Cass Freight Index Takes Another Dive Killing August’s 'False Hope'

Mike (Mish) Shedlock | Oct 19, 2016 02:30AM ET

Heading into the Christmas shopping season, the Cass Freight Index shows shipments sank 0.4% for the month and are down 3.1% from shipments a year ago.

It’s difficult to make a case for a great holiday sales season or robust third quarter GDP, based not only on shipments, but also on many other factors discussed below.

After offering a glimmer of ‘less bad’ hope in August (only down 1.1% YoY and up 0.4% sequentially), the Cass Freight Index shipments data in September disappointed, providing hindsight that August only gave us ‘false hope.’ September data is once again signaling that overall shipment volumes (and pricing) continued to be weak in most modes, with increased levels of volatility as all levels of the supply chain (manufacturing, wholesale, retail) continue to try and work down inventory levels.

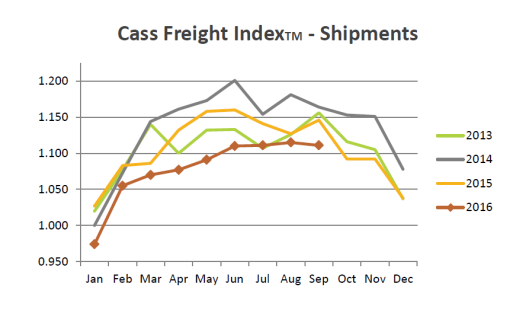

Cass Freight Shipment Index

Shipments are lower than in 2015, 2014, and 2013.

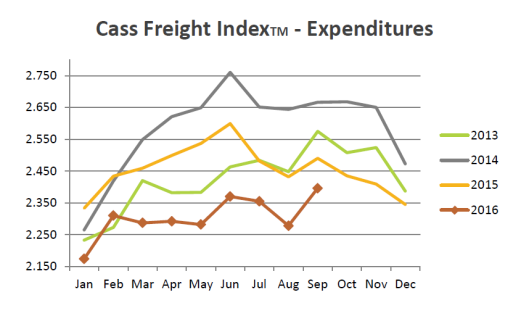

Cass Freight Expenditures Index

Expenditures are lower than in 2015, 2014, and 2013.

Rail Volumes

Rail volumes are lower in 2016 than 2015 and 2014.

Rail Volumes vs. US Dollar Index Inverted and Advanced 6 Months

Inventory Contribution to GDP

Cass Comments

- Rails have seen persistent weakness, with overall volumes being negative 86 out of the last 87 weeks. Why do rail volumes continue to be weak? We see the strength of the U.S. Dollar driving fewer exports and less domestic manufacturing as the primary driver.

- We continue to assert that the trucking industry provides one of the more reliable reads on the pulse of the domestic economy, as it gives us clues about the health of both the manufacturing and retail sectors. No matter how it is measured, the data coming out of the trucking industry has been both volatile and uninspiring.

- Nearly all of us practicing the dismal science of economics began predicting in the Spring of 2015 that as the price of oil and natural gas fell, the consumer would take the increase in disposable income—created by the decreases in the costs of their daily commute and heating and cooling their house—and spend it. Why? Because since the end of World War II, the greatest predictor of consumer spending, expansion or growth, was the expansion or growth of consumer disposable income. But instead of following the playbook, most U.S. consumers have been choosing to pay down debt and increase their savings rate. Simply put, the consumer has not yet picked up where the industrial economy left off.

- Inventories have now contracted from GPD for five consecutive quarters to the tune of ~3% of GDP. This is the longest stretch outside of a recession since 1956-57 and the largest in magnitude since 1995. We expect de-stocking to continue into Q3 in retail, based on the NRF’s (National Retail Federation’s) Port Tracker survey. We remain concerned about elevated levels of cars on dealer lots, and we acknowledge continued efforts to streamline finished inventory in most machinery sectors. Overall inventory levels remain elevated compared to sales, but with further improvement on many ratios in ‘2H (which we expect), and unless demand takes another step down, we believe the persistent drag of de-stocking should progressively lessen as we enter 2017. The Atlanta Fed’s GDPNow index now expects inventories to contribute 22 basis points to GDP, down from 90 basis points at the start of the quarter.

- Talked Themselves Into It: We believe the Federal Reserve should not raise rates again. Unfortunately, if they do so in December, it will only serve to make the U.S. Dollar stronger. Historically, a strong Dollar has produced a serious headwind for freight volumes, first in all things exported, and then in a reduction of things manufactured or assembled domestically.

- Expecting Flattish 2H: Ex auto industrial production trends did start to flatten out in Q2 (improving to up 0.2% in Q2 from down 1.2% in Q1). We see this largely as a return to more normal seasonal production patterns than anything else. Overall industrial production continues to track between 0 and +1% thanks to the lift from autos and nondurables (goods consumption picked up in Q2 as seen in the GDP data). However, we are concerned that elevated inventories on dealer lots, along with slowing sales, will lead to U.S. auto production growing less than 1% on a YoY basis in Q3. Thus, we are now anticipating ‘2H manufacturing industrial production to be flat YoY, down from our prior hopes of a modest recovery into the up 1+% range.

- As we have pointed out, the U.S. consumer has been saving and paying down debt with this disposable income for over six quarters. By this holiday season, we expect them to begin to spend at least part of their income. If not, the risk of an overall recession grows. That said, there is a bit of irony in our prediction of possible recession. The longer the consumer saves and pays down debt, the more likely it is that the U.S. falls into a recession. But, the longer the consumer saves and pays down debt, the shorter and more mild the recession will be since there will be less excess to clean up. Stay tuned…

Mish Comments

This mythical GDP build based on inventories keeps sinking in to the sunset. In particular, auto inventories have soared, and autos have been one of the few bright spots in the economy.

The other bright spot has been housing. While not robust, it has been reasonably solid. However, prices home buyers have been able or willing to pay keeps declining.

Thanks to Obamacare, medical premiums have soared. Yesterday’s CPI report (see Bloomberg Cheers Rising Rent and Gas Prices: Parrots vs. Humans ) shows additional cause for concern.

Rent, energy, and medical costs are up. This will impact discretionary spending.

Inventory Crisis: Can Parrots Read Charts?

Bloomberg cited tight management of inventories. My conclusion was parrots cannot read charts.

Supply Chain notes an inventory crisis with retailers caught in a dilemma. Retailers need inventory, but they are not moving it well.

Inventory Management

- Warehouse vacancy rates in many major cities sit below 5%

- A glut of inventory is building up in across retailers in the US

- Retailers turning to direct shipments as a clever way of reducing inventory burdens

Finally, the November election will leave at least half the country in a sour mood.

All things considered, things are not shaping up well for third quarter GDP and estimates are falling like a rock, as expected in this quarter.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.