Chart Review: Everyone Has A Whole Apple Again – Bearish Reversal Invalidated

Dr. Duru | Feb 28, 2012 12:18AM ET

February 15 was a day noted around the world: Schaeffer’s Research :

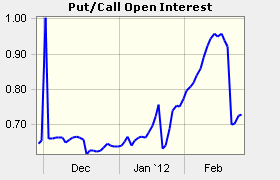

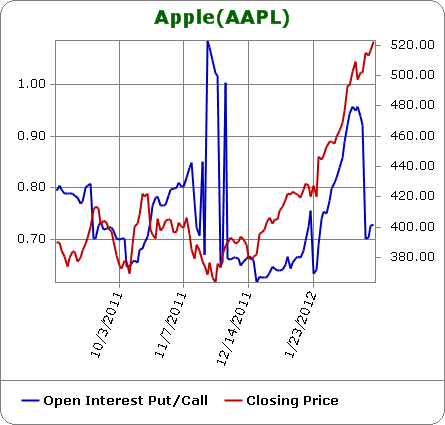

(The put/call ratio is measured using options with less than 3 months left to expiration).

Clearly, skepticism about Apple was running higher and higher with price and/or shareholders were rushing to protect positions. After all, Apple could not buy love as late as November when the put/call ratio was bouncing wildly as the stock struggled near October’s lows. One might imagine that as Apple kept running, put buyers protecting positions finally locked in profits as their puts began to provide little downside protection. Perhaps even the skeptics who were trying to bet on a top all decided at once to provide the blow-off top symbolic of the rush of the “last” buyers finally buying into the rally. Now, even THEY can be relieved…assuming they held on for dear life.

Be careful out there!

Full disclosure: no positions

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.