Bonds Rose With The Return Of Risk-Off Sentiment Last Week

James Picerno | Jun 29, 2020 07:07AM ET

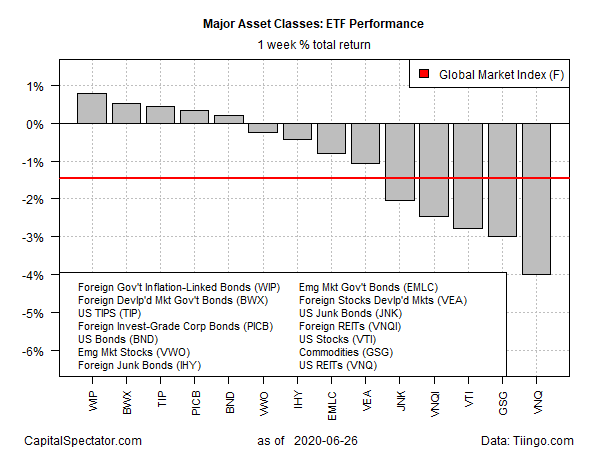

Amid news of rising coronavirus cases in the US and elsewhere last week, investors favored bonds at the expense of risk assets, based on a set of exchange-traded funds representing the major asset classes for the trading week through June 26.

Inflation-linked government bonds outside the US-led fixed-income rally last week. SPDR FTSE International Government Inflation-Protected Bond (NYSE:WIP) rose 0.8%. The advance marks the fund’s first weekly gain in three weeks.

US inflation-indexed Treasuries were last week’s third-best performer. The iShares TIPS Bond (NYSE:TIP) rose 0.4%, the ETF’s third straight weekly gain that boost TIP to a record close.

Driving demand for inflation-linked bonds: renewed worry that inflation may be a rising risk in the years ahead, thanks to a recent surge in fiscal and monetary stimulus in the US and around the world to combat the economic loss due to Covid-19. In the shorter term, however, disinflation/deflation may prevail if the aftershock of the coronavirus blowback lingers.

“We are going to be facing now a significant amount of supply shocks in the global economy,” predicts Nouriel Roubini, a professor of economics at New York University.

“Eventually the inflation genie is going to get out of the bottle.”

Last week’s biggest loser: US-listed real estate investment trusts (REITs). Vanguard Real Estate (NYSE:VNQ) lost 4.0% — the third weekly decline for the fund.

For the major asset classes generally, prices fell 1.5%, based on the Global Markets Index that uses exchange-traded funds (GMI.F). This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETFs, has lost ground in two of the past three weeks.

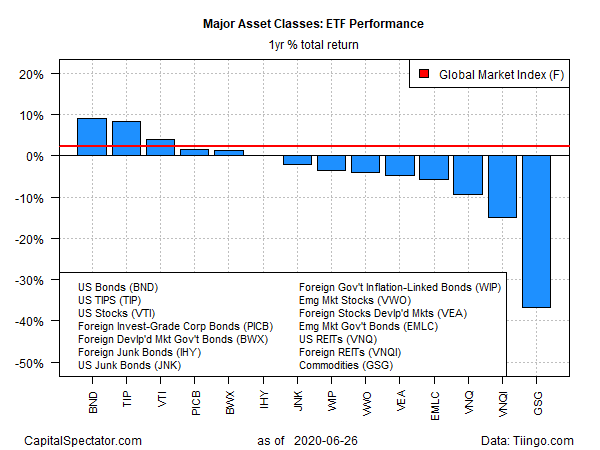

For the one-year trend, US investment-grade bonds are still the top-performer and continue to hold a small lead over the number-two one-year gain via inflation-linked Treasuries. Vanguard Total Bond Market (NASDAQ:BND) is ahead by a solid 9.4% over the trailing 12-month period, based on total return. The iShares TIPS Bond (TIP) is a close second with an 8.6% gain.

Broadly defined commodities continue to post the deepest one-year loss by far for the major asset classes. The iShares S&P GSCI Commodity-Indexed Trust (GSG) is off more than 38% at Friday’s close vs. the year-earlier price.

GMI.F’s one-year return is a modest 2.2% increase.

Ranking asset classes by current drawdown continues to show a wide range of results, ranging from a 70%-plus peak-to-trough decline for commodities (GSG) to the zero drawdowns for US investment-grade bonds (BND) and inflation-indexed Treasuries (TIPS).

GMI.F’s current drawdown: -7.3%.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.