China Deleveraging Spurred On By Recovery

ING Economic and Financial Analysis | May 07, 2021 11:53AM ET

China's economic recovery seems to be sustainable, although the high GDP growth number was partly due to the low base effect. Given this background, the government has determined that the economy could deleverage for the rest of 2021. Hopefully this will reduce the overall debt level but the risk is that too-fast a deleveraging could trigger market events.

China achieved some results on deleveraging

China's GDP growth was 18.3% year-on-year in 1Q21. This was partly attributable to the low base from 1Q20 and partly from genuine growth. The government has confirmed that now is a good time to reduce leverage in the economy.

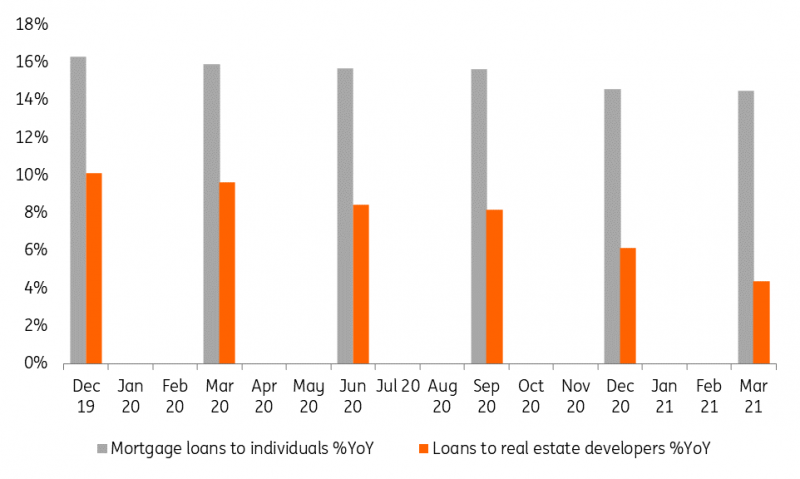

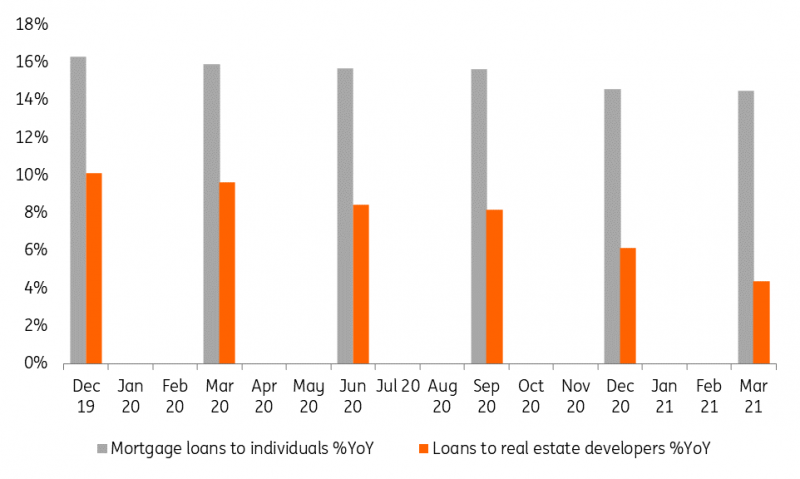

We have discussed this deleveraging reform for a few months and here is the report card. Loans for real estate development (not individual mortgages) rose 4% year-on-year in 1Q21, slowing from 10% YoY 12 months ago. The individual mortgage growth rate remained at 11% YoY for the 12 months to 1Q21.

As we have emphasised, this deleveraging reform is not to squeeze developers to an unsustainable operating situation but rather to downsize their books and their debt ratios. Loan growth for property developers is much lower than the overall economic growth (4% property developer loan growth vs 18% nominal GDP growth). This will help the overall debt ratio of China to fall as we expect the deleveraging reform will continue for the rest of the year.

Loans for real estate developers have fallen

Source: CEIC, ING

The next sector for reform

Fintech is now under reform. This is just the beginning.

There have been at least two parts in terms of the reforms. One is anti-monopoly; this is not just happening in China but also globally. Another is small loan businesses owned by fintechs in China.

But whether this reform will lead to slower growth of small loans taken by individuals and small business owners is in question. If this loan growth does not slow down then this reform would not result in a lower leverage level from the household segment. This may be the case as there is demand for such loans. In fact, the existence of these fintechs is a result of the banks in general not wanting to take high credit risk. The regulator needs to assess how to channel these loans to banks or to let them stay with fintechs but with a bank-like regulatory framework to limit credit risks.

The willingness to reform shows that the government is optimistic on growth

Reform after reform implies that the Chinese government is confident about the economic situation.

Our view is that GDP will grow by 8.6% in 2021, as domestic consumption will continue to act as a stabiliser for the economy, domestic infrastructure should continue to support growth, and hopefully, export demand improves with Covid vaccinations.

The risks include a too-fast reform speed that could create concerns for the market and trigger market events; and a chip shortage which is affecting various sectors. China cannot escape this as it manufactures and exports many electronic goods. Thirdly, the strained China-US relationship, with tensions possibly increasing from time to time, also plays a part. All this means that we are not as optimistic as the government.

Read more

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.