Borrowers With Modified Mortgages Re-Default As Homes Re-Enter Shadow

Sober Look | Nov 20, 2012 02:16AM ET

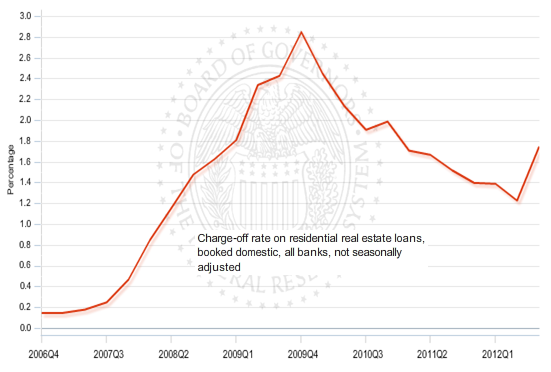

According to the Fed, banks had a visible increase in resi mortgage charge-offs in the third quarter.

This could be a cause for concern. However, banks have some leeway in when they actually take charge-offs during the year, so it is worth taking a look at a more up to date delinquency data. JPMorgan recently published the October delinquency results. Indeed there was an increase in delinquencies, mostly in October (there seems to be some delay in reporting delinquencies that the Fed picked up in Q3, particularly by Bank of America).

But delinquencies seem to the heaviest in sub-prime mortgages. Is this another wave of subprime defaults? Is Kyle Bass going to feel the pain from this increase by having half his book in sub-prime (see see discussion - "mods" in the pie-chart). And now some of these homes are moving into the "shadow" once again.

JPMorgan: It appears that mod re-defaults drove the increase. The number of re-defaults jumped 24% from the previous month.... We have argued that the sharp decrease in shadow inventory over the past two years was to some extent the result of aggressive modification activity. We think we are now seeing a wave of re-defaults from the modifications over the last two years that failed. This wave should last through 2013, and a greater share of current-to-30 rolls will come from re-defaults going forward.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.