Contrarian Gold Stocks 2: Pushing The Yellow Metal Higher

Adam Hamilton | Jun 16, 2013 02:33AM ET

Successful investing requires buying low before later selling high. And stock prices are the lowest when they are the most deeply out of favor. That perfectly describes gold miners’ stocks these days, this sector is loathed and despised after a horrendous year so far. But these battered stocks are now offering epic buying opportunities for contrarians who have steeled themselves to be brave when others are afraid.

Our subscribers have made fortunes trading gold stocks over the past decade. Between November 2000 and September 2011, the flagship HUI gold-stock index rocketed up an astounding 1664%! This dwarfed gold’s 603% gain over that same span, and the general stock markets as represented by the mighty S&P 500 actually lost 14%! Gold stocks were almost certainly the past decade’s best-performing sector.

Though their secular bull has truly been glorious, it’s been far from an easy ride. The gold miners have always been a very volatile sector, with massive swings that can persist longer than anyone expects. I’ve seen them loved near major highs and loathed near major lows. But the visceral antipathy towards them these days is something special. It’s the worst I’ve ever seen, even exceeding that in 2008’s stock panic.

It’s not hard to understand why. Gold stocks as a sector have not made new highs since September 2011, a couple weeks after gold’s last new highs. They corrected with gold and were stuck in a high consolidation until the end of 2012. And then the bottom fell out this year. At worst in May, the HUI had plummeted a gut-wrenching 44.6% year-to-date! This was driven by gold’s parallel and unprecedented 18.8% selloff.

Gold stocks were long overdue to surge as 2013 dawned, and are radically more bullish now after 2013’s gold debacle. A perfect storm of low-probability events hammered gold and destroyed investor interest in the gold miners. Melting-up general stock markets seduced stock traders into dumping GLD gold-ETF shares en masse, flooding the global markets with far more gold supply than could quickly be absorbed.

This wildly unprecedented extreme GLD liquidation is either ending or over. So the fierce gold headwinds sparked by levitating stock markets are already abating. And as gold rebounds dramatically in its new upleg, gold stocks are going to catch a monster bid. They are so universally despised that not much buying at all will catapult them dramatically higher.

Unfortunately a lot of investors, including me, have been burned trying to game the long-overdue gold-stock bottom earlier this year. But getting stung by ultra-low-probability events shouldn’t discourage contrarians. If I’m playing poker, and I draw four of a kind, I’m going to bet huge. It’s a fantastic hand with 4,200-to-1 odds. In nearly every situation, that high-probability-for-success hand will easily win big.

But if my opponent happens to draw a straight flush, an ultra-low-probability hand with 72,000-to-1 odds, I will lose despite my strong position. That sucks, but such is life. I wouldn’t quit playing poker because an exceedingly rare event trumped my strong hand. And I certainly won’t quit investing because gold stocks I bought really cheap were pummeled even cheaper by an ultra-low-probability perfect storm in gold.

If you liked gold stocks last autumn with the HUI near 500, you ought to love them this spring near 250! It is never easy fighting the crowd, being brave when others are afraid, but that’s when a sector has the greatest odds of soon soaring. Gold stocks are epically oversold after such extreme selling in 2013, and I’ve never seen any sector so viscerally abhorred. Their recovery upleg ought to be massive beyond belief.

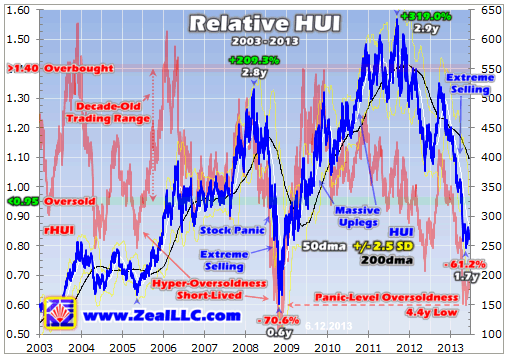

The extreme contrarian appeal of gold stocks today is readily evident both technically and fundamentally. This first chart examines the former front. It looks at the benchmark HUI gold-stock index superimposed over a technical indicator I created called the Relative HUI (rHUI). Gold stocks as a sector have only been this oversold one other time in their decade-plus secular bull, and that was during 2008’s crazy stock panic.

Just look at the HUI’s (blue) path over the past decade or so, it’s been one wild ride. Gold stocks are a really volatile alternative sector not for the faint of heart. While casual investors can thrive during the HUI’s massive uplegs, it takes tough-as-nails battle-hardened contrarians to not be scared away during the subsequent brutal corrections. I can’t even count the number of sharp selloffs we’ve had to weather.

