Come Easy, Go Easy: The Tech Takedown

Aswath Damodaran | Apr 08, 2018 01:35AM ET

If there is one thing that I have learned about markets over the years, it is that they have a way of leveling egos and cutting companies and investors down to size. The last three weeks have been humbling ones for tech companies, especially the big four (Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and Alphabet (NASDAQ:GOOGL) or FANG) which seemed unstoppable in their pursuit of revenues and ever-rising market capitalizations, and for tech investors, many of whom seem to have mistaken luck for skill. Not surprisingly, some of the cheerleaders who were just a short while ago telling us that nothing could go wrong with these companies are in the midst of a mood shift, where they are convinced that nothing can go right with them. As Mark Zuckerberg gets ready to testify to Congress, amidst calls for both regulating and perhaps even breaking up tech companies, it is time to take a sober look at where we stand with these companies, what the last three weeks have changed and the consequences for investment decisions.

The Rise of Facebook, Amazon, Netflix and Google (FANG)

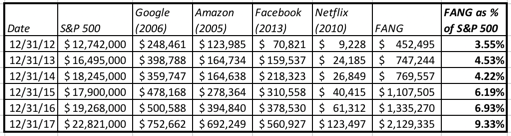

The outsized attention paid to the FANG (Facebook, Amazon, Netflix and Google) stocks sometimes obscures how young these companies are in the public market place. Amazon, a company that I valued as an online, book retailer in 1998, a year after its listing, is the granddaddy of the group. The Google IPO , remembered primarily because of its use of a Dutch auction, instead of a banker, to set its offering price was in 2004, but you probably completely missed the Netflix IPO two years earlier in 2002, and Facebook, the youngest of the four, went public in 2012. The growth in market capitalization at these companies is the stuff of investing legend and the table below shows how they have almost tripled their contribution to the overall market capitalization of the S&P 500 between 2012 and 2017 (with all numbers in billions of US $):

At the end of the 2017, Amazon, Google and Facebook were three of the ten largest market capitalization companies in the world.

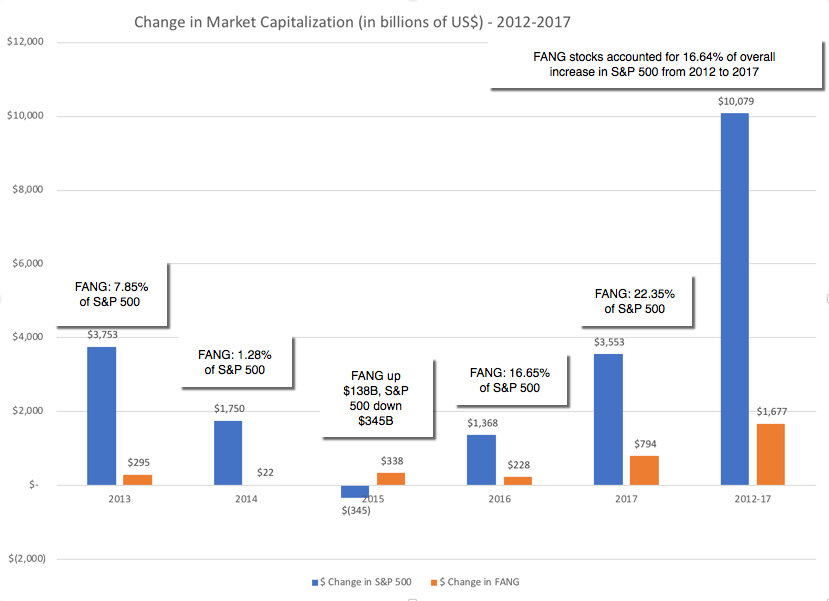

The role that the FANG companies have played in driving US equities can be best seen with a different lens, by looking at the total change in the market capitalization of the S&P 500 and how much of that change can be attributed to the rising values of just these four companies:

To add weight to these numbers, consider these facts. The four companies that comprise FANG added almost $1.7 trillion in market capitalization over these five years and accounted for one-sixth of the increase in value for the entire index. Put simply, if you were a large-cap US portfolio manager and you held none of these stocks between 2013-2017, it would have been very, very difficult, if not impossible, to beat the S&P 500 over this period.

