Constructive Action In Precious Metals Stocks

Jordan Roy-Byrne, CMT | Nov 04, 2019 03:31PM ET

In our most recent editorial we concluded by observing a few positives in the gold and silver stocks. We concluded with:

Their performance over the weeks ahead could give us an early hint as to how much longer the correction will last.

Fast forward another week and a few positives have morphed into a handful of positives.

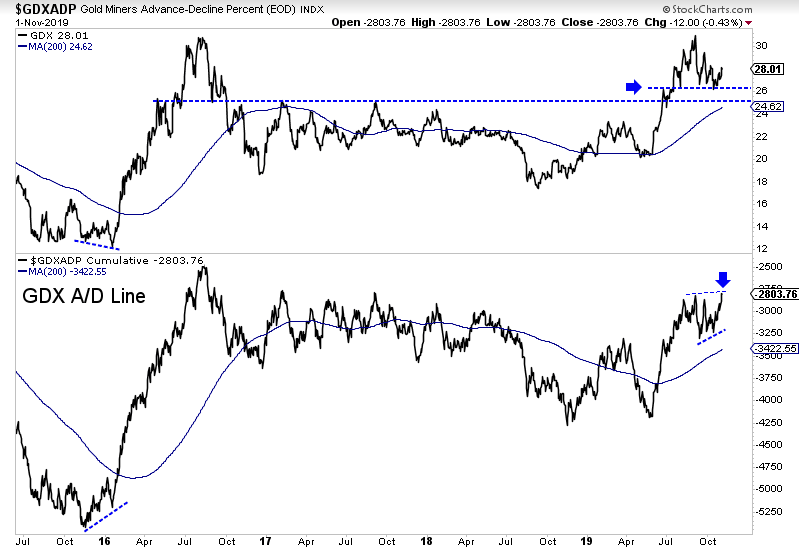

First let’s look at GDX. In the chart below, we plot GDX and its advance decline (A/D) line.

GDX (NYSE:GDX) has essentially corrected for two months and has yet to test the previous resistance zone at $24 to $25. It has bounced from $26 several times and established good support there. So it’s holding its gains.

The A/D line had been showing a positive divergence with its higher lows to GDX’s lower lows. However last Thursday the A/D line made a higher high. GDX (NYSE:GDX) itself isn’t close to making a higher high. That is a strong positive divergence.

Meanwhile, the silver stocks have perked up quite a bit in recent weeks. In the chart below we plot SIL (silver's ETF), SIL against GDX (NYSE:GDX) and SIL against silver.

SIL has enjoyed a strong rebound since its low in mid November. The ETF is now much closer to its September peak than GDX (NYSE:GDX).

SIL relative to GDX (NYSE:GDX) just closed at a 5.5-month high. The ratio is about to close above its 200-day moving average for the first time since early 2017.

Two More Positives

GDXJ has strongly outperformed GDX in recent weeks. Also, Friday's jobs report beat expectations, which is bad news for precious metals – yet they traded higher. What does that tell you?The only potential negative is the speculative long positions in gold remain stubbornly high. More time is needed to flush out some longs before gold can sustain an advance.

Watch The Miners

With that said, the relative strength of the silver stocks and the juniors (GDXJ) gives me confidence that the stocks are ultimately going to lead gold higher. In other words, we should take our cues from the miners.

These various positive developments argue that the worst for this correction is probably over. If the correction were going to deepen in price or time, then silver stocks would not be leading and gold stocks would not be holding support levels and showing strong breadth.

A move to a breakout may not be imminent but as long as the stocks (GDX (NYSE:GDX), GDXJ, SIL) continue to hold recent lows then a bullish consolidation could be forming, which would eventually lead to a breakout.

We have been focusing on identifying and accumulating quality juniors with significant upside potential in 2020.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.