CAD/JPY And Inflation: Canadian CPI On Tap

Matthew Weller | Nov 20, 2014 03:51PM ET

One theme we’ve been consistently highlighting over the last few weeks is policymakers’ (and thus traders’) increasing focus on inflation reports. With price pressures in many developed markets rapidly falling toward outright deflation, many central banks are pondering additional monetary stimulus to help support their moribund economies.

On Friday, Statistics Canada will release its measure of CPI inflation (Oct), with traders and economists expecting a -0.3% m/m contraction on the headline figure, but a 0.2% m/m rise in the Core reading (2.0% and 2.1% y/y, respectively). Following Thursday’s decent US CPI report , there is a chance core inflation could come in hotter than expected in the Great White North, though the persistent fall in oil prices will keep a lid on headline inflation.

Technical View: CAD/JPY

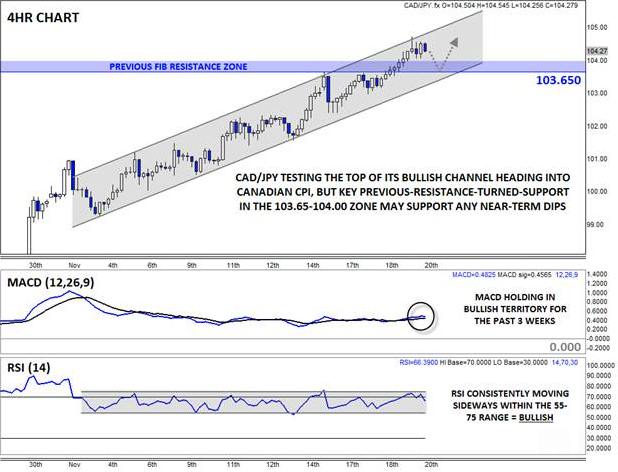

It will hardly come as a surprise to any reader that CAD/JPY has been surging of late, primarily on the back of continued easing and poor economic data out of Japan. The 4-hr. chart (below) shows that rates have been consistently following a bullish channel higher since the start of November, though a near-term pullback is possible after rates hit the top of the channel early Thursday. More importantly, the pair just broke above a key area of converging previous / Fibonacci extension resistance in the 103.65-104.00 zone; now that this resistance zone has been broken, it should provide support on any near-term dips moving forward.

Turning our attention to the secondary indicators, the uptrend remains healthy. The MACD has been moving sideways above the zero level for the last three weeks, while the RSI has also been rangebound in a bullish range (55-75) since the beginning of the month. As long as these indicators maintain their consistently bullish positions, the path of least resistance for CAD/JPY will remain to the topside. Only a move back below key previous-resistance-turned-support in the 113.65-114.00 area would leave the pair vulnerable to a deeper pullback.

Source: FOREX.com

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom).

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.