Business Cycle Warning Signs

Tiho Brkan | Nov 23, 2012 05:49AM ET

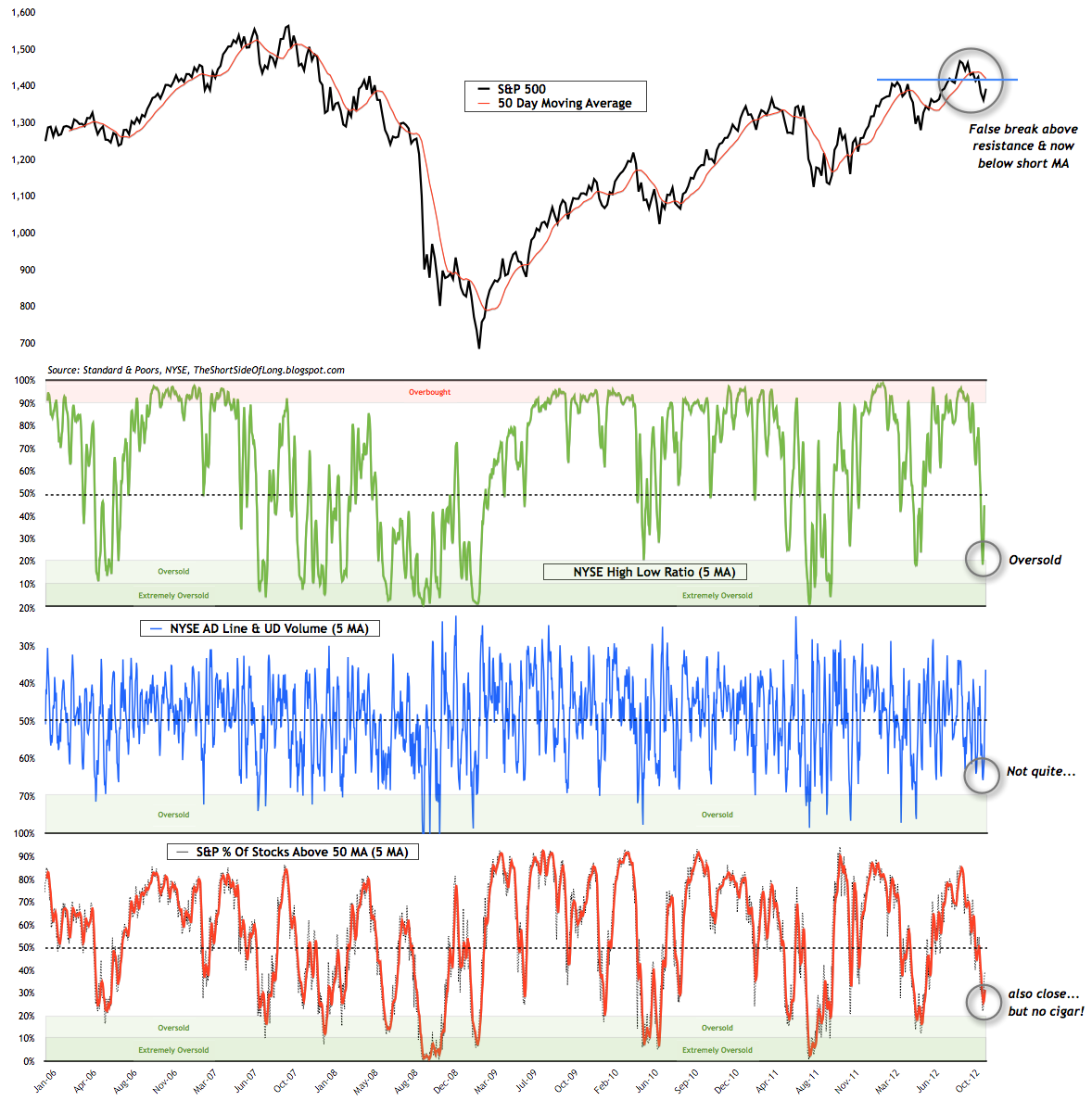

If you haven't heard the news already, the bulls have declared victory. Various bloggers around the internet have posted articles titled The bottom is in, Waiting for Santa Claus rally and Major buying opportunity (plus many others). The first note in Saturday's post warned that all in all, one could make an argument that a bounce or relief rally might be in store soon and that is what we have gotten so far. However, I'm personally not expecting anything remotely close to "a major buying opportunity... just yet. While there are many reasons for this, the chart above which tracks short term market breadth internals, shows that the market didn't really experience a proper oversold condition. We only became slightly oversold with Net New Highs, while the AD Line & Volume as well as the Stocks Above 50 MA never really washed out properly. Many will ask, why is it import to get oversold? Extreme oversold conditions create panic selling and re-build the wall of worry by removing weak hands from the market. These occurrences are necessary to forge longer term lasting supports as anything less usually fails.

