BoJ’s New Script Supports The Carry-Trade

MarketPulse | Jul 31, 2018 07:58AM ET

Tuesday July 31: Five things the markets are talking about

Sovereign government bond prices have rallied overnight as the Bank of Japan (BoJ) again committed to keep its “ultra-loose” monetary policy intact.

As expected, Japanese policy makers tweaked some policies, but signaled rates to stay low for an “extended period of time.”

In respect to the long-term rates, the BoJ reiterated that it would continue to buy JGB’s to keep their 10-year yield at about +0%, but added that “while doing so, the yields may move upward and downward to some extent mainly depending on developments in economic activity and prices.”

Elsewhere, global equities have been trading somewhat mixed as corporate earnings reporting continues – all market eyes will be on Apple’s Q2 results today after the close.

From a central bank monetary policy perspective, next up will be the Fed (Aug 1) and the Bank of England (Aug 2). Capital markets will be looking for confirmation that US policy makers plan two more interest-rate hikes before year-end, while in the US, Governor Carney is expected to hike interest rates by +25 bps despite ongoing Brexit worries.

Commodity prices are under pressure after China’s manufacturing PMI’s fell this month (51.2 vs. 51.5 m/m) as the first-round of US tariffs begin to have an impact.

On tap: US personal spending and income data for June will be released. On Friday, it’s US non-farm payrolls (NFP), which is expected to show a healthy labor market with +193K new jobs, and an unemployment rate slipping back to +3.9%.

1. Stocks mixed results

Global stocks are broadly steady, but mixed overnight, after US tech share losses yesterday.

In Japan, the Nikkei share average ended flat, rebounding from a one-week low after the BoJ tweaked its monetary policy settings, but refrained from making any radical moves. The benchmark Nikkei inched up +0.04%, while the broader Topix fell -0.84% as bank shares fell on profit-taking after the rate decision.

Down-under, Aussie shares found support Tuesday, mostly supported by BHP The S&P/ASX 200 rallied +0.03%, holding atop of its multi-year highs, to close out for a fourth consecutive month of gains. In S. Korea, the KOSPI inched higher, closing out the month +0.08% in the ‘black.”

In Hong Kong, the Hang Seng index ended down overnight, following the US tech sector lower. At the close of trade, the index was down -0.52%, while the Hang Seng China Enterprise (CEI) closed -0.2% lower.

In China, stocks closed higher, aided by gains in real estate and energy firms, while the market response to the country’s manufacturing data has been relatively muted – the data clearly reports a slowdown in economic momentum. The blue-chip Shanghai Shenzhen CSI 300 index ended +0.1% higher, while the Shanghai Composite Index closed +0.3% firmer.

In Europe, regional bourses are trading mixed in a range bound trade, while in the US stocks are set to open in the ‘black” (+0.2%).

Indices: STOXX 600 +0.1% at 391.2, FTSE +0.1% at 7711 DAX +0.1% at 12811, CAC 40 flat at 5492, IBEX 35 +0.5% at 9905, FTSE MIB +0.6% at 22080, SMI +0.2% at 9183, S&P 500 Futures +0.2%

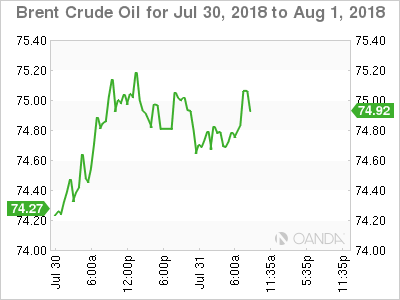

2. Oil prices drop on oversupply worries, gold unchanged

Oil prices fell overnight, with Brent futures set for their biggest monthly loss in two-years, as oversupply concerns rose on reports that OPEC’s output rose in July to its highest for 2018.

September Brent crude futures fell -25c, or -0.3% to +$74.72 a barrel after rising nearly +1% yesterday. US West Texas Intermediate crude futures (WTI) are down -24c, or -0.3% at +$69.88 a barrel, after rising more than +2% on Monday.

Note: For the month, Brent futures are set to drop -6%, while WTI futures are set to decline -5.8%.

A Thomson Reuters survey showed that OPEC increased production by +70K bpd to +32.64M bpd in July, the most this year – to offset the loss of Iranian supply as US sanctions have already started to cut exports from the world’s third-largest producer.

Ahead of the US open, gold prices are steady, trading within a tight range as the market adopts a “wait-and-see” approach ahead of the Fed’s two-day monetary policy meeting, commencing today. Spot gold is up about +0.1% at +$1,222.15 an ounce, while US gold futures are -0.1% lower.

3. Euro zone bond yields edge up after inflation beats expectations

Eurozone government bond yields are edging higher this morning, after preliminary data showed that inflation was higher than expected in July.

Headline consumer inflation accelerated to +2.1% from +2.0% in June, while core-inflation rose to +1.3% from +1.2% in June.

Germany’s Germany 10-Year yield has backed up to +0.44%, while other euro zone bond yields have come off their lows, rising about +1 bps across the board.

This Thursday, the Bank of England (BoE) is expected to hike +25 bps. However, market expectations are looking for a split vote of perhaps 6-3 in favour of a rate rise – some members are likely to continue favoring waiting to see how the data develops.

Note: The market is pricing in an almost +90% odds for a hike.

Elsewhere, the yield on US 10-year notes has declined -2 bps to +2.95%, the lowest in a week, while in the US, the 10-year yield has declined -2 bps to +1.343%, the biggest fall in more than a week.

4. Dollar’s mixed results

The yen (¥111.51) is a tad weaker after the BoJ’s policy decision overnight. The bank has stressed a “prolong period of extremely low rates” or in other terms further “policy stimulus” in its first-ever forward guidance. Technically, the statement is encouraging for long-term investors to consider adding to their ‘carry-trade’ positions.

Elsewhere, a plethora of mixed European data (see below) is supporting the EUR (€1.1724). Nevertheless, the pair remains confined to its tight summer trading range. This morning’s mixed data will do little to persuade the ECB to move away from its current stimulus objectives.

5. Eurozone economy slows further

Data this morning showed the eurozone’s economy slowing further in Q2, as exports and business confidence both weakened on trade relations concerns.

Eurostat said that compared with Q1, the eurozone’s GDP was +0.3% higher, the weakest expansion in two-years, and year-over-year, it was +2.1% higher.

Note: The US/EU growth differential is the widest in four-years. Stateside, economic growth was +4.1% q/q.

Consumer confidence is expected to rebound if there is progress in talks to resolve trans-Atlantic tensions.

Higher oil prices are another obstacle. The ECB confirmed last week that it would proceed with plans to end QE in December, but a “lengthening period of weaker growth may make it reluctant to hike rates next year.”

Other data this morning released showed the annual rate of inflation rose to +2.1% in July, further above the ECB’s target and that the unemployment rate across the eurozone was steady at +8.3% in June, but the number of people without work rose slightly for the first time in 12-months.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.