China Braces For More Pain Ahead As Economy Slowdown Accelerates

Guy Manno | Jan 23, 2017 07:50AM ET

China's amazing GDP growth and recovery experienced since the 2008 - 2009 crisis is slowing down. The rate of growth continues on a downward trajectory, as more economic problems begins to emerge that are accelerating its slowdown for the economy and global growth. These problems have been building for some time now and many of the problems now faced by China have stemmed from the economic policy decisions that the Government implemented to fight off the last crisis.

How Did China's Economic Problems Start?

China's economic recovery from the 2008 crisis has been remarkable as the country was able to quickly adapt to the global challenges that swept through and effected its own economy. China was able to shift the focus temporarily away from exports, to their own domestic economy as they began to accelerate spending on fixed asset expenditure on various large infrastructure projects around the country. This was funded by lowering interest rates and accelerating the use of debt to spur their own economic recovery. By implementing this strategy it also spurred demand for overall consumer spending as more credit began to flow through their economy.

This strategy worked very well and within a short period of time the flow of credit and spending began to shift the growth of China's economy higher once again. As a result, it lifted the global economy higher as China grew imports to fuel its large fixed investment expenditure projects and increased consumer spending. This allowed many commodity based countries like Canada, Brazil, US and Australia among others to bounce back quickly from the 2008 economic crisis. The increase growth in consumer spending in China also facilitated countries with a large manufacturing base like the EU region to also return to growth.

As a direct result of China's return to strong GDP growth, global foreign capital investment in China soared, as investors were attracted by the growth rates.

So why does China have some many problems effecting its economy in 2017?

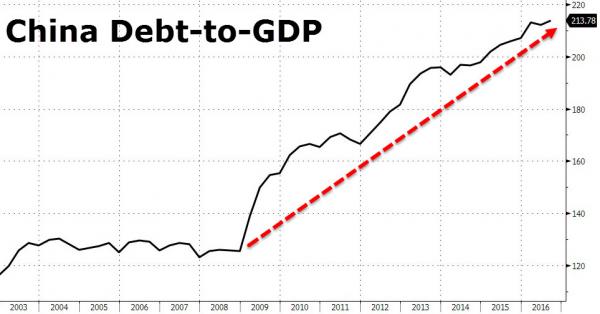

One of the main causes is because China's economic recovery was predominately achieved by utilizing record amounts of debt to stimulate demand and now the debt load is becoming an anchor to their economy. (See chart below)

Before the 2008 / 2009 crisis, debt to GDP in China was moving sideways at around 130%, as new debt growth offset new growth in GDP. After the crisis hit the debt to GDP skyrocketed, meaning the new debt was no longer having the same effect on demand and GDP growth like it did prior to 2008 - 2009 crisis. The probably cause for the shift in effectiveness on GDP growth after the crisis, was due to increased debt towards inefficient projects designed only to spur immediate demand regardless if the projects were financially viable.

Since demand now has been effected by the debt levels of mostly inefficient debt accumulation, it began to hamper growth and the economy began to slow after a few short years.

Now that the economy slow down is accelerating, the capital that came from abroad during the China growth recovery, together with domestic savings of China's citizens is fleeing China, in search of new growth opportunities in other countries.

The capital flight of over $1.2 trillion since 2015, is impacting on China's financial system and its currency the Yuan as financial conditions have tightened. This has impacted demand in China as access to credit becomes more difficult. This in turn spurs more demand for capital to find a new home globally as the currency becomes weaker as well as growth.

Click chart for source: Zerohedge.com

How Are The Economic Problems Impacting China's Growth?

Real Household Disposable Income Growth Falling

Prior to 2008 - 2009 crisis, China's real household disposable income was growing above 10% (See chart below). It reached a temporary high of 14% y/y on growth just after the crisis took hold as the stimulus spurred growth and incomes for a short period. After the crisis was in full swing the real household disposable income slowed to 6-7 % growth.

After peaking in 2012 income continued to decrease, as it made its way to just above 4% growth in real household disposable income in 2015. A level of growth that was considerable lower than the trough reached in 2009.

Since the new debt that flowed into the economy during the recovery was not introduced in an efficient way, the increased debt provided only a short term spike in growth rates. This most likely caused the slow down in real household disposable income growth as the debt began to wane on overall demand rather than expanding it.

China's Capital Flight Explained

The flow of capital leaving the country has been accelerating in late 2016 and 2017. This short video below explains why the rush of capital out of China is occurring.

China Tries To Stem The Capital Flight Problem

Since record amounts of capital is continuing to leave China each month it has placed an enormous amount of pressure on the financial system, as the outflow pressure is tightening financial conditions and liquidity within China. To tackle the tightening conditions, the Chinese Government has been adding massive amounts of liquidity that spiked in 2016 to attempt to stem the pressure. While they continue to add billions in liquidity the People's Bank Of China (PBOC) have had to sell their foreign reserves assets to fund their liquidity injections and support the currency.

The Outflow Pressure Continues In 2017

The chart below highlights the fact that China continues to struggle with managing their financial conditions as their financial system has once again required a surge of liquidity injections to ease the tightening conditions. Over the 5 day period from the 16th to the 20th January 2017, the PBOC had pumped in $1,130 billion Yuan into the system.

Without these injections the banks would face a cash crunch and the whole system would seize up and their economy would go from slowing growth to a crash in GDP.

Defending The Yuan To Slow Capital Flight

The existing policy of China is to have an orderly and planned depreciation of the Yuan currency relative to the US dollar, in order to keep their export driven economy competitive internationally.

