Commodities Posted Lone Gain Last Week For Major Asset Classes

James Picerno | Oct 08, 2018 09:45AM ET

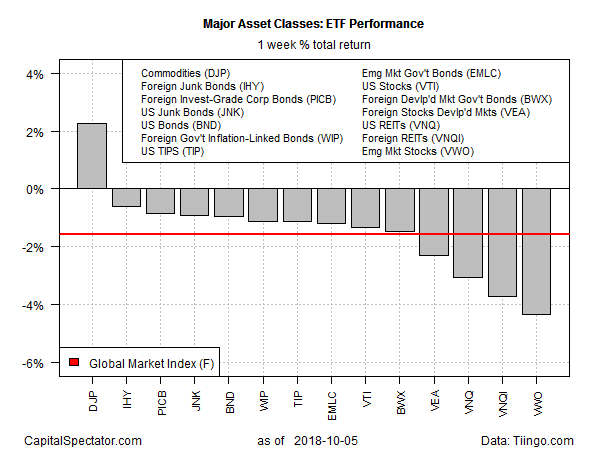

With the exception of broadly defined commodities, all the major asset classes lost ground in the first week of October, based on a set of exchange-traded products. Stocks in emerging markets suffered the biggest setback among widespread losses in global markets.

The iPath Bloomberg Commodity (NYSE:DJP), by contrast, had a good week over the five trading days through Oct. 5, posting a 2.3% return. The gain marks the third straight weekly advance for DJP, lifting the exchange-traded note to a level that’s near its highest price since June.

Last week’s big loser: emerging-markets stocks. The latest slump in Vanguard FTSE Emerging Markets (NYSE:VWO) left the ETF at its lowest price in more than a year.

The selling in emerging markets has persuaded some investors to look for bargains. “We’re finding opportunities because of the trade war,” says Chris Mack, a portfolio manager of the Harding Loevner Global Equity fund. He tells Reuters that the fund has its highest weighting in emerging market stocks in 12 years and the lowest exposure to the US over that span.

Last week’s broad wave of selling weighed on an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights fell for a second straight week, diving 1.6% — the index’s deepest weekly loss since March.

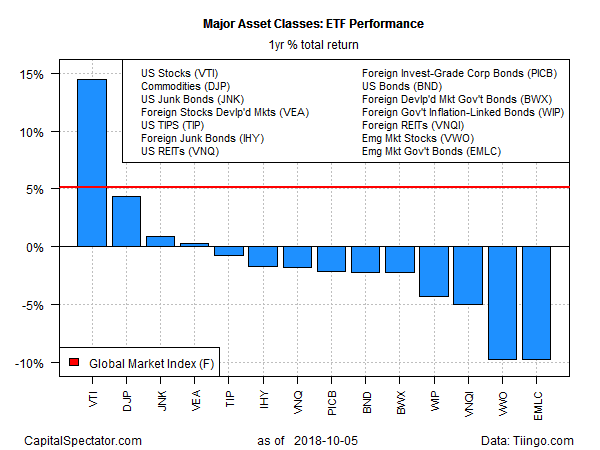

Losses also dominate results for the one-year trend. The main exception: US equities, which are still posting the biggest gain by far for the trailing 12-month window. Vanguard Total Stock Market (NYSE:VTI) is up a strong 14.5% over the past year.

Commodities are a distant second-place performer for the one-year change, posting a 4.4% gain.

Two ETFs are currently tied for the deepest one-year loss for the major asset classes: emerging markets stocks and bonds. VanEck Vectors JP Morgan Emerging Markets Local Currency Bond (NYSE:EMLC) is off 9.8% in total return terms, matching the one-year slide in emerging markets stocks via VWO.

GMI.F, by comparison, is still comfortably in positive terrain, posting a 7.4% total return for the past year.

For current drawdown, broadly defined commodities continue to suffer the biggest slide from the previous peak. The iPath Bloomberg Commodity (DJP) is currently posting a roughly 46% peak-to-trough decline. At the opposite extreme: US junk bonds have a mild 1.2% drawdown, based on SPDR Bloomberg Barclays High Yield Bond (NYSE:JNK).

GMI.F’s current drawdown is also modest at 3.5%.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.