Chart Predicts Every Market Crash In History

Mike (Mish) Shedlock | Mar 01, 2018 02:08AM ET

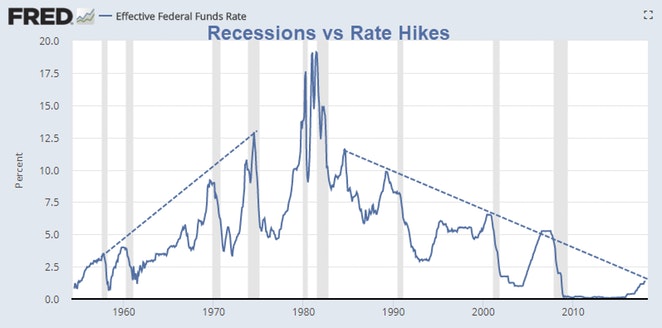

The Fed blows bubbles. Then it eventually pops them. Where are we in the cycle?

Bill Bonner writes This Has Predicted Every Market Crash in History .

I recreated the chart in Fred and added trendlines. But let's tune in to Bill Bonner.

“Buy the dip” has worked for the last 38 years. And now, investors are more than 100% convinced that it will work again. But they are wrong. Every major stock market decline and every recession in the last 100 years was preceded by the Federal Reserve raising short-term interest rates by enough to provide the pin to prick the balloon.

Note the emphasis on every. Yes, there have been periods where the Fed raised rates and a recession didn’t ensue. Everyone knows the famous saying about the stock market having predicted nine of the past five recessions! That may be true, that rising rates don’t necessarily cause a recession. But as an investor, you must be aware that every major stock market decline occurred on the heels of a tightening phase by the Fed. More importantly, there have been no substantive Fed tightening phases that did not end with a stock market decline.*

This is an economy built on debt. The whole capital structure – stocks, bonds, and real estate – now depends on excess debt… and more of it.

In a correction, the only way to stop stock prices from falling and the economy from shrinking is to bring in some more debt. But when you do that a few times, you are soon beyond Peak Debt… which is to say, you’re way over the legal limit.

Debt has been growing three to six times faster than income for more than an entire generation. This makes the old 1.5-to-1 ratio of debt to income seem quaint. It is now 3.5-to-1 nationwide.

Every penny in debt that we add now is a penny that cannot be repaid, not by any plausible combination of economic projections.

Because there is no way to “grow your way out of debt” when your income is falling while your debt is still increasing. Instead, you have to suffer the indignities of a correction, including a major reset in the stock market.

That’s what happens when stocks that are more than fully priced meet a debt load that is beyond 100% of capacity.

Bill Bonner

Word About Predictions

The chart shown does not "predict" anything, at least in a meaningful sense. It does show what eventually happens.

In regards to "rising rates don’t necessarily cause a recession" I would add that rising rates "never" cause recessions.

Recessions are caused by the inept policies the preceded the recessions.

Three rounds of Fed QE, even bigger QE by the ECB, suspension of mark-to-market rules, and massive global stimulus elsewhere sowed the seeds of the next recession.

The recession on deck will be a deflationary bust, not an inflationary one as we saw in the '80s. Credit busts are deflationary by definition.

As I stated earlier today, Inflation is in the Rear-View Mirror .

Addendum

I originally posted a chart of the Prime Bank Lending Rate, not the Fed Funds Rate. They tell the same story.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.