Commodity Performance: Don't Forget The Roll Yield

Saxo Bank | Dec 30, 2012 02:26AM ET

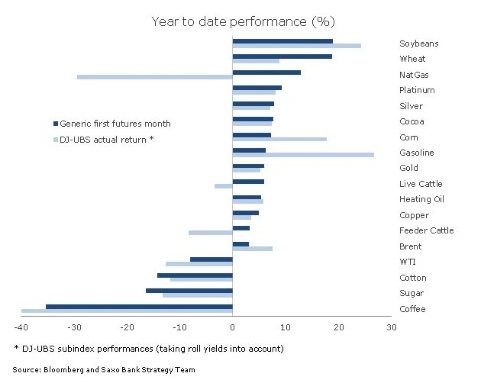

In this last update of the year i take a look at the 2012 performances of some of the key commodities. When looking at the performances of commodities, which are all traded as futures contracts requiring a regular roll, the true performance is often not shown correctly due to the inability of charts to take into account the positive or negative roll yield between an expiring contract and the next. To highlight the difference that these rolls create in performance we have used the individual return on commodities in the DJ-UBS Index versus the return when using the first futures month, thereby ignoring the roll.

The DJ-UBS commodity index invests in the futures contract that is closest to expiration in order to achieve the greatest amount of liquidity and transparency. As a result futures position must frequently be rolled forward to the next contract. Not only does this lead to significant trading costs for the index but in addition the shape of the forward curve also impacts performance.

Contango and backwardation

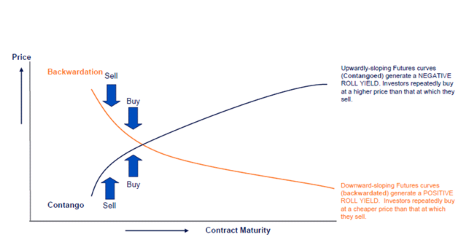

In a situation where the forward price is higher than the current the index will accrue a loss as it is buying the next contract at a higher price than the one it is selling. This shape of the futures curve is called Contango and it occurs in a situation where ample supplies keep the spot price under pressure.

The opposite scenario is backwardation, which we currently see in Brent crude and gasoline, where tightness in the physical market raises the spot price above the forward price. This situation, which has become more frequent over the last year, creates a positive roll environment for the index and helps to improve the overall performance of the index.

Contango trap affects natural gas

The contango trap mentioned above has once again played havoc with natural gas as seen below. During 2012 the price of the front month contract has risen by 13 percent but when taking into account the steep contango of the futures curve the actual return from a long only investment with a monthly (negative) roll has actually been closer to minus 30 percent.

Another example is the difference in performance between WTI and Brent Crude. During the year brent crude has outperformed WTI by 11 percent when using the front month contracts. However if we take the roll yield, which is positive on brent (backwardation) and negative on WTI (contango) the difference is actually more than 20 percent.

The discrepancy is also relevant when taking a look at wheat and soybeans. Here the first futures contract describes a dead heat between the two but because soybeans' forward structure has been in backwardatation and wheat in contango the real return has varied greatly with soybeans returning 15 percent more than wheat.

Generally we find that the returns are more or less in line between the two methods which indicate little or no differnce in forward prices, an example of which is gold and silver. It should also be mentioned that some of the difference in performance between the two methods is due to the fact that futures invested by the DJ-UBS Index are always rolled during a specific time period which is often a couple of weeks before expiry or first notice. As the generic first future month rolls just ahead of the expiry or first notice this time the difference may create a small variation in performance.

But as we enter 2013 and new investment decisions are about to be made investors who are potentially looking for a passive long only investment through one of many different commodity index funds should be aware of the potential impact on performance of the shape of the individual forward curves.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.