China PMI: Soft But Is It Weak Enough Yet?

Callum Thomas | Nov 01, 2018 01:01AM ET

With China's economy under pressure on a number of fronts, the PMI takes on a new level of importance - particularly so as global markets come under pressure and with China growing to become the world's second largest economy... it makes sense to place due attention here.

On with the results. The manufacturing PMI fell by 0.6 points to 50.2 (vs expected 50.6, and previous 50.8), while the non-manufacturing PMI also fell by 1.0 points to 53.9. Across the major sub-categories, in manufacturing, medium-sized firms fell the most -1pt to 47.7 ...add to that the point that manufacturing export orders fell to a 34 month low of 46.9 and it's clear the trade war is distinctly making its impact felt.

Within the non-manufacturing index, the services index was down -1.3pts to 52.1 and the construction index was *up* 0.5pts to a booming 63.9. That last point is important as I previously highlighted 2 key rotations underway in the Chinese property market (presents upside risk to base metals). Indeed, at this point the strength in the property sector is providing an important offset to the economic downdrafts China is facing.

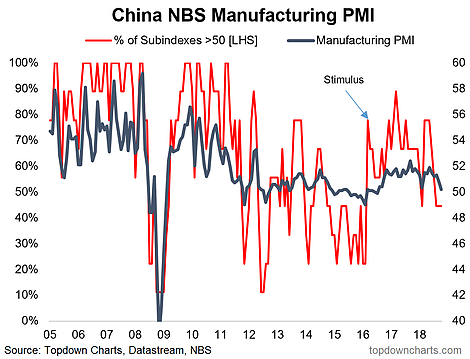

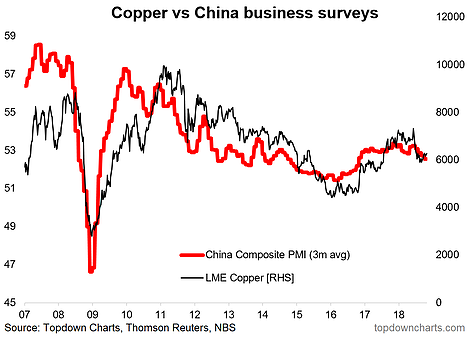

On with the charts. Here are 2 of my favorite China PMI charts.

1. China Manufacturing PMI: The first focuses on the official manufacturing PMI - visually you can see it's at the weakest point since around the time the 2016 stimulus was announced, and the breadth across sub-indexes has likewise remained weak. So back to the title of this post - my question I think should be "is it weak enough yet?" --> my view is when China slows a little it's a bad thing for EM and commodities, but when China slows a lot, it's a good thing because it prompts policymakers to undertake stimulus and hence provide a real economic and sentiment boost to those asset classes. My view is we're getting closer but not quite close enough.

2. Composite PMI vs Copper Price: Another key chart, and a running feature within my client reports is the copper price vs the smoothed composite China PMI. For logical reasons these two move closely together (China accounts for around half of global copper demand). So the softening in the PMIs is basically being confirmed here by the weaker copper prices - a risk I talked about late last year. From here I think both are close to a bottom given the weight of evidence, but it may take some more pain before a credible catalyst emerges to drive copper prices higher.

As I noted, the results are clearly and consistently across the board weaker vs last month and materially weaker vs the start of the year. Previous policy tightening and the adverse real and sentiment effects of the trade war have exerted headwinds on the Chinese economy, and while property may offset this partially, we're likely getting closer to policymakers' pain point in China. So the results are soft, yes, but likely not quite soft enough to drive more forceful stimulus.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.