Bubble Talk: Does It Ever Coincide With StocksTopping?

Chris Ciovacco | Nov 20, 2013 12:21AM ET

If you work around or trade the financial markets, it is impossible to insulate yourself from the never-ending use of the term bubble. Bloomberg :

In any historical asset bubble, we do not get bubble magazine covers in major news media at the height of the bubble. If anything, it’s the precise opposite. A positive story on gold on the cover on New York Times Magazine in 2011 — and GLD passing SPY as the biggest ETF — marked the top. Perhaps the most infamous was the June 2005 Time Magazine cover on “Why We Love Housing.”

The Death of Equities

As this video clip.

Investment Implications – Markets Will Guide Us

Using the magazine covers as a contrary and bullish indicator, should we calmly remain fully invested in stocks? No, we should continue to monitor the message being delivered by the market’s pricing mechanism with a flexible and open mind. Mr. Ritholtz summarizes the significance of all the talk of bubbles via Bloomberg:

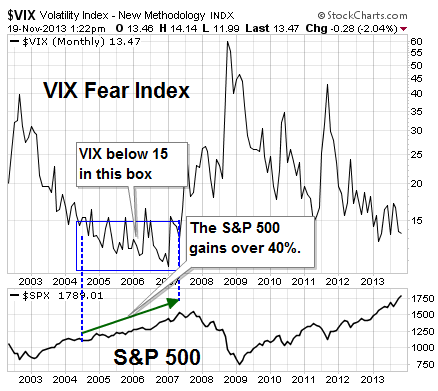

I am hard-pressed to recall when any sort of bubble was accurately identified in real time on the cover of a major media publication. If anything, the opposite is true. All of the skeptical bubble talk — and there has been lots — seems to be a contrarian indicator that this long-in-the-tooth, overpriced market might still have a ways to go.

Gains For Six Weeks

As of Tuesday, the message from the market’s pricing mechanism continues to support a “risk-on” investment stance. Consequently, we will continue to hold our stake in U.S. stocks (SPY), technology (QQQ), financials (XLF), energy (XLE), foreign stocks (VEU), and emerging markets (EEM). Stocks have posted gains for six weeks, which means we have to be open to a period of healthy consolidation even under bullish scenarios.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.