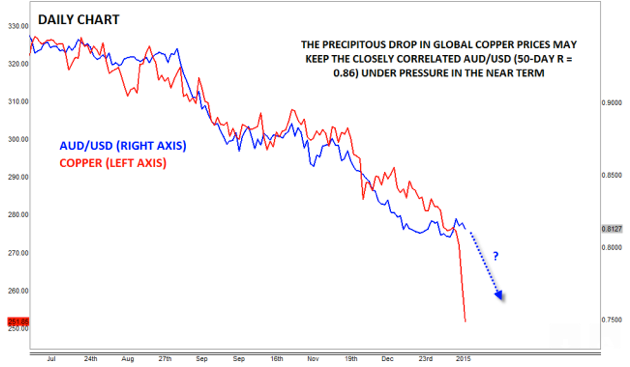

Could Correlation With Collapsing Copper Kill AUD/USD?

Matthew Weller | Jan 14, 2015 10:52AM ET

Today’s big trading story is undoubtedly the staggering drop in the price of Copper. After today’s nearly 5% drop, the industrial metal is down over 14% already this year, building on the 16.6% plunge in 2014. This is particularly concerning because it is said that “Dr. Copper” has a PhD in global economics: due to its heavy usage in the industrial and manufacturing industries, copper tends to change course ahead of turning points in the global economy as a whole.

Only time will tell whether the recent drop in copper will bode ill for the global economy this time around, but there may be an immediate impact on the Australian dollar. The antipodean currency often moves in lockstep with copper, as evidenced by the 0.86 correlation coefficient between AUD/USD (using FXA as a proxy) and spot copper prices over the last 50 days. In fact, today’s big drop would imply an AUD/USD exchange rate near .7500, over 600 pips below the current market price.

Source: FOREX.com

*NOTE: correlations can change, and there are other factors beyond the price of copper that impact AUD/USD.

For now, AUD/USD may struggle to rally as its terms of trade continue to deteriorate. Turning our attention to the candlestick chart, the unit remains within its 1-month range between .8050 and .8200, so the near-term bias is still neutral. That said, if rates close below .8050 support, a continuation to sub-.8000 is likely. AUD/USD traders should keep a close eye on tonight’s AU Employment report (0:30 GMT, expected at +5.3k) as the next near-term catalyst.

Source: FOREX.com

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.