However, as the capital flight began to increase in reaction to the Government decision to devalue the Yuan by larger amounts in August 2015, the currency has become more volatile on the market as the Yuan began to depreciate at a faster rate to what the Government had planned. To reduce the pace of devaluation, the PBOC has been actively supporting the Yuan by selling their foreign US dollar reserves to allow the Yuan to appreciate and offset the selling demand from capital leaving the country. By engaging in continuous support of Yuan they have depleted their reserves of US dollars by over $800 billion to support the Yuan.

Depleting Foreign Exchange Reserves

Since the Yuan is pegged to the US dollar, with a small allowance for market swings from the set daily spot rate, the Chinese Government has created another problem as it tries to control their currency devaluation to spur exports. The PBOC is rapidly depleting its reserves to control Yuan currency market. With the current pace of depletion of reserves the PBOC will run out of foreign reserves in only a few years time. So their current strategy to control the exodus of capital leaving their country by actively intervening in their currency is running out of money and time.

This is why the calls from economists around the globe to allow their currency to be fully floated rather than be pegged is growing. This will allow the PBOC to retain their reserves as they no longer need to intervene. The downside is that the reaction from the market from a free floating dollar is that the currency will most likely experience a sharp fall once floated, compounding the problems for China.

Chinese Citizens Buy Bitcoin To Protect From Devaluation Of The Yuan

The Chinese people are fully aware of the Governments plans for a continued devaluation of the Yuan as one of the economic policies to spur GDP growth for China. This has led to Chinese citizens sending large amounts of their capital in 2014 & 2015 overseas to purchase foreign assets like real estate in Vancouver, Sydney and New York to protect themselves from devaluation. To combat this the Government has implemented stricter capital controls to slow the capital flight by limiting the annual limit of capital leaving China to $USD 50,000 which is one of the many recent capital controls put in place by the Government.

To get around the capital controls the Chinese citizens have had to become creative and finds new ways around the capital controls. One of the big trend in 2016 to get around the capital controls, was to buy Bitcoin in China. When they want to sell their Bitcoin investment, they sell on a foreign Bitcoin exchange rather than the Chinese exchange meaning their capital is now outside of China.

This strategy became very popular last year and was one of the main reasons why Bitcoin was the best performing currency in 2016 with an approximate 100% return priced in Yuan / Rmb currency. (See chart below)

If the Government decided to also crack down on the use of Bitcoin as part of their capital controls, we could see a sizeable correction in the price of Bitcoin in 2017.

Global Economy Slowing As Trade Volumes Show Anemic Growth

Global trade volumes are barely growing and have been experiencing anemic growth since 2012. (See chart below). Like many of the charts shown in this article, there was a spike in volumes in 2010 as stimulus measures impacted on trade volumes as they spiked to just under 20% growth. After the stimulus waned the growth rates collapsed as well and now are barely growing.

Since China is a major trading partner with most countries the trade volumes growth doesn't bode well for its exports. Together with China's other economic problems, China will struggle with its GDP targets for 2017 due to its export weakness. This is especially true as it appears that the low growth in volumes is slowly heading towards 0% growth.

Global Export Values Slowing

The global trade values show a similar picture to the trends experienced with trade volumes globally. After experiencing a sizeable correction in trade values in 2009, global trade was able to rebound and make new highs. However since 2010 - 2011 the global trade values have been trending sideways, with the last 2 years showing that global trade values have been steadily falling.

China's Growth Engine - Exports Records Worse Slump Since 2009

Recent data released last week showed that China's exports recorded its biggest fall in exports since the 2009 slump. Exports actually declined by 7.7% in 2016, while China's imports also slowed by 5.5% as their economy internal demand for goods continued to decline.

Now President Trump is officially in office, the Chinese Government are worried about the implications of an impending trade war that could begin under his Presidency, as he tries to restore jobs and begin to increase manufacturing of goods in the US. If tariffs are implemented in the US on foreign goods as previously suggested by Trump, China's exports would fall even further in 2017 and beyond which would encourage more capital to flee China.

China's Key Economic Data - All Trending Down

The four key areas the world monitors to gauge the health and prosperity of China's economy are GDP, Industrial production, retail sales and fixed asset investment. From the most recent data available provided by the Chinese Government (see chart below), you can see the long term charts of all 4 data areas, are trending down from 2010. The official economic data even though may be overstated by the Government on the true state of the economy, reflect the consensus that China is slowing by its own metrics.

The Market Reacts To A Slowing China

The market has taken notice on the shift of China's economy and the problems its currently faces, as traders have been steadily increasing the bets on the Chinese stock market that it will fall. The percentage of shorts over shares on the iShares MSCI China A (NYSE:CNYA) ETF has jumped from 1% in September 2016 to 13% in January 2017 as traders prepare for a correction in the stock market based on a deteriorating economic outlook for China.

China's Economic Challenges Face No Easy Solutions.

This article highlights the many issues at play contributing to China's slowdown of the economy for 2017. There are however several more issues currently at play that are not covered in this article. See below a short video to highlight some of the problems discuss in this article, as well as others not addressed that China need to solve for the long term viability of the economy and its people.

China & Global Economy Fortunes Tied Together

The implications of China's problems on the global economy are real and significant as the world relies on China's annual GDP growth to fuel global GDP growth. China also relies on the global economy for its export growth. This means that if China's growth slowdown is gathering pace in conjunction with global trade stagnating, it would appear the global economy is heading for another slowdown. If the slowdown persists this could easily turn into a recession. The only difference this time compared to the 2008 - 2009 crisis, is that the stimulus plan that will be implemented by Central Banks and Governments might not work as effectively. This is because the global economy has already been subjected to at least one or more forms of stimulus continuously for the last 8 years to support global growth.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.