In pure technical terms, the absolute level of any market price at any given time doesn’t matter all that much. The important question is how fast the price got to prevailing levels. The slower the move the more durable the price, the faster the move the more precarious. When prices move too far too fast in either direction, sentiment gets unsustainably excessive. And then a mean reversion soon reverses the trend.

In order to measure how fast a price has moved, you need some kind of objective yet slowly-evolving baseline. My favorite is the 200-day moving average. Looking at prices relative to their own 200dmas is the basis for my highly profitable at the time about how wildly bullish gold stocks were during that panic, a dead-right contrarian play, countless former gold-stock investors gave up and walked away. The markets’ straight flush beat their four of a kind, so they sold low and never came back.

Nevertheless, smart new investors arrived to fuel the HUI’s inevitable mean reversion out of such extreme panic oversoldness. And gold stocks climbed much faster than gold for the first year or so, nearly pushing the HGR back into its pre-panic fundamental range. Over the next year and a half gold started climbing so fast that the HUI merely paced its gains, so the HGR stabilized not far under 0.40x.

As gold stocks started falling out of favor again in mid-2011, the HGR began losing ground. This is natural during a gold correction. Gold miners have profits leverage to the gold price, a given percentage move in gold itself translates into much larger changes in profitability for mining it. So they always fall faster than gold when this metal is correcting. The upside of this is their stock prices usually leverage gold’s rallies too.

The HGR had finally stabilized in late 2012 and was starting to climb again, a very bullish sign. That was the gold-stock equivalent to that four-of-a-kind poker hand, a high-probability-for-success bet in early 2013. But then the Fed-driven SPX melt-up started sucking copious amounts of capital out of GLD, flooding the world with too much marginal gold supply to quickly absorb. So gold and therefore gold stocks crumbled.

This GLD mass liquidation was so far beyond precedent it should have been impossible. It was the straight flush, an exceedingly unlucky hand for the contrarians on the other side of the trade. So as the HUI fell even faster than gold this year, the HGR plummeted lower. It hit an astounding 0.181x in mid-May, well below the stock-panic extreme of 0.207x in October 2008. This was the lowest in gold stocks’ entire secular bull!

But is such an absurdly-bad HUI/Gold Ratio sustainable? History argues no way. After that stock-panic extreme, the HGR more than doubled over the subsequent year as gold stocks soared in their mean-reversion recovery upleg. And even if the pre-panic average HGR isn’t attained again, the 2009-to-2012 post-panic average HGR will certainly be hit in gold stocks’ necessary and inevitable mean reversion.

That number is 0.346x, and is 91% higher than mid-May’s extreme HGR low. What this means is if the HUI merely returns to its post-panic average relative to gold, and gold does nothing but languish at its current oversold levels, gold stocks would rally 90% from their mid-May lows! Even if the 2013 extreme selling anomaly is included, the full post-panic average HGR is still 0.333x. That is 76% higher than today’s 0.189x.

Gold stocks were also just pounded to the cheapest levels of their entire secular bull by traditional valuation metrics including price-to-earnings ratios. The HUI has been trading around just one-third of its 2007-to-2012 average P/E ratio. So fundamentally gold stocks are a screaming buy too, making their mean-reversion massive-upleg case based purely on technicals and sentiment all the stronger today.

Gold stocks are the ultimate contrarian buy. No sector in the entire stock markets is cheaper fundamentally, no sector is more oversold, and no sector is more despised. It is never easy fighting the crowd and being brave when others are afraid, but that’s when fortunes have been made in this secular gold-stock bull. The best time to buy is when you least want to, when it literally feels nauseating.

All these factors make gold stocks look like a royal flush today, the rarest of poker hands (650,000-to-1 odds) that beats everything else. No matter what any other markets do, gold stocks are way overdue for an enormous new upleg to accelerate higher. Most investors will miss this mean reversion, and fail to get interested in gold stocks until the HUI is several times higher a couple years from now. You don’t have to.

The bottom line is gold stocks are the ultimate contrarian bet today. An unprecedented confluence of events that is already abating drove 2013’s incredibly anomalous selloff. This left gold stocks extremely oversold, extremely undervalued, and extremely unloved. But the deeper out of favor any sector falls, the higher the odds for a massive mean-reversion rebound. And they’re approaching certainty for gold stocks.

With gold emerging from a similar hyper-oversold extreme, it won’t take much buying at all to push the yellow metal higher. And any meaningful gold rally at all will be taken as the all-clear signal by the contrarians awaiting gold stocks’ long-overdue recovery. Soon buying will beget more buying, and within a few years the HUI should again more than quadruple. Great small gold miners will fare much better.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.