CBOE Suspends Bitcoin Futures; Beginning Of The End For Cryptocurrencies?

Investing.com | Mar 22, 2019 03:07AM ET

When the Chicago Board Options Exchange (Cboe) introduced Bitcoin futures trading, the event was heralded with a bang; now that the exchange has announced it will no longer be adding new contracts , the news has garnered barely a whimper.

Of course, in December 2017 when the Cboe became the first exchange to offer a crypto options derivative, Bitcoin and peer digital currencies were trading at nosebleed levels. Now, the crypto-winter has endured for more than a year. When Bitcoin futures trading launched, the expectation was for it to play a significant role in legitimizing crypto assets, driving demand and providing a less risky way for new investors—both retail and institutional—to participate. Is the Cboe's suspension of its Bitcoin futures product the beginning of the end for cryptocurrencies?

Ryan Radloff, CEO of CoinShares believes these contracts weren't crucial to the greater crypto market infrastructure. "We're not concerned by their loss," he says. He believes there will be no real impact.

For one thing, rival Chicago Mercantile Exchange (CME) will continue to trade Bitcoin futures. As well, notes Radloff:

“One of the ‘industrial’ use cases for BTC futures contracts, at least within the crypto community, is for hedging revenues from Bitcoin mining. In the case of the CBOE’s cash-settled contracts, the risk of getting a different maturity price than is what is actually available in market is too high to use them as an efficient hedge, so physical delivery simply wins every time.”

Laurent Kssis, managing director of XBT Provider sums up the situation:

“In the race for more transparent, professional grade products with efficient price discovery mechanisms and greater liquidity, the Cboe looks to be conceding the market to CME.”

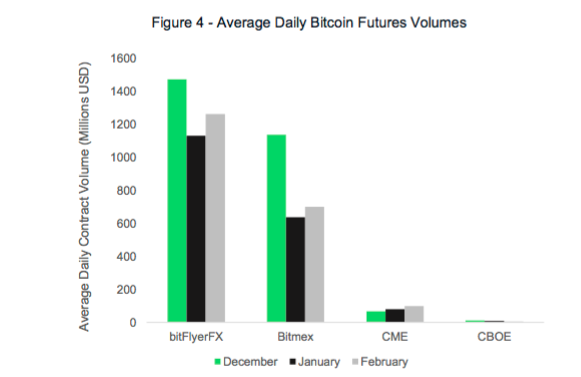

Of course, part of the problem for Cboe's Bitcoin futures product was the paucity of trading volume. According to CryptoCompare, from January to February 2019 Cboe's volumes fell by around 31% while CME's daily average increased more than 23%.

Courtesy: CryptoCompare

In part this could be because the margin requirement for trading BTC futures on the CME is 35% while it was 40% on the Cboe to account for BTC volatility.

Kssis speculates that the cost of low volumes must have outweighed any revenue benefits given the declining, underlying asset price.

Get The News You Want

Read market moving news with a personalized feed of stocks you care about.Get The App“On the professional side, market makers prefer to hedge futures contracts using settled ‘physical’ contracts to reduce the risk of potential settlement price manipulation. With cash-settled contracts, the settlement price is never truly efficient upon maturity. As a result, it would appear the buyers of these contracts were simply speculators, capitalizing on the offer of leverage.

Once the long awaited physical contracts come to market, I would expect most cash-settled contracts to lose their appeal as the market will usually choose more efficient and professional delta one vehicles when presented with the opportunity.“

Some crypto market participants are disappointed, but acknowledge that the suspension has more to do with business models than a failure of the asset class. En Hui Ong, head of business development at Zilliqa , a public blockchain platform, says:

“Though some are concerned that the announcement is a sign of waning institutional interest, it is actually a matter of competition and convenience. Competitor CME has its own Bitcoin futures product, with 1 Cboe contract equal to 1 Bitcoin (BTC) and 1 CME contract equal to 5 BTC, it simply goes to show that CME has a more competitive and attractive product.”

Moreover, she explains, regarding settlements, Cboe also announced that it would only be taking prices from cryptocurrency exchange Gemini's auction. Single-source pricing opens up opportunities for price manipulation, leading to greater risks.

In contrast, CME has taken a much more measured approach, using prices from several exchanges while leveraging its proprietary process to mitigate potential for price manipulation. “As such," notes Ong, "Cboe's announcement should not be taken as a reflection of the state of institutional interest in cryptocurrencies. They simply had a product that failed to gain market share.”

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.