Trade Disputes Drive Markets, Gold Returns To The Spotlight

FxPro Financial Services Ltd | May 14, 2019 07:31AM ET

Market focus

The trade disputes escalation is driving force for the markets at the moment. The increase in tariffs on the part of the United States and the announcement of China’s response measures caused a powerful wave of pressure on the markets, which the politicians of both countries tried to ease. Both China and the United States do not overlook the situation in the financial markets, therefore they support the market participants in the belief that an agreement will be concluded. The U.S. noted that they want to hold public hearings on tariffs, and a high-ranking official in China noted that the world's largest economies “have the ability and wisdom” to resolve trade disputes. It is hard to remember when there was so much dissonance on the markets between disappointing actions so promising rhetoric.

Stocks

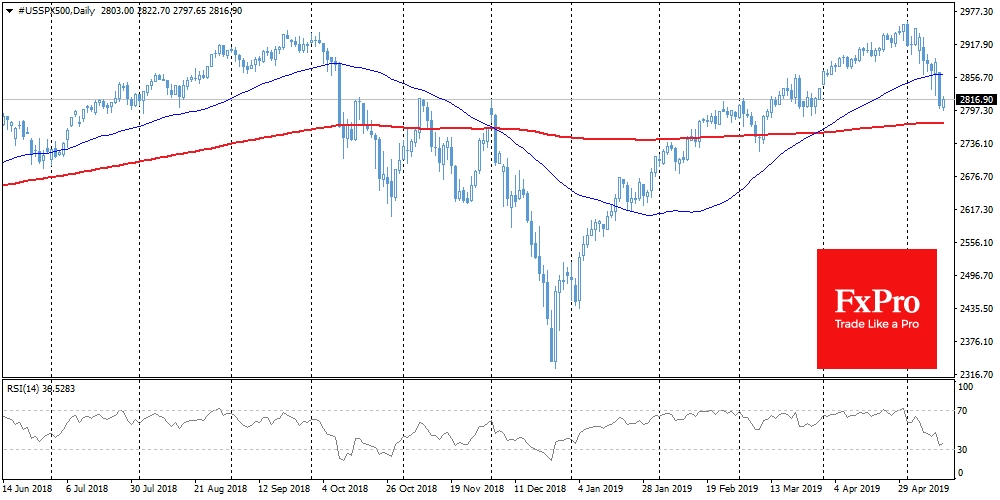

US indices: S&P 500 and Dow Jones lost more than 2.4% during trading in the US. On Tuesday, they rebounded slightly from 6-week lows, following politicians' attempts to regain faith in a deal. However, technically existing market dynamic is more like a short-term rebound than a longer-term reversal to growth. The S&P 500 with a powerful movement declined under a 50-day moving average. A sharp break of important levels is often a precursor to the development of the movement in the direction of a breakthrough. The next important support is the 200-day moving average on the S&P 500 passing through 2774.

EUR/USD

The single currency was once again dropped on the approach to the MA50, that underlines the importance of this resistance. Increased pressure pushed EURUSD down from 1.1260 to 1.1220 by Tuesday morning. Today, both the MA50 and the resistance of the downward corridor pass through 1.1260. Growth above this level is able to mark the breakdown of the downward trend. However, maintaining tension in the markets increases the chances of the pair reversing down to the lower border at 1.05. In the case of a trade conflict worsening, the pair has the potential to be there as early as May.

Chart of the day: Gold

The surge in stock market volatility has brought gold back into the spotlight of investors as a defensive asset in a period of turbulence. Gold sharply broke through the resistance of the downward channel at $1285 and rose to $1300. On Tuesday morning, market participants carefully took profits after a 1.3% jump following cautious purchases on stock markets. Technically, growth above $1310 will confirm the breakdown of the downward channel, which is able to attract the additional interest of buyers.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.