Covered Calls Minus The Hassle For 10%+ Yields

Contrarian Outlook | Nov 07, 2018 05:30AM ET

Most investors buy stocks and hope they’ll go up in price. They do nothing in the interim to generate cash flow from those stocks while they sit in their portfolio.

Dividends are a good start. But did you know that it’s possible to accelerate many payouts by writing covered calls?

“Write” what?

I’ll explain. And I’ll also highlight some popular exchange-traded funds (ETFs) and closed-end funds (CEFs) that will help you generate 10% cash yields or better from this income strategy without actually handling an options contract yourself.

A call option is a contract that gives its buyer the right to purchase a stock from the seller for a certain price within a certain period of time. For that right, the buyer pays the seller a sum upfront, called a premium.

Option traders buy calls hoping they can multiply their money in a short period of time. Rather than buy a stock and hope for a 10% gain in a year or so, they buy call options aiming for a 100% gain in a month.

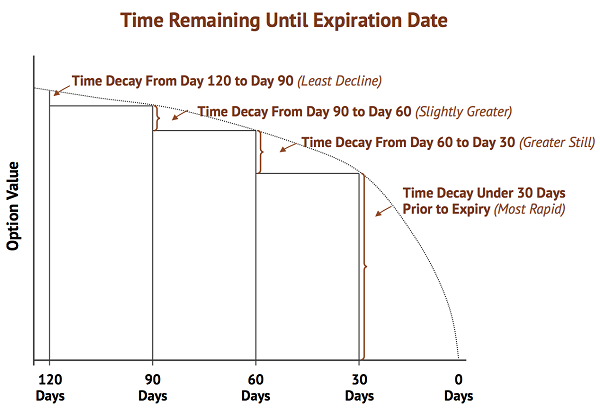

Of course there’s a catch – otherwise option traders would be the richest people in the world! And that caveat is time. When you buy a call option, not only do you need the share price to move higher for you to make money – but you also need it to happen within a relatively short timeframe. The clock is ticking. Loudly.

With each day that passes, options decay in value. That’s bad for buyers, but great for sellers – those who collected the premium up front. With each passing day, they grow richer. They don’t have to worry about the clock. In fact, it’s their friend.

Horizons NASDAQ 100 Covered Call (NASDAQ:QYLD) takes money from option buyers and pays it out as distributions to its investors. The fund simply buys the NASDAQ index, and writes calls just above the current price that expire in about a month.

For a 0.60% management fee, you can outsource your option selling to QYLD. The fund yielded 10.7% over the past year thanks to the premiums it sells to option buyers (plus the capital appreciation it enjoys from the index itself.)

This sounds like a good strategy – and it is – but there are a couple of big flaws in QYLD’s execution:

- It would reap larger premiums by selling covered calls on individual stocks rather than the index itself, and

- It should be selling options with even shorter expiration times to maximize the value that expires with each passing day.

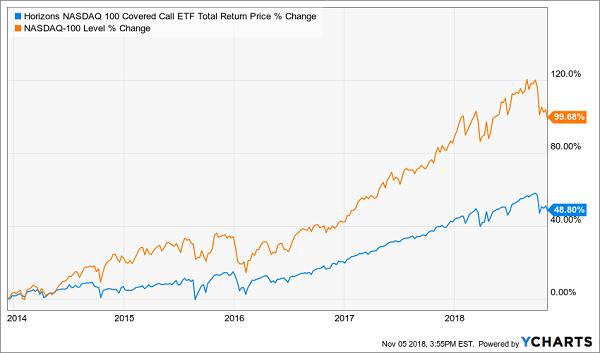

Over time, these miscues add up. Since inception, QYLD has been less volatile than the NASDAQ (as you’d expect). But its investors are missing out on most of the index’s upside:

QYLD Gets Killed

If only there were a human at the helm!

Fortunately, covered call fans can upgrade to a living, breathing money manager for a modest fee. For example, Keith Hembre runs the Nuveen NASDAQ 100 Dynamic Overwrite Closed End Fund (NASDAQ:QQQX) and employs a strategy more nuanced than my simplified example. He actually buys the individual stocks and sells call options against them.

Keith usually sells options on 35% to 75% of the portfolio. He ups the percentage when Nuveen’s indicators look bearish (to protect on the downside) and holds more “uncovered” positions when tech looks bullish (to maximize upside).

In exchange for his expertise, our management fee is 0.93%. That’s money well spent. Keith has earned his paycheck, with his hedged gains mostly keeping pace with the unhedged gains provided by the NASDAQ itself:

The Human Touch Matters When Selling Calls

QQQX pays a 7.4% annual yield. It sells for about its net asset value (NAV) today but has traded at a 6% discount to its NAV as recently as January 2017. That’s when my Contrarian Income Report subscribers took advantage of the “free money” discount and bought the fund for just 94 cents on the dollar.

It’s hard to picture now, but back then, QQQX was trading at a 6% discount to its net asset value (NAV). That was a bigger gap than usual thanks to interest rate and general CEF worries (sound familiar?).

The headline worries remain, but QQQX quickly developed quite the cache in the income world. We received two dividend increases over the 15 months we owned it and enjoyed the fund’s increasing popularity in the form of price gains. The fund’s ticker had actually rallied so much that it soon traded for a $3 premium to its NAV!

As usual, we contrarians directly benefited from this rags to riches CEF story. We took a 7.5% payer and banked 40% total returns (including dividends) in just 15 months!

40% Gains From Safe Covered Calls

I love Keith, and I love his fund. Problem is, it became a bit too popular too fast. So let’s thank our covered call maestro for our previous profits, and keep QQQX on our watch list. Investing fads fade, and someday in the near future the fund will trade at a generous discount once again. When it does, we’ll be ready to buy.

I require “free money” in addition to my high yields, so I prefer to purchase CEFs when their discounts are high. And I like three funds in particular as my “best buys” for 8%+ yields right now.

Retire on Just $500K with These 8.7% to 10.1% Paying CEFs

Closed-end funds are a cornerstone of my , which lets retirees rely entirely on dividend income and leave their principal 100% intact.

Well, it’s actually even better than that.

Their principal is more than 100% intact thanks to price gains like these! Which means principal is actually 110% intact after year 1, and so on.

To do this, I seek out closed-end funds that:

- Pay 8% or better…

- Have well-funded distributions…

- Trade at meaningful discounts to their NAV…

- And know how to make their shareholders money.

And I talk to management, because online research isn’t enough. I also track insider buying to make sure these guys have real skin in the game.

Today, I like three “blue chip” closed-end funds as best income buys. And wait ‘til you see their yields! These “slam dunk” income plays pay 8.7%, 8.9% and even 10.1% dividends.

Plus, they trade at 10% to 15% discounts to their net asset value (NAV) today. Which means they’re perfect for your retirement portfolio because your downside risk is minimal. Even if the market takes a tumble, these top-notch funds will simply trade flat… and we’ll still collect those fat dividends!

If you’re an investor who strives to live off dividends alone, while slowly but safely increasing the value of your nest egg, these are the ideal holdings for you. Click here and I’ll explain more about my no-withdrawal approach.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.