Correction, What Correction?

Cam Hui | Oct 27, 2014 12:26AM ET

Trend Model signal summary

Trend Model signal: Risk-off

Direction of last change (trading model): Positive (upgrade)

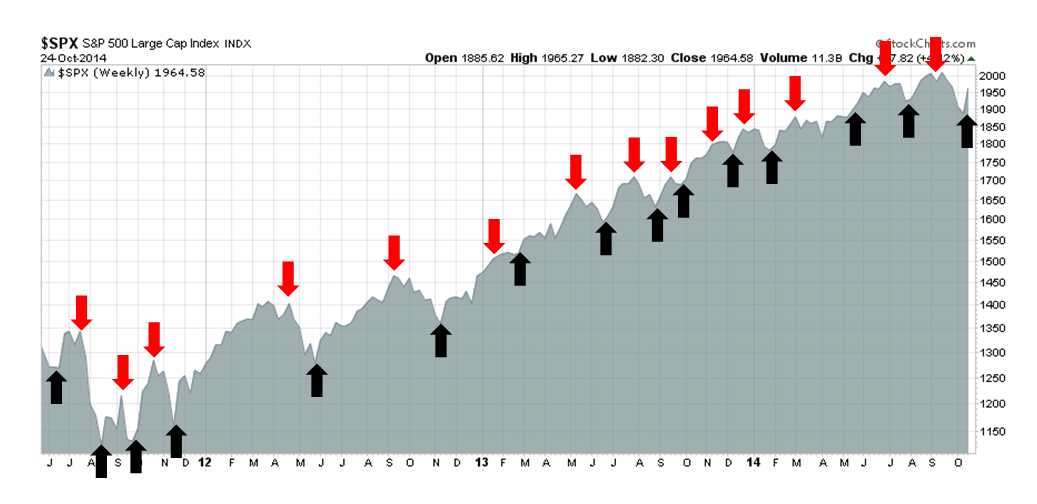

The actual historical (not back-tested) buy and sell signals of the Trend Model are shown in the chart below:

Update schedule: I generally update Trend Model readings on weekends and tweet any changes during the week at @humblestudent. In addition, I have been trading an account based on the signals of the Trend Model. The last report card of that account can be found Gavyn Davies had the most reasonable explanation of what happened:

Overall, then, three separate factors have probably been at work:The combined effects of all this should be unequivocally supportive for bonds, but ambiguous or even supportive for some global equity markets.

- a reversal of speculative positions, which has had temporary effects on asset prices;

- a contractionary and deflationary demand shock in the euro area;

- an oil shock that will also be deflationary, but will be expansionary for many economies.

Note the first point Davies raised about a reversal of speculative positions. In the past week, I have seen a couple of indications that the weakness was attributable to hedge funds re-positioning their portfolios. At the Robin Hood Investors Conference, leading hedge fund investor Paul Tudor Jones was quoted as attributing the recent downdraft to "position clearing" and that he expected further near term volatility (via Credit Suisse (emphasi:

The de-risking sentiment that prompted investors to dump stocks, however, is likely to lose steam sooner, according to Credit Suisse Head of Flow Equity Derivatives Trading Khoa Le. “A lot of people were caught on the wrong side of market volatility, and the majority of flows we saw were essentially closing positions,” he said on a recent conference call. “Effectively, you had the buy-side community saying, ‘We’re out.’” If volatility spikes again soon, they’ll probably stay out. But if it remains subdued, they will likely feel pressure to come back in.

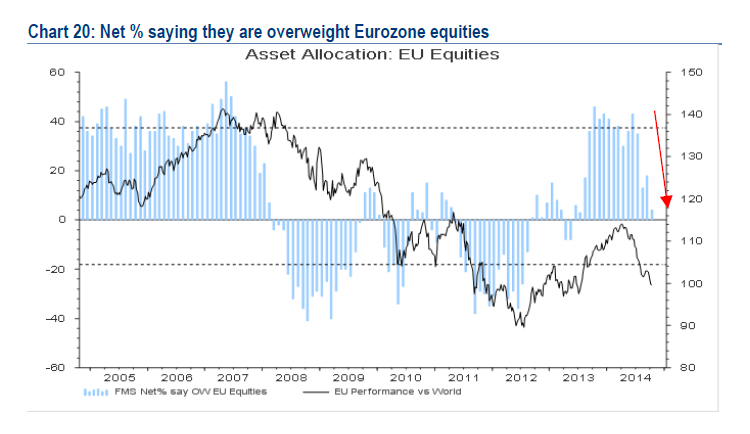

Against this backdrop, European growth continued to slow. The BoAML Fund Manager Survey showed that institutional managers were overweight eurozone equities and were in the process of reducing their positions.

When the fast money crowd (read: hedge funds) were forced to de-risk and reduce their position sizes, the expectations of slower global growth set off a stampede for the exits.

