CAD/JPY: Picking The Underdog

Neal Gilbert | Mar 19, 2015 04:37PM ET

The second half of the North American trading day wasn’t too compelling if you were watching charts as a healthy portion of traders were likely taking extended lunches to enjoy the start of the NCAA Tournament. Therefore the moves of the morning pretty much remained for the duration, but Asia is lying in wait to pick up the liquidity. On tap for the region is Meeting Minutes from the Bank of Japan, Reserve Bank of Australia’s Governor Glenn Stevens giving a speech, and a couple of minor New Zealand economic releases. The first two have a decent chance of moving markets particularly now that the world is up to date with the thoughts of the Federal Reserve.

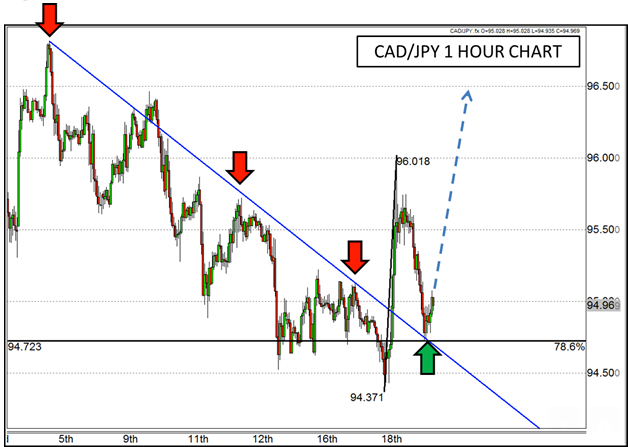

Moving away from the US though may be a wise path to follow for the time being. After witnessing yesterday’s extreme market moves along with today’s reversal of those moves could mean that the market is still trying to figure out what the Fed really meant. In a nod to the aforementioned tournament, sometimes it is better to pick a market underdog to find opportunities, and Canada may qualify (particularly in comparison to the US). The CAD/JPY had an extreme move yesterday after the Fed meeting as well, and has retraced back to an interesting level that correlates with a trend line and a Fibonacci level.

Canada will be releasing a couple of market moving metrics tomorrow including CPI and Retail Sales that have a chance of being good for the CAD. So far this month, the Bank of Canada sounded more optimistic than anticipated, GDP was pretty decent, and Employment wasn’t as bad as expected; perhaps those good vibes could leak over to inflation and sales. If those fundamental factors combine with the former trend line resistance turned support, and 78.6% Fibonacci retracement of yesterday’s low to high, a rally back above 96.00 and beyond may be a possibility.

Source: www.forex.com

For more intraday analysis and trade ideas, follow me on twitter (@FXexaminer ).

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.