Commodities Lead Markets For Second Week In A Row

James Picerno | Nov 06, 2017 09:35AM ET

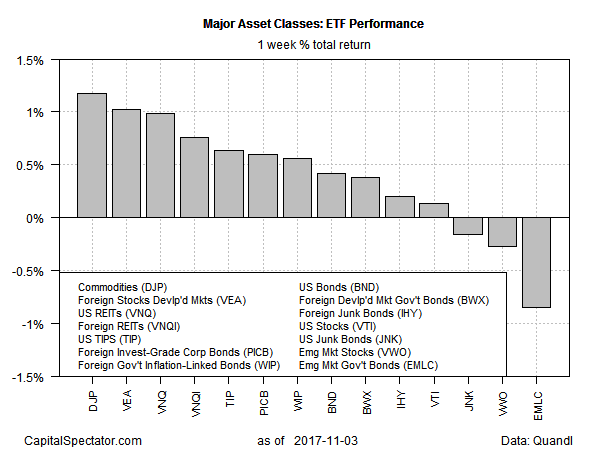

Broadly defined commodities posted the strongest gain for the major asset classes last week, based on a set of exchange-traded products. The advance marks the second time in as many weeks that commodities topped the performance list.

The iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) was up 1.2% for the five trading days through Friday, Nov. 3. The second weekly advance lifted DJP to its highest close in nearly nine months.

A recent report by Goldman Sachs (NYSE:GS) noted that demand for commodities this year has been robust. “[A]ll markets are currently facing the best demand backdrop in over a decade with strong global synchronous growth,” the bank advised.

Meantime, emerging markets have been on the defensive lately. Equities and bonds in these countries were the biggest losers last week for the major asset classes. VanEck Vectors JP Morgan EM Local Currency Bd (NYSE:EMLC) posted the biggest decline. The fund fell 0.9%, marking the third weekly decline that left EMLC at its lowest close since May.

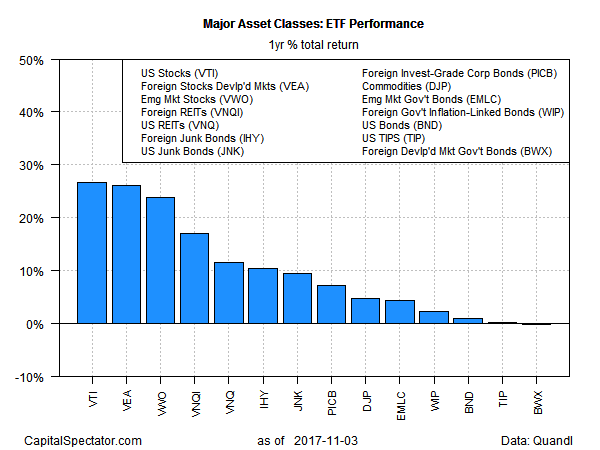

For the one-year change, the US stock market continues to outperform the rest of the field, albeit by a small margin vs. the second- and third- place runners up: foreign equities in developed and emerging markets, respectively.

Vanguard Total Stock Market (NYSE:VTI) total return is currently a strong 26.8% for the past 12 months, or just ahead of the second-strongest one-year performer: Vanguard FTSE Developed Markets (NYSE:VEA), which is ahead by 26.2%. In third place: Vanguard FTSE Emerging Markets (NYSE:VWO), which is up 23.8% over the year-earlier level based on total return.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.