Is Cardano Too Good To Be True?

Kiana Danial | Dec 20, 2018 11:49PM ET

Today we’re going to look at one of the most promising projects in the New Year: Cardano. I’ll overview the fundamentals, and will also take a look at ADA’s price action versus the USD and BTC respectively.

Cardano (ADA) Overview

Cardano is a platform for decentralized applications founded by Charles Hoskinson, who was also involved in the creation of Ethereum. The network is still controlled by a handful of developers, but that’s expected to change as Cardano starts to decentralize next year to become more like IOTA. But unlike Ethereum, Cardano uses a proof-of-stake consensus protocol and a different programming language to solve the big problems in smart contract technology. Also, Cardano is also planning a self-funded governance system, similar to Dash, where users will be able to vote on the next developments for the blockchain ecosystem.

But is that too good to be true? Crypto Briefing’s recently published its first research on Cardano in a Digital Asset Report and Evaluation, or DARE. Although our analysts were very impressed by the Cardano team’s scientific approach to solving blockchain problems, they did find a few things to make you think twice. You can read about that in the DARE report.

ADA's Price Action

Meanwhile, Cardano’s ADA’s price action has been similar to that of many other cryptocurrencies like Bitcoin in the past year. It reached an all-time high in January 2018 and spent the rest of the year in the bear market. One interesting note is when you compare ADA’s price action versus the USD, to its value versus Bitcoin. There’s a slight difference between the two pairs.

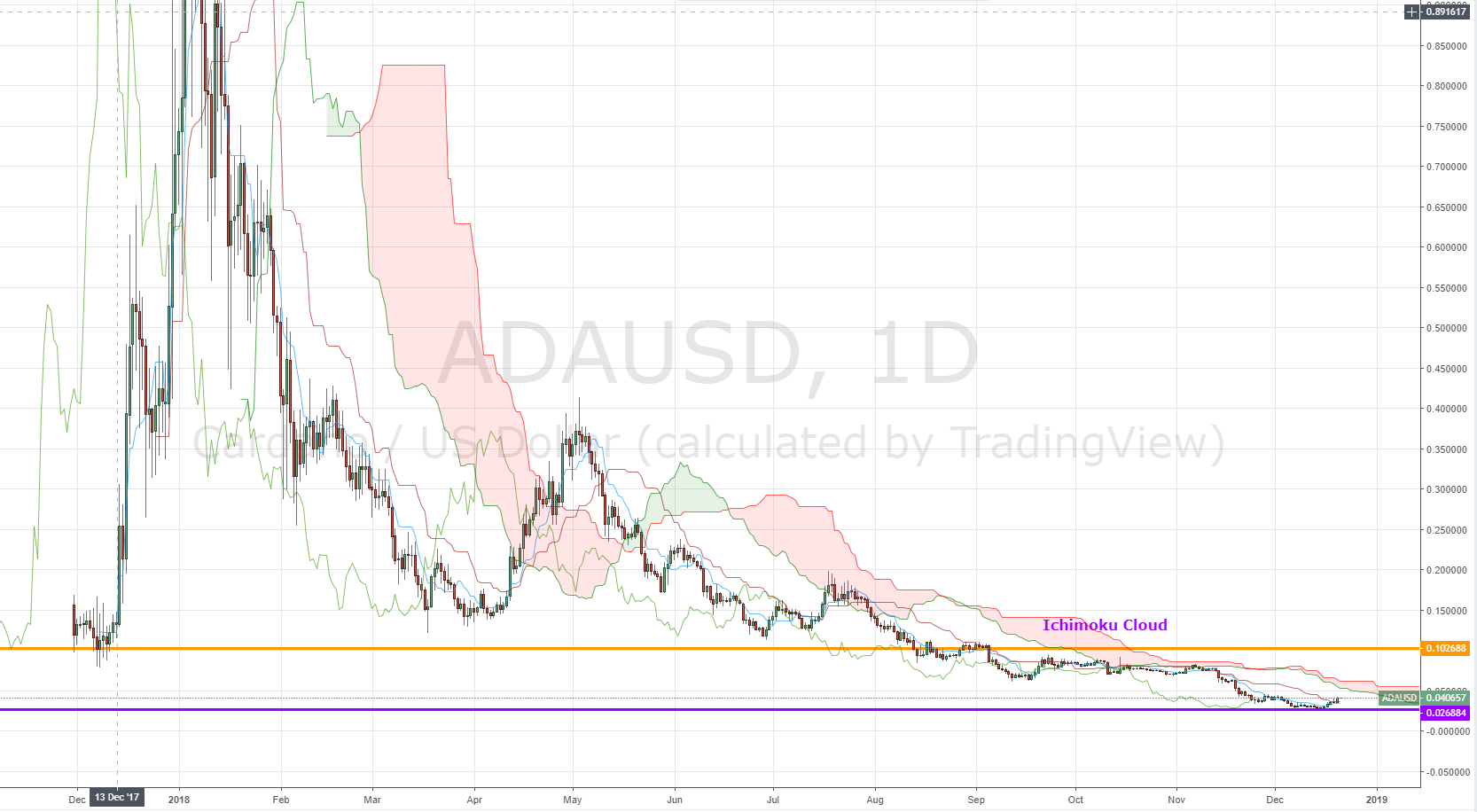

Versus the USD, ADA’s value has already reached and surpassed below its previously held lowest price of 10 cents. In September 2018, it broke below this level and reached the all-time-low of three cents in December. With the most recent bullish wave, its price is attempting to recover, but it still has a hard Ichimoku cloud to cross over.

Cardano Price Action: ADA/USD

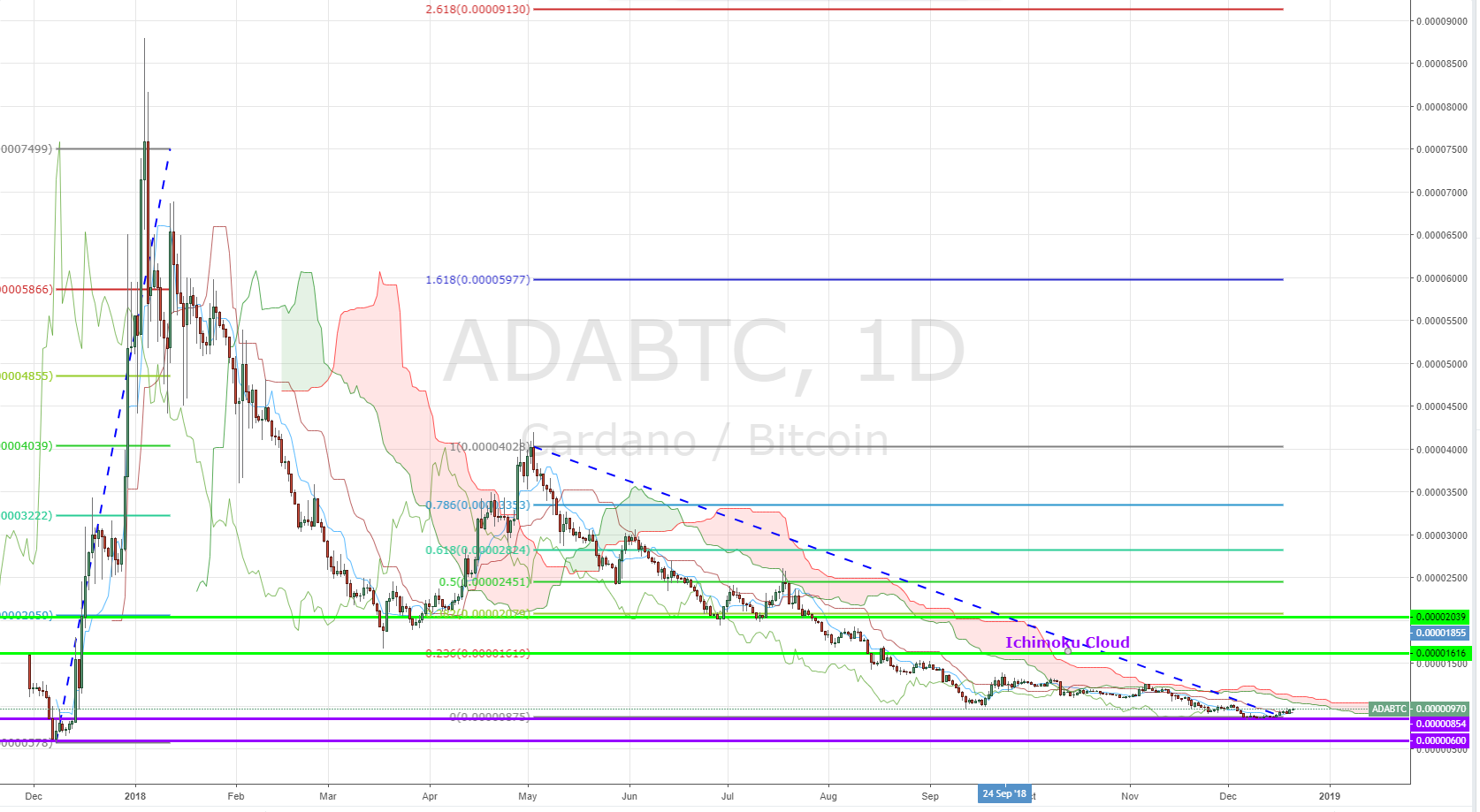

Versus Bitcoin, on the other hand, ADA’s value has yet to reach the all-time lows. Keep in mind that for the ADA/BTC pair to slip lower, Bitcoin needs to get stronger. So this comparison basically means that Bitcoin has dropped more than the US dollar’s median value. Learn about how currency pairs work here.

Cardano's ADA Price Action versus Bitcoin - ADA/BTC

But since Cardano’s value is strongly correlated to Bitcoin, at least for now, any significant shifts in its sentiment depends on the general market direction. 2019 remains promising for Cardano on a technical level as well, but I’d like to hear from you.

*This article was originally published on Invest Diva

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.