A Reversal in Fortunes for the FANG stocks

It is the sustained success of these companies that has made the last few weeks so trying for investors in them and so unsettling for market watchers. While these stocks went through the same ups and downs that the rest of the market was going through in February, it was in the middle of March that they became the central story, with the revelations from Cambridge Analytica, a data analytics and consulting firm, that they had harvested data on about 50 million Facebook users (a number that has since been increased to 87 million) for use in political and commercial campaigns. The political firestorm that followed has not only hurt Facebook, but the other three companies as well, and the graph below chronicles the damage in the days since the news story, since the news story was released:

The numbers are staggering, at least in absolute terms. Collectively, the FANG stocks lost $282 billion in market capitalization between March 15 and April 2 and contributed significantly to the drop in US equity markets over that period. To put that in perspective, the market capitalization lost in just these four companies in about two weeks was greater than the total value all crypto currencies (Bitcoin and all its relatives) as of the start of April of 2018, perhaps suggesting that we have been letting ourselves get distracted by penny change, when dollars are at stake. It is also interesting that while much of the attention has been directed at Facebook, which lost 15% of its value in just over two weeks, the three other stocks each lost about 12% of their value.

Speaking of perspective, though, investors in these four stocks should consider another fact before they complain too much about being punished by the market. Even with the losses through April 2 incorporated, the collective market value of these companies remains about $400 billion higher than it was a year ago, on April 3, 2017.

The bottom line is that two weeks of market pull backs cannot take away from the longer term success at these companies. If this is what failure looks like, I would love to see more of it in my portfolio.

The Fang Story Line To understand both the rise and recent pullback, let's look at what these four companies have in common. As I see it, here are the salient features: Scaling Success: Each of these companies has been able to keep revenue growing rapidly, even as they scale up and acquire larger market share. In effect, they have been able to deliver small company growth rates, while becoming monoliths.

- This success of these companies at delivering high growth, as they have become bigger, have some led some to rethink long-held beliefs about the limits of growth .

- Bigger Slice of a Bigger Pie: All four of these companies have also been able to change the businesses that they have entered, increasing the size of the total market by attracting new customers, while also changing the way business is run to their benefit. With Google and Facebook, that business is advertising, with Netflix, it is entertainment, and with Amazon, it is just about any business it enters, from retailing to entertainment to cloud services. In each of these businesses, they have not only made the pie bigger but also increased their slice of it, quite a feat!

- Promise of Profitability: Alphabet and Facebook are money-making machines, with very high profit margins; Facebook's margins are among the highest among large market capitalization companies and Google's are in the top decile.

Amazon has lagged on profitability historically, but it seems to be showing progress in the last few years, and Netflix still struggles to generate decent profit margins. The low margins that these companies show are deceptively low because they are after expensing what would be business building or capital expenditures in most other companies - $22.6 billion in technology and content at Amazon and almost $8 billion in content costs at Netflix. If, in 2008, you had described the trajectories that these companies would go through, to get to where they are today, I would have given you long odds on it happening. To the question of how they pulled it off, I would point to three factors;

- Centralized Power: These companies are more corporate dictatorships, than corporate democracies. All four of these companies continue to be run by founder/CEOs, whose visions and narratives have focused these companies; Brin and Page, at Alphabet, Zuckerberg, at Facebook, Bezos at Amazon and Hastings at Netflix, have unchallenged power at these companies, and the only option that shareholders who disagree with them have is to sell and move on.

- Big Data: While big data is often a buzz word thrown into conversations where it does not belong, these four companies epitomize how data can be used to create value. In fact, you can argue that what Google learns from our search behavior, Facebook from our social media interactions, Netflix from our video watching choices and Amazon from our shopping carts (and Alexa) is central to these companies being able to scale up successfully and change the businesses they are in. Google and Facebook use what they learn about us to allow companies to target their advertising, Netflix develops content that reflects our watching preferences and Amazon uses our shopping history and Prime membership to run circles around its competitors.

- Intimidation Factor: There is one final intangible in the mix and that is the perception that these companies have created in regulators, customers and competitors that they are unstoppable. Advertisers facing off against Google and Facebook increasingly settle for crumbs off the table, convinced that they cannot take on either company frontally, the entertainment business which once viewed Netflix as a nuisance has learned not only to live with the company but has adapted itself to the streaming world and Amazon's entry into almost any business seems to lead to a negative reassessment of the status quo in that business .

In short, if you were an investor in any of these companies until three weeks ago, the story that you would have used to justify holding them would have been that they were juggernauts headed for global domination, and valued accordingly.