The panic spread to NAAIM managers, who are RIAs managing individual investors' assets, to panic. They reduced equity exposures to historically low levels, which have since recovered, The last episode of panic and recovery was in 2011. The key question then becomes, "Can the uptrend in equities continue?" (via Ryan Detrick annotations in white are mine):

The fast money market reaction is exemplified by the events on Thursday night and Friday. Late Thursday, news came across the wire that a shooting at a high school just north of Seattle. (What if the news wires had reported shooter was a local 14 year-old boy who converted to Islam, would the algos have reacted differently?)

Earnings, earnings, earnings!

If the scenario that I outlined is correct, then we need to more or less throw out all the technical analysis around the brief correction as it was only a momentary panic. It's time to get back to fundamentals and the real world.

Where does the market stand today? Last week, I highlighted analysis from John Butters of Factset on the US earnings season and outlook. Here is the updated Factset chart of how consensus forward 12 month EPS estimates are evolving (annotations in red are mine).

I have highlighted in red previous episodes when the forward 12 month EPS estimates have rolled over. These periods have been associated with either bear markets or corrections as the market digests an uncertain earnings outlook. Further, Butters reported that while both the EPS and revenue beat rates have been better than the historical average, the guidance rate has been negative:

Earnings Scorecard: Of the 208 companies that have reported earnings to date for Q3 2014, 75% have reported earnings above the mean estimate and 60% have reported sales above the mean estimate.Earnings Guidance: For Q4 2014, 29 companies have issued negative EPS guidance and 8 companies have issued positive EPS guidance.

For investors, the current period of stalling forward EPS growth is not a signal for panic, as forward EPS does not appear to lead the stock market. Rather it seems to be, at best, a coincidental indicator.

Where is the EPS weakness coming from? Diving further into the latest earnings reports and company conference calls, it seems to be coming mostly from worries about European growth. US large cap companies derive a significant portion of their sales overseas and global weakness inevitably weighs down the earnings outlook. Butters highlights company comments about the US, Europe and China. The US outlook remains robust (emphasis added):

On a quarter-over-quarter basis (SAAR), U.S. economic growth has been inconsistent in recent quarters. In Q4 2013, Q1 2014, and Q2 2014, quarter-over-quarter (SAAR) GDP growth rates for the U.S. were 3.5%, -2.1%, and 4.6%. According to FactSet Economic estimates, quarter-over-quarter (SAAR) GDP growth for the third quarter is estimated to be 3.0%. Despite the inconsistency, a number of companies to date have reported strong results from the U.S. and North America in their third quarter earnings releases and conference calls, or see continued strength going forward.

The worries are mainly about Europe:

On a quarter-over-quarter basis, economic growth in Europe has been weak in recent quarters. In Q4 2013, Q1 2014, and Q2 2014, quarter-over-quarter GDP growth rates in the Eurozone were 0.3%, 0.2%, and 0.0%. According to FactSet Economic estimates, economic growth in the Eurozone is expected to remain weak, as quarter-over-quarter GDP growth in the Eurozone is estimated to rise 0.2% for the third quarter. Companies have generally provided mixed comments regarding Europe. Some companies have commented on deteriorating conditions in Europe.

Surprisingly, American corporations are not that concerned about growth in China despite the signs of a slowdown:

On a year-over-year basis, economic growth in China has been declining in recent quarters. In Q3 2013, Q4 2013, and Q1 2014, year-over-year growth GDP growth rates in China were 7.8%, 7.7%, and 7.4%. In Q2 2014, there was a slight uptick in GDP growth to 7.5%. However, year-over-year GDP growth in China dipped back to 7.3% for the third quarter. Despite the slowing growth, most companies have been positive in their comments regarding China in their third quarter earnings releases and conference calls.

Watch Europe, not just the Fed

In the coming week, most American investors will be watching the FOMC announcement for clues as to the direction of future policy. While Fed policy is important to the markets, I will be keeping an eye on Europe for clues as to the longer term equity market outlook.

Indeed, the Federal Reserve has shifted its gaze overseas as well as domestically to determine monetary policy. In an unusual turn, New York Fed governor Bill Dudley recently referred to the US dollar exchange rate in a comment about Fed policy (via the column written last Friday, Kaletsky outlined why the next week is crucial to the future of Europe:

Europe is at a make or break moment. Two very different events on Sunday, occurring at opposite ends of Europe, will largely determine the entire continent’s direction for years ahead: the parliamentary election in Ukraine and the bank “stress tests” and Asset Quality Review conducted by the European Central Bank. Before explaining the significance of these two events, and their unexpected linkage, I need to mention a third announcement, due next Wednesday: the European Commission’s verdict on the budget for 2015 submitted last week by the French government.The Commission will next week have to come up with a Solomonic judgment that somehow reconciles the French government’s determination to stimulate its economy by cutting taxes with the German-imposed “fiscal compact” that former-President Nicolas Sarkozy rashly accepted in a moment of desperation in the 2012 euro crisis and which requires France to raise taxes or drastically cut spending in order to reduce its budget deficit to 3 percent of GDP. The fiscal compact rules, if applied literally, would make economic recovery in France a mathematical impossibility. Yet bending these rules will provoke a German public backlash, and perhaps even a constitutional court challenge, that could even force Angela Merkel to renege on her commitment to support the rest of the euro-zone.

