Primary Silver Miners REAL COST Higher Than Published All-In-Sustaining Cost

Steve St. Angelo | May 17, 2020 04:47AM ET

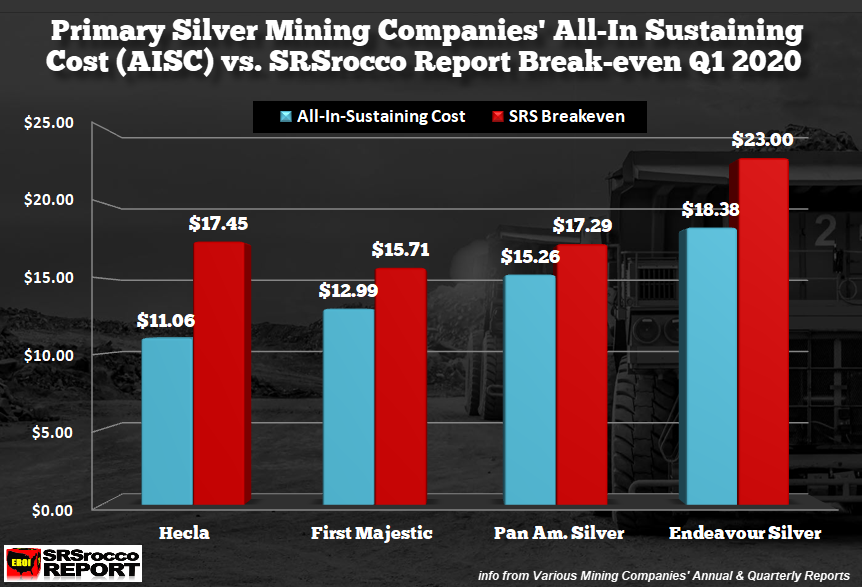

The chart of the week shows that some of the leading primary silver miners total REAL COSTS are higher than their published All-In Sustaining Cost. My analysis suggests that the companies’ All-In Sustaining Costs (AISC), are not really “All-In.” So, I quickly did my calculations based on these companies’ adjusted earnings. If I used their net income, their estimated Breakeven would be much higher.

In the chart below, the four primary silver mining companies (if we can still call some of them that) posted their AISC for Q1 2020. The biggest JOKE of them all is Hecla, which reported a low $11.06 All-In Sustaining Cost for silver. Well, that’s surprising when Hecla suffered a $17 million net income loss for the period. So, how could Hecla be losing money if its All-In Sustaining Cost was $11.06 when they received $16.94 per ounce for their silver during Q1 2020?

It’s quite simple… the All-In Sustaining Cost is a BOGUS METRIC used to confuse and bamboozle unsophisticated investors… and it works like a charm:

So, if you scan across the chart above, you will see the individual company’s AISC in BLUE, while the RED BARS show my simple estimated Breakeven for each. Endeavour Silver (NYSE:EXK) gets the TAKE ME OUT THE WOODSHED AWARD because it’s losing money hand-over-fist ever since it had to shut down its El Cubo Mine, a COMPLETE WASTE of a mine that should have never been acquired by the company.

In a nutshell, if you are a new investor looking for HOT silver mines to invest, do me a favor and pay no attention whatsoever to the All-In Sustaining Cost metric. I need to do more analysis in this area to help investors from buying the WORST CANDIDATES in the industry.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.