Story Break, Recalibration or Tweak? If you have read my prior posts on valuation, you know that I am a great believer that stories hold together valuations, and that it is changes to stories that change valuation. It is still early, but the question that investors face is whether what has happened in the last three weeks has changed the story dynamics fundamentally at these companies. At the very minimum, we have at least noticed that the strengths that we noted in the last section come with accompanying weaknesses

- CEO heads cannot roll: Unlike traditional companies facing crises, where CEOs can be offered by a board of director as a sacrificial offering to calm investors, regulators or politicians, the FANG companies and their CEOs are so intertwined, with power entrenched in the current CEOs, this option is off the table. Even if Mark Zuckerberg performs like Valeant's Michael Pearson (LON:PSON) did in front of a congressional committee next week, he will still be CEO for the foreseeable future, an advantage that having voting shares and controlling more than 50% of the voting rights gives him.

- The Dark Side of Sharing: I don't know what we, collectively as users of these companies' products and services, thought they were doing with all of the information that we were sharing so willingly with them, but until the last few weeks, we were able to look the other way and assume that it would be used benevolently. The Facebook fiasco with Cambridge Analytica has pushed some of us out of denial and perhaps into a reassessment of how we share data and how that data is used. It has also created a firestorm about data sharing and privacy that may result in restrictions in how the data gets used.

- No Friends: When other companies feel threatened by your success and growth, it should come as no surprise that many of them are cheering, as you stumble. From Elon Musk shutting down Tesla (NASDAQ:TSLA)'s Facebook presence] to Tim Cook castigating Google and Facebook for misusing data, there seems to be a desire to pile on. Musk has far bigger problems at Tesla than it's Facebook page, and Cook should be careful about throwing stones from a glass house, but watching the FANG companies squirm is evoking joy in the boardrooms of its competitors.

So, what now? As I see it, there are three ways to read the tea leaves, with the effects on value ranging from very negative to non-existent.

- Second Thoughts on Sharing: It is possible that the news stories about how exposed we have left ourselves, as a consequence of our sharing, will lead us to all to reassess how much and how we interact online. That would have significant consequences for all of the FANG stocks, since their scaling success and business models depend upon continued user engagement.

- Tempest in a teapot: At the other end of the spectrum, there are some who argue that after the Zuckerberg testimony, the story will blow over and that not only will the companies revert back to their old ways, but that they will continue to accumulate users and grow revenues, while doing so.

- Data Protections: The third possibility lies somewhere between the first two. While the news stories may have little effect on how people use these companies' products and services, there may be new restrictions on how the data that is collected from their usage is utilized by the companies. That would include not only privacy restrictions, similar to those already in place in the EU, but also regulations on how the data is collected, stored and shared. In addition, the companies themselves may feel pressure to change current business practices, which while profitable, have left data vulnerabilities.

I don't buy into either of the first two scenarios. I think that we are too far gone down the sharing road to reverse field, and that while we will have a few high profile individuals signal their displeasure by abandoning (or claiming to abandon) a platform, most of us are too attached to Google search, our Facebook friends, watching Black Mirror on Netflix and the convenience of Prime to throw them overboard, because our privacy has been breached. In fact, I would not be surprised if Facebook usage has gone up in the days since the crisis, rather than down.

I also think that assuming that these stories will pass with no effect is a mistake, since there are changes coming to these firms, from within and without, that will have value consequences. To illustrate, Facebook has already announced that it will stop using data from third party aggregators to supplement its own data in customer targeting, because of data concerns, and I am sure that there are more changes coming, many of which will increase Facebook's costs and crimp revenue growth, and through those changes, the value that we attach to Facebook. I also believe that you will see more restrictions on the use of data and that these rules will also have an effect on costs, growth and value. Rather than extend this post further, by looking at the impact of these changes, I will be using my next post to update my stories and valuations of Facebook, Amazon, Netflix and Google. If you want a preview, suffice to say that I am back to being a Facebook shareholder, that I am close to becoming a Google shareholder for the first time and that Amazon and Netflix remain out of my reach.

Blog Posts on Tech Takedown

- Come easy, go easy: The Tech Takedown!

- Facebook: Friendless, But Still Formidable!

- Amazon: Glimpses of Shoeless Joe!

- Netflix: Entertainment's Future?

- Alphabet: If Google is alpha, where is the "bet"?

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.