Depending on how these three events turn out, Europe will either be on the road to a moderate economic recovery next year or it will condemned to permanent stagnation, possibly leading to the break-up the euro or even the European Union as a whole.

Personally, I would downplay the threat from the first two events. The markets have largely discounted the Russia-Ukraine situation, much like it has discounted the Hong Kong pro-democracy protests. Nevertheless, there appears to be an upside surprise here as the latest reports indicate that pro-European coalition led by Poroshenko will dominate the new Ukrainian parliament.

Starting with the Ukrainian election, a victory for President Poroshenko’s moderate party should allow EU leaders to launch a genuine peace process that recognises the loss of Crimea as irreversible and acknowledges Russia’s vital interests in maintaining the military neutrality of its immediate neighbours. Once these basic conditions are satisfied, a rapprochement with Russia should become possible, allowing sanctions to be gradually dismantled or at least confirming that sanctions will expire by mid-2015, as currently legislated. Removing the threat of war or further sanctions in eastern Europe will have a major beneficial effect on businesses in Germany and Italy, which been hurt much more by the confrontation with Russia than European leaders expected.

The Asset Quality Review is important because it is a necessary pre-condition for launching QE:

Sunday’s completion of the AQR has always looked like a necessary, though not sufficient, condition for a substantial improvement in monetary policy. This is because the ECB wants to stimulate private borrowing, as Britain did with the sub-prime mortgage subsidies it announced in March 2013, rather than supporting public debt, as in U.S. and Japanese quantitative easing. For this plan to work, European banks must be recapitalized and cleaned up, which the AQR is designed to achieve. If Sunday’s AQR plan proves convincing (admittedly still a big “if”) the stage will be set for the ECB to announced some serious monetary stimulus at its next meeting on Nov. 6.

Since he wrote those words, the AQR results have been published and 25 banks failed the tests but 12 have already taken steps to address the capital shortfalls since then. The good news is there are no big German or French banks on either list and the problem banks are concentrated in the troubled peripheral countries, with Spain as the outperforming outlier. All that needs to be raised is €9.5 billion, which is on the low end of estimates.

Kaletsky thinks that we could also see an upside surprise when the Commission reviews the French budget. No doubt, we will at some point see the usual European grand bargain struck behind closed doors, where the letter of the rules are respected but possibly not their intent.

Finally, a U-turn on fiscal austerity is highly probable when the Commission delivers its verdict on the French budget on Oct. 29, or failing that, in mid-November after a symbolic “re-negotiation” leading to some cosmetic strengthening of French structural reforms.

Back to 2011?

If the events of 2011 are to serve as a template for the markets of 2014, then the big question becomes one of where are we in 2011. Are the markets in the shaded area when stocks tanked, rallied and chopped up and down during the period of uncertainty? Or have we seen, or about to see, the policy response like the LTRO announcement that eventually propelled equity prices to another bull phase?

On one hand, we have started to see a policy response from the authorities. The ECB announced that Reuters story last Friday indicated that Merkel is softening her stance on fiscal stimulus and went out of her way to praise Draghi and the ECB:

German Chancellor Angela Merkel thanked ECB President Mario Draghi for spelling out to leaders at an EU summit that governments must play a role in boosting the faltering euro zone economy, and said it was their firm intention to do so."I am very thankful to Mario Draghi for holding up a mirror for us once again," Merkel told a news conference in Brussels on Friday, a day after Reuters reported tensions in the relationship between Berlin and the Italian ECB president.

"Monetary policy can do some things, that is the job of the independent European Central Bank. But if fiscal policy doesn't react simultaneously, if we don't improve our economic policies, our competitiveness and our investment climate, then we won't come out of this unsatisfactory situation," Merkel said.

She added that leaders had expressed their "clear intention" to do all this in response to the weak economy.

You have to love European theater!

The week ahead

As we approach the week ahead, the SPX has rallied strongly from a V-shaped bottom. It sliced through the 200 day moving average resistance in a single day and it's now approaching the 50 dma. Momentum indicators remain positive and the 14-day RSI is not yet in overbought territory. Given the violence of the recent up and down moves, I would not be surprised to see some degree of consolidation in the week ahead with pullbacks to test any of the Fibonacci retracement levels or the 200 dma, though a further advance cannot be ruled out. In effect, the markets are normalizing after the downdraft and reversion of the last few weeks.

The behavior of the small cap stocks have also normalized. The relative performance chart below of the Russell 2000 against the SPX tells the story. The shaded area shows the outperformance of small caps during the market swoon and their reversal soon after. This pattern is consistent with the hedge fund re-positioning thesis. Many long-short funds buy individual favored stocks and then hedge with short positions in the Russell 2000. If forced to reduce their positions, they would naturally buy back their Russell 2000 short positions, which put upward pressure on the small cap index during the unwind. When they finished, the relative downtrend of small caps relative to large caps continued.

My inner trader is nervously long and prepared for volatility. My inner investor is asking, "Correction, what correction?"

Disclosure: Long TQQQ

Disclaimer: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.