Chart Of The Day: Financial Sector Looks Set To Slip

Investing.com | Sep 11, 2017 10:14AM ET

By Pinchas Cohen

Last Thursday, we posted the first article in a series to be published over the next few days taking a closer look S&P 500 sectors. Last week's article offered a deeper drilldown into the energy sector and oil.

Today's piece focuses on financials via the Financial Select Sector SPDR ETF (NYSE:XLF). Last Thursday, financials led the market decline. While the S&P 500 Index fell 0.75 percent, financials fell harder, down 2.15 percent.

Financial Sector Under Pressure

Financials have already been under pressure; the Fed has shifting gears from the fast-lane rhetoric of higher interest rates during their June meeting to —after inflation and growth have consistently disappointed—a much slower expected trajectory back to normalcy. Harvey, followed almost immediately by Irma, the first back-to-back hurricanes since 1964 and the implications of their one-two punch will have on the US's economic growth, including damage to property, businesses (especially insurance companies which are financials), as well the expected hit to the energy sector gains, will likely spur investors to shift into safe haven bonds, causing yields to plummet, along with bank earnings.

If all this weren't enough, last Thursday was the day Federal Reserve Vice Chairman Stanley Fischer announced his resignation. The Fed’s loss of his gravitas weakens its leadership, increases uncertainty and reduces the probability for higher interest rates even further.

Some hypothesize that his sudden resignation for “personal reasons” is an escape in front of an economic hurricane he doesn't want to weather, at the end of a decade-long run of global QE. While the central bank intervention was led by former Fed Chief Ben Bernanke, the former Fed Chair studied Keynesian economics at the 'feet of' then MIT Professor Stanley Fischer, who was his PhD thesis advisor (and also advisor to Mario Draghi). Fischer, in fact, was even then a leading advocate of activist central banking.

XLF Price Action

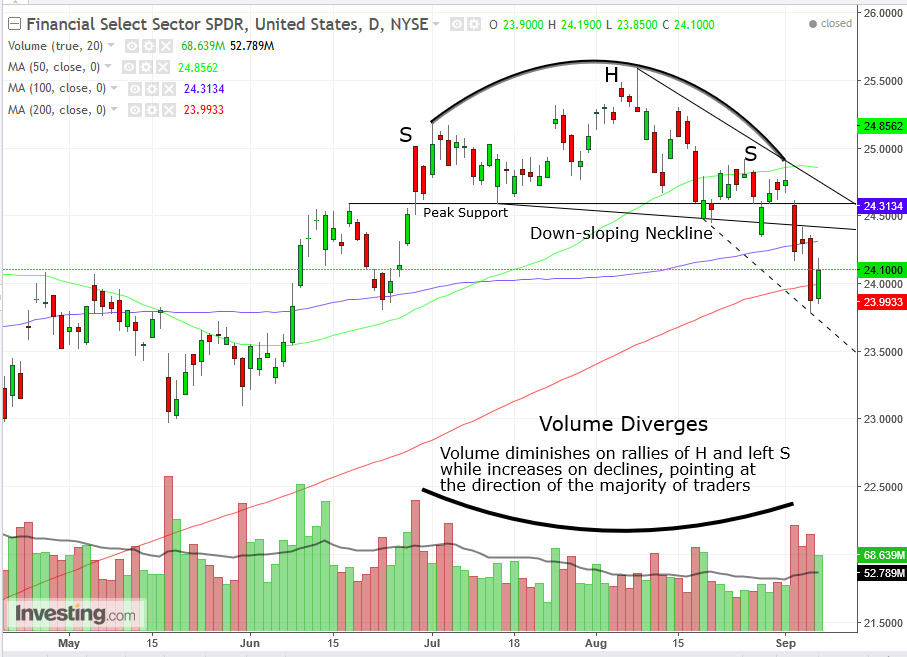

On Thursday, XLF confirmed an H&S top, extending the decline of the price after it crossed below its so-called neckline on Tuesday. This reversal line, which marks the price level for the second trough, completed the minimum of two peaks and troughs to form a trend; as well, it's on a close for the first time (it crossed below on an intra-day basis on August 21 and August 29).

The neckline is down-sloping. That means the June peak support failed, as selling increased, reaching lower prices, whose plotting formed a down-sloping neckline. Therefore, it’s an especially bearish H&S pattern.

Volume Confirmation – Traders Support Declines

The volume confirmation is crucial for calling a successful H&S from what may have otherwise looked like a failure. This turns it into a continuation pattern, catapulting prices in the opposite direction. Note that the volume curve is the opposite of the price curve. Initially, volume rose, alongside price on the right shoulder, which formed at the end of June.

This means that most traders supported that move. On the next rally, however, forming the head between July and August, volume diminished, as traders didn’t support that rally. They did however support the decline that followed in early August, as indicated by the rising volume.

The next rally, forming the right shoulder in late August, again didn’t rally the troops, per the diminished volume, which is why it failed to continue the previous rising trend, by registering a price higher than the former mid-August peak, the head.

Price and Volume Come Together

The decisive cross below the neckline completes a new series of downward heading peaks-and-troughs. The rising volume supports its validity.

A return move occurs roughly 65 percent of the time, when short traders are forced to acknowledge the error of their ways and cover their shorts, which means buying the asset, so that they can return it to their broker. The buying supports the price, and traders who may think the price went too far trade the asset back toward the resistance of the pattern (there are either short-term traders who are willing to go against the new trend, or traders who are simply on the wrong side of the trade, especially if spurred by news with temporary effects). The resistance is formed by traders who believe that the asset will decline and consider the latest rally a shorting opportunity.

Filters: Avoid A Bear Trap

The price plunged 2.6 percent from the neckline break price level of 24.4300, which puts it between satisfying moderate and conservative traders. Another filtering method is number of periods the price remains within the breakout zone, increasing the likelihood of a reversal. We can apply the same period-system we use for percentages to number of trading sessions: "1" satisfies aggressive traders, "2" satisfies moderate traders and "3" satisfies conservative traders.

Friday's close marked a 4th day of price remaining below the neckline. Moreover, it was a close before a weekend. Some investors and analysts want to see a weekend close that shows investors are willing to be exposed for the longer time period before they'll enter a longer position, particularly when event risk is elevated, because it indicates that investors are confident in their positions. Obviously this was not the case here.

Trading Strategies

Conservative traders may wait for a return-move to the neckline—especially on North Korea’s deferment of another intercontinental ballistic missile launch, though US increasing sanctions may still provoke one—or even to the 24.6000 June peak support, which failed to form into the neckline. The lower the volume the less supported the rally, and the greater the likelihood of a follow-up plunge.

Moderate traders may wait for the return-move to reach the down-sloping neckline, at around 24.4000. The lower the volume, the less support the rally has and the added likelihood of the follow-up plunge.

Aggressive traders may short now, while accepting the possibility of a return-move, and place stop losses accordingly.

Very aggressive traders may go long, counting on a return-move; they are willing to take the risk of trading against the trend, while employing strict money management.

Amateur traders will jump in head first, fantasizing about deep profits, only to hit their heads on the hard-floor at the bottom of shallow waters.

Risk-Reward and How to Get on the Good Side of Statistics

A common trader mistake is to cut wins (on fear of exiting on a loss) and run with their losses – deluding themself into believing that the price will turn around, thereby digging an ever-deeper hole. Traders must do the opposite: cut losses (to avoid losses...duh) and run with their wins to milk the trend, cover losses and cost of trading and allow themselves the chance to incur a profit.

A classic risk-reward ratio is 1:3. In this way, a loss won’t take your account to the point of no return, and a win will make up for several small losses. That means when traders select a stop-loss, they should factor in the target profit, consider its viability, then stick to it. Otherwise, they fall back into a negative risk:reward ratio, by increasing risk and limiting reward probabilities. These catch up with you.

Target Price

The minimum target price, based on a conservative measuring of the pattern’s height is 23.5000. So even if a trader enters a short immediately at 24.1000 – assuming prices will open around Friday’s close, which is not likely as North Korea didn’t shoot another missile and Irma is downgraded - it only means a better entry and an even more favorable risk-reward ratio, and a conservative stop-loss at 24.5000, makes a 4000-point risk. Should the target-price pan out, it would be 4,000: 10,000, or 1:2.5 risk-reward ratio.

A return-move will allow for a better entry. And, of course, traders can select a lower stop-loss, as well as a higher target.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.