COT Green: DXY’s Future(s)

Alhambra Investment Partners, LLC | Jan 23, 2018 01:20AM ET

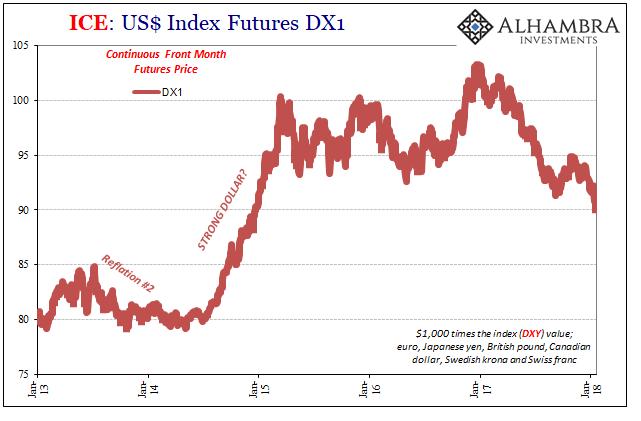

As with other prices, if we are interested in what’s going on with dollar exchange values (not be confused with eurodollars, the shadow conditions behind everything) we have to start with the futures market. Unlike UST’s or WTI, the one standing for the dollar index, or DXY in this case, isn’t particularly massive. That may be an unfair comparison given the role of DXY vs. something intrinsically vital like the treasury market or eurodollar futures, but there’s enough depth and liquidity to DXx futures to draw reasonable conclusions anyway.

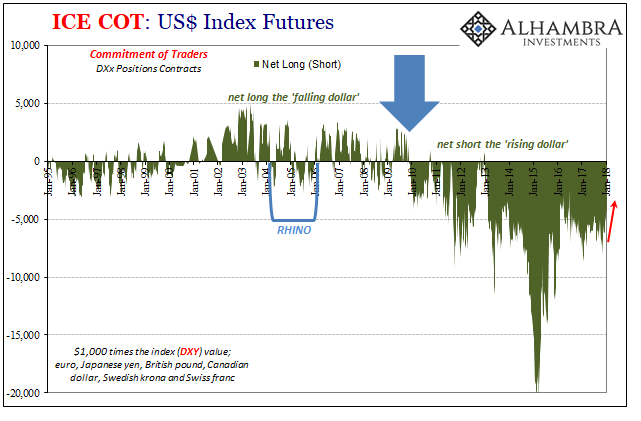

Like other futures markets, investors’ cumulative net position tends to be the opposite of what where market prices are going. For DXY, we would expect to see the cumulative net short position rise as the index does (get shorter the “rising dollar”). Conversely, as the dollar index falls, as it has since the start of last year, the net position becomes much less short and occasionally (in the past, anyway) net long.

It is obviously significant that this regime change in general, aggregate positions occurred when it did – the week in late November 2009 when Dubai World halted the resumption of the “falling dollar” that everyone expected after the crisis. Since that point, the futures market has been to some degree net short for the general rising exchange value.

This year is no different, with DXY dropping to multi-year lows and the net short in futures the least since the middle of 2016, and really getting back toward 2012-13 levels that were more closely balanced. In terms of contrarian indications, that would be more bullish than bearish on at least DXY.

The problem I have with this particular dollar index, though it is the most closely and widely followed, is that there is nothing Asian in it. I know it includes the yen and Japan is most assuredly an Asian nation, but in my view JPY is another funding proxy for “dollar” redistribution and therefore can become a contrary signal to what we are after (falling yen signals “good” eurodollar). There is no CNY or HKD, no bahts, rubles, or won to be found. That’s a problem given that one big thing that changed in 2009 was the increasingly Asian nature of the eurodollar system.

Still, the history of DXY and its futures market does match pretty closely our perceptions of the last ten years – its not good for anyone when the dollar rises (which is why it is an immediate red flat when anyone seriously attempts to invoke the term “strong dollar”).

I don’t want to make too much of the comparison, but there is a resemblance to 2013 in the most recent data. From Draghi’s July 2012 “promise”, DXY would weaken only to firm up in early 2013. It was moving higher long before “taper” was first used, and it didn’t unwind lower until the second half of 2013 when “reflation” sentiment took hold against shadow eurodollar reality.

Then, as now, all the fundamentals were discussed in the mainstream as if recovery and good growth were not just possible but likely. Inflation was going to pick up, maybe sharply, the yield curve was believed ready to really steepen out and interest rates had nowhere to go but (further) up.

That feeling only grew in 2014 even as markets more and more priced against the scenario as that year wore on. In dollar terms, by the middle of 2014 the futures market went from “reflation” to “watch out China” in the blink of an eye.

Technical analysis places a great deal of emphasis on the index never having been able to break below the 2012 floor. Maybe that’s significant, and if it is what’s important to note for me is that when it reached that technical point toward the end of 2013 during Reflation #2 it did so with less of the futures market behind it (lower net short).

Unlike then, or the big drop in the summer of 2012 that pushed to net long by QE4, there’s no immediately discernable reason or emphasis behind the current falling dollar. During those years there was the still widespread belief in monetary policy, and for a few months in 2013 the possibility that it might actually be unfolding as planned. You could point to QE or the ECB’s LTRO’s as a basis for expecting the “falling dollar” baseline to re-emerge.

In 2017, by contrast, there is perhaps even more talk about growth, particularly it being claimed as globally synchronized, but apart from that other market indications are so much more pessimistic now than three and four years ago (because of what actually happened in between). The yield curve, while nominal rates are rising more recently, is flattening out at an extremely low level. It doesn’t suggest normal for the UST or eurodollar futures curve, so I have to believe that what we are seeing in DXY (and other dollar indices) is a combination of CNY/HKD “reflation” sentiment playing against a more general unwinding of the extreme net short still left from the “rising dollar.”

In other words, it’s the path of least resistance, the absence of further breakout negative pressures from the shadows. Nothing’s really changed, in my view, except that the last “rising dollar” is further in the past not yet having bled into the next one. The lower level net shorts so far this year might suggest the futures market wondering about that possibility, too.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.