CAD/JPY: Can BoC Boost Maintain?

Neal Gilbert | Apr 15, 2015 12:19PM ET

There were a lot of interesting moments occurring in global markets during the North American morning trading session that has created a bit of a hodgepodge of market moves. First of all, the Chinese GDP figure released last night of merely 7.0% growth over the last year was disheartening as it is the lowest level seen since 2009, but it did meet expectations; however, other Chinese data releases didn’t reach consensus and was a general drag on the commodity currencies as a result. The European Central Bank and President Mario Draghi didn’t release the statement that got most of the attention . Within the statement they insinuated that they expect the Canadian economy to recover more quickly than they anticipated merely a couple months ago when they unexpectedly cut interest rates. For instance, “the oil price shock on growth will be more front-loaded than predicted in January, but not larger”, and “risks to the outlook for inflation are now roughly balanced” were statements that were deemed much more positive than in the recent past.

Due to the BoC’s sunny disposition, the CAD has been the star of the show against virtually every other currency, and threatens to break out of the month’s long sideways channel in which it has been trapped in the USD/CAD. Since the USD has been experiencing a bit of a comeuppance against many currencies this morning, that channel break may not be that surprising. It is the CAD/JPY which could offer a more intriguing setup as the CAD is the only currency gaining substantially against the JPY. Remarks from Japanese Prime Minister Shinzo Abe’s economic advisor Koichi Hamada a couple of days ago that the USD/JPY would be priced appropriately at 105 haven’t been retracted, nor have they been denounced by Japanese authorities. Since that statement has been allowed to marinate, the thought is that the JPY may start to get back some mojo here moving forward.

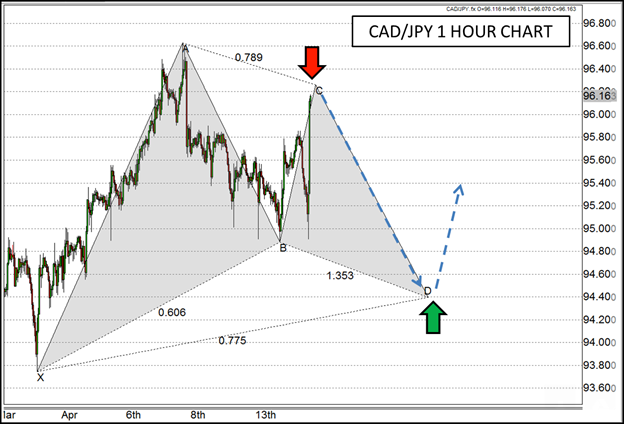

On the technical front, there is a 78.6% Fibonacci retracement near 96.25 that could create some resistance on the CAD/JPY if JPY strength were to take hold. In addition, if it were to decline all the way down to 94.40/50 thereafter, it would complete a visually satisfying Bullish Gartley pattern, where potential support could come in to play. Before we can start talking about bullish patterns though, the resistance near current levels needs to hold, but a break above A near 96.60 could deem this pattern null and void.

Source: www.forex.com

For more intraday analysis and trade ideas, follow me on twitter (@FXexaminer ).

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.