Broad Asset Allocation Mix Or Managed Funds?

James Picerno | Jan 09, 2013 06:13AM ET

It's true for stocks, it's true for bonds—yes, it's even true for hedge funds. As The Economist reported back in October:

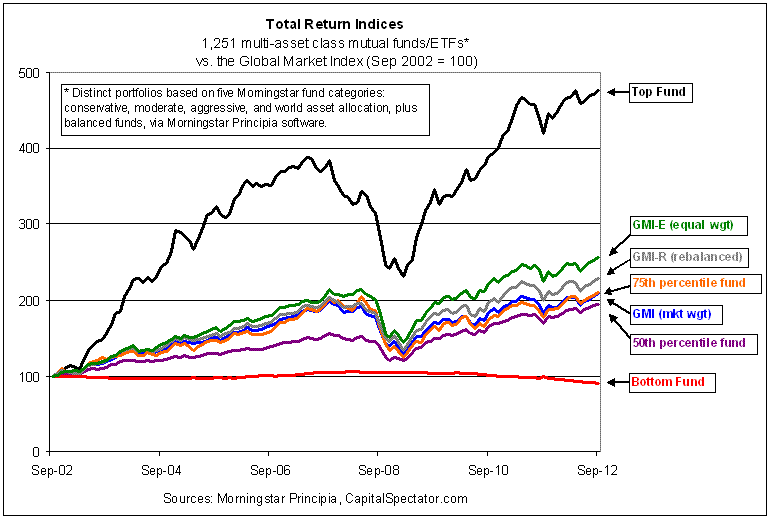

GMI ended up near the 75th percentile for performance. That's probably high relative to what you should expect for the next 10 years. But average to above-average results are good bet, in part because you can replicate GMI for less than 50 basis points with ETFs. By contrast, the active strategies depicted in the chart above nip you for two, three, and even four times as much. Over time, that's the equivalent of trying to run a race with a couple of bricks tied to your feet.

These types of studies are now a staple in financial research. The lesson for most folks is that broad diversification across asset classes, and periodic rebalancing of those assets, will capture average to above-average returns on a fairly reliable basis through time. The flip side of this lesson is that trying too hard in money management boosts the odds of ending up with high-priced mediocrity, or worse.

Granted, a relative few will beat the odds. Predictably, this is where the crowd focuses. The dirty little secret, however, is that the upper decile or quartile of performers is often a fluctuating mix of names. By contrast, a representative benchmark is a dependably average to above-average performer. This empirical fact, however, is the equivalent of a wet rag when it comes to popularity contests among investment strategies. Considering the returns that most folks end up with, however, that's a costly oversight.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.