Buyers Keep Shorts At Bay, Focus On Defensive Large Caps

Declan Fallon | Feb 27, 2017 12:02AM ET

Just when it looks like shorts may have something to attack, buyers step in to make up the lost ground. The rally is out on a limb, but not enough to place it at the outer extremes of historic price action. So while there hasn't been any big pullback since the election, there isn't much to suggest a pullback is coming soon either.

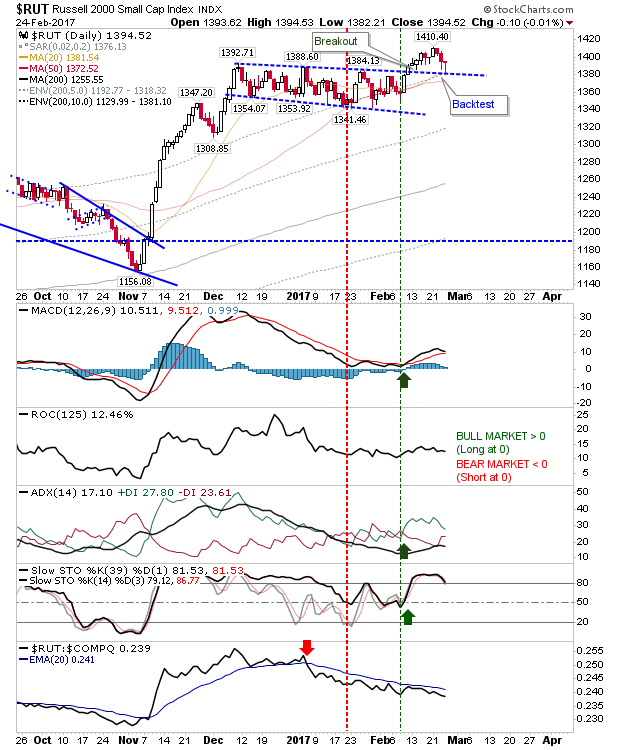

The weakest of the indices is the Russell 2000 as 2017 continues to see money rotate out of speculative stocks into more defensive Large Caps. However, Friday did offer some healthy backtest of former resistance turned support, and buyers have a relatively low risk opportunity to take advantage; helped by the proximity of 20-day and 50-day MAs.

The NASDAQ had a solid close on Friday, but now there is a downtick in relative performance against the S&P to consider. With the focus on defensive stocks, buyers now have fewer options to sustain the rally. Having said that, price and technical action for the NASDAQ is excellent.

The S&P is slowly re-assuming the market leadership role after an extended 'flat' period of relative performance. While this isn't the best news for those looking for the rally to continue long-term, it does suggest bulls will still find joy with defensive, large cap stocks for the foreseeable future.

The Semiconductor Index almost registered a channel breakdown, but did enough to come back and finish above channel support. Of the indices, it's perhaps the one closest to showing a period of intermediate-length (up to 3 weeks) weakness. Technicals have become very scrappy and it has struggled to lead out against other technical stocks.

Another rally experiencing some weakness is the relationship between the Dow Transports and Dow Index. This Dow Theory bellwether had seen a positive turn last summer, with transports enjoying two channel breakouts. However, since the election result, transports have struggled - suggesting the economy has little more to give.

And near maximum employment, there won't be many new consumers coming on line. And we all know when it comes to boosting profits, letting staff go is the cheapest way to please shareholders and overpaid CEOs. Eventually, this catches up with the economy and recession returns.

The short term outlook remains favourable for the market, but there are warning signs for a more prolonged period of bearishness on the horizon.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.