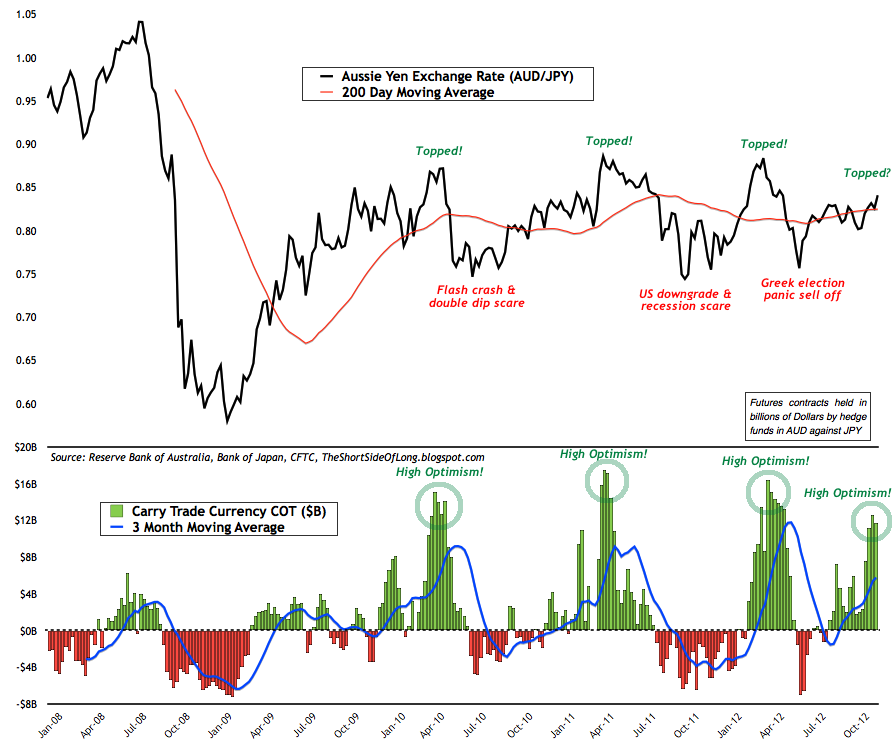

Within the foreign exchange world, the Australian Dollar Japanese Yen cross pair is commonly known as the risk barometer or a perfect example of the carry trade concept. In recent years, this trade has been a great signal of market sentiment as it ebbs and flows from pessimism to optimism and back to pessimism again. As of last Friday, the CFTC commitment of traders report showed that hedge funds are currently extremely long the Aussie and extremely short the Yen. Furthermore, since that report was complied two Tuesdays ago, on the 13th of November, the recent price action has been very negative on the Japanese Yen. Therefore, one could assume that hedge funds have increased their bearish Yen bets and pushed the Carry Trade COT towards further extremes. Similar events occurred in April 2010, May 2011 and March 2012 with a result of a sharp and swift sell off (in all risk assets). I eagerly await the new CFTC report today to see further hedge fund positioning developments in both the Aussie and the Yen.

Total equity offerings in the US hit an all-time record Trading Diary (Last update 16 of November 12)

- Economic Outlook: The global economy continues to slow towards a recession, as we find ourselves in the very late cycle of the expansion. United States growth remains below 2% for five out of the last six quarters, with durable goods new orders collapsing recently. The Eurozone remains in a recession, as Germany dangerously flirts with a contraction in growth. German CEOs see the business cycle moving deeper into a downturn with a high probability of recession. Japanese growth rates are once again anaemic post the earthquake recovery, with Industrial Production slowing meaningfully. Chinese growth continues to slow for the seventh quarter in a row, however many do not believe official growth data. Business confidence is decreasing rapidly, while the manufacturing sector has been in a doldrum for a year, confirmed by the slowest electricity consumption since 2009. More importantly the price of cement, iron ore and steel has crashed recently, indicating the end of the property building boom. Finally, exports are now slowing rapidly, while railway cargo freight is looking very weak.

- Equities: Short positions are held in various US equity sectors, which include Dow Transports (IYT), Technology (XLK), Discretionary (XLY) and Industrials (XLI). Large put options have been bought on Apple (AAPL). Call options have been sold on Homebuilders (XHB), JP Morgan (JPM), Amazon (AMZN), IBM (IMB), Commonwealth Bank (CBA), Adidas (ADS) and others.

- Bonds: There isn't a lot of exposure in the bond space, as we believe this sector is experiencing euphoric investor demand. Call options have been sold on Junk Bonds (HYG). We plan to short Long Bond Treasuries (TLT) in due time.

- Currencies: Long positions are held in Japanese Yen (FXY). Put options have been bought on British Pound (FXB) & Canadian Dollar (FXC). Put options have been sold on Japanese Yen (FXY).

- Commodities: Long positions are held in various commodity sectors, which include Silver (SLV, SIVR, PSLV, Comex futures), Agriculture (RJA, JJA) and Sugar (SGG). We plan to increase longs in PMs and Softs in due time.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.