Can Alibaba's Cloud Compete With Amazon And Microsoft?

Estimize | Jan 24, 2017 06:57AM ET

Alibaba Group Holding

Consumer Discretionary - Internet & Catalog Retail | Reports January 24, Before Market Opens

Key Takeaways

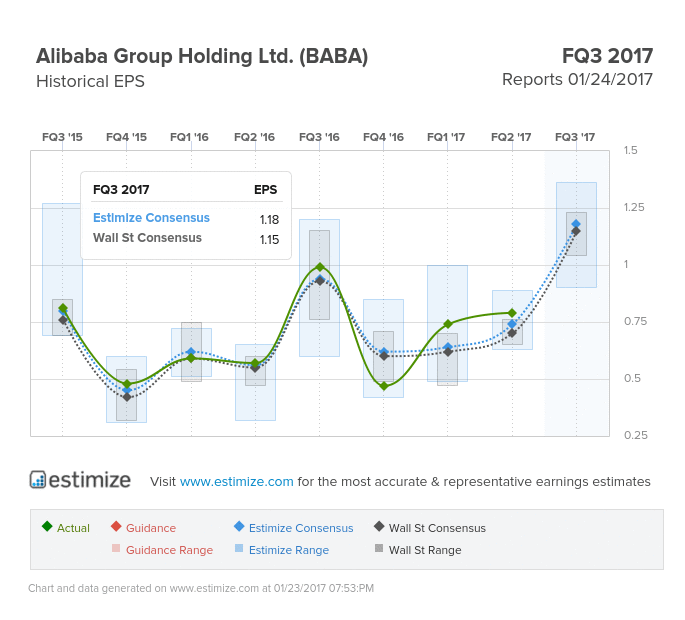

- The Estimize consensus is calling for earnings per share of $1.18 on $7.53 billion in revenue, 3 cent higher than Wall Street on the bottom line and $50 million on the top

- Alibaba (NYSE:BABA) broke a Single’s Day record, the equivalent of Prime day, with $17.8 billion in sales

- Alibaba continues to break ground in China’s cloud computing industry but still lags behind Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT) in terms of global dominance

Chinese ecommerce giant Alibaba is scheduled to report fiscal third quarter earnings tomorrow after the market closes. Despite a series of strong reports, the stock ended 2016 on a sour note. Shares edged lower amid speculation that President Trump would impose a severe tariff on China or at the very least significantly hamper relations with the region. Most of these concerns were put to rest when Alibaba’s CEO Jack Ma visited Trump himself to talk through the ongoing issues. As part of the discussion, Ma promised Alibaba would add 1 million jobs in the United States,what many deem as a publicity stunt to keep the President at bay.

For the fiscal third quarter, analysts expect Alibaba to post record high earnings and revenue, largely on the back of the best Singles Day in company history. This year Singles Day, essentially Amazon Prime Day in China, generated $17.8 billion in revenue for the ecommerce giant. As a result the Estimize consensus predicts earnings to increase 18% from a year earlier to $1.18 per share. Revenue for the period is forecasted to grow by 41% to $7.53 billion, marking 3 consecutive quarters of 40%+ top line growth.

Unfortunately, investor sentiment has turned pessimistic lately, causing shares to plummet 7% in the past 3 months. Historically, shares experience a great deal of volatility during the earnings period; increasing 2% through the print and then dropping 3% 30 days following a report.

Alibaba, like its American counterpart Amazon, controls multiple entities ranging from a financial services arm to a cloud computing business. Many of these spinoffs make successful companies in their own right. Alipay or Ant Financial, a spinoff of Alibaba, is the largest online payment service provider in the region preparing to IPO in 2017 with a valuation north of $60 billion.

Meanwhile, AliCloud, the cloud computing arm of Alibaba, continues to make waves in China’s rapidly growing cloud computing industry. As part of the company’s larger strategy, Alibaba plans on leveraging its cloud services to diversify into multiple verticals including AI, machine learning and image recognition. Some of these tools are being used to help tackle the rampant counterfeiting problem taking place on the platform. Alibaba Cloud has scaled significantly in the region but globally it still can’t compete with Amazon Web Services or Microsoft Azure.

The cloud service did score a huge victory at last week’s Davos event, agreeing to a 12 year partnership to provide the Olympics with cloud computing services. Gaining more publicity on the global stage will help narrow the gap between them and either of the cloud computing heavy weights.

As with most companies, a few near term headwinds could hamper this week’s financial report. Trump still remains committed to doing something about China, which could very well limit Alibaba’s U.S. expansion. Beyond geopolitical risks, increasing competition, currency headwinds and an overall weak consumer environment pose a threat to performance.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.