Corning Stock Could Be A Buy Before Earnings

Schaeffer's Investment Research | Oct 23, 2018 12:48AM ET

Glass concern Corning Incorporated (NYSE:GLW) will report earnings before the open tomorrow, Oct. 23. The shares have pulled back with the broader stock market of late, but if recent history is any indicator, it could be time to bet bullishly on GLW.

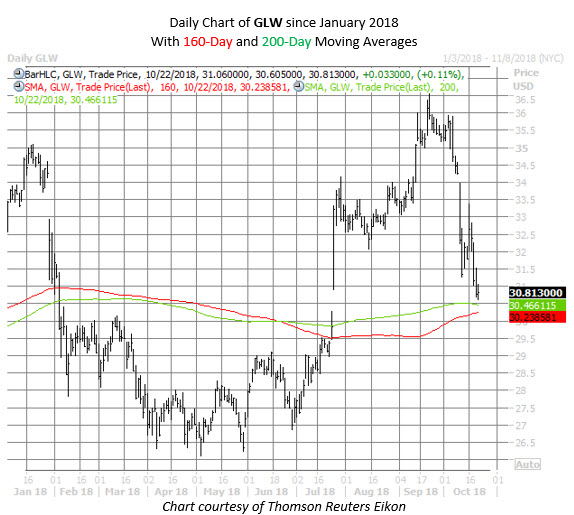

Corning stock notched a 17-year high of $36.56 on Sept. 21, but since then has surrendered roughly 16% to trade around $30.81, on pace for its first monthly loss since April. However, GLW is now within one standard deviation of its 160-day and 200-day moving averages, after a lengthy stretch north of these trendlines -- and similar pullbacks have had bullish implications in the past.

Specifically, in the past three years, Corning shares have experienced a similar pullback to the 160-day trendline four times, after which the stock went on to average a one-month gain of 4.35%, and was higher 75% of the time, per data from Schaeffer's Senior Quantitative Analyst Rocky White. Meanwhile, GLW has experienced similar pullbacks to the 200-day on three occasions, averaging a subsequent one-month gain of 5.26%, and higher two-thirds of the time.

Along with double-barreled trendline support, the stock could also find a foothold in the round-number $30 region. This area is where GLW was trading prior to a third-quarter bull gap, and acted as a ceiling in the early part of 2018.

In fact, the aforementioned bull gap came on the heels of a well-received Corning earnings report in late July, with GLW shares enjoying a one-day gain of 11.3% after reporting. Looking back eight quarters, the stock has averaged a single-session post-earnings reaction of 5.1%, regardless of direction. This time around, the options market is pricing in a bigger-than-usual 9.1% swing for GLW, per implied volatility data.

Should Corning stock, once again, bounce off key trendlines -- especially in the wake of another blowout earnings report -- there's plenty of room on the bullish bandwagon for the oversold stock. Just three of eight analysts following GLW deem it worthy of a "buy" or better rating, and recent option buyers have been upping the bearish ante.

On the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day put/call volume ratio of 0.78 is in the 95th percentile of its annual range. While this tells us that calls bought to open have outnumbered puts on an absolute basis lately, the percentile indicates GLW option buyers have demonstrated a much healthier-than-usual appetite for bearish bets over bullish in the past two weeks.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.