action to shift production, enhance factory throughput, leverage air freight, and strategically allocate units.

It remains optimistic about navigating through the tough times. Notably, it is shifting production capacity to countries, namely China, Indonesia and Bosnia. Management notified that the company can ramp up factory production due to the limited inputs and simple configuration of products. Crocs is also planning to lower its dependency on West Coast ports by adding East Coast transshipment capabilities to reach key customers in the United States.

In spite of the temporary disruptions, Crocs anticipates revenues growth of more than 20% in 2022, fueled by brand strength and consumer demand globally. Wholesale orders for the first half of 2022 have been exceptionally strong. To strengthen inventory positions across all its regions for the first half of 2022, Crocs plans to invest $75 million in air freight.

Stocks to Watch

We have highlighted some better-ranked stocks from the same industry, namely Delta Apparel (NYSE:DLA) .

The Zacks Consensus Estimate for Delta Apparel’s current financial-year sales and earnings per share suggests growth of 11.6% and 9.4%, respectively, from the year-ago period’s reported numbers.

Guess currently carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 97%, on average. Shares of GES have risen 14.1% in the past year.

The Zacks Consensus Estimate for Guess’ current financial-year sales suggests growth of 38.6% and the same for earnings per share indicates substantial growth from the year-ago period’s reported figures.

Under Armour currently carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 244.5%, on average. Shares of UAA have gained 18.4% in the past year.

The Zacks Consensus Estimate for Under Armour’s current financial-year sales and earnings per share suggests growth of 25% and 396.2%, respectively, from the year-ago period’s reported numbers. UAA has an expected long-term earnings growth rate